Technical Analsys

Technical Analysis #H-0700: 2019-05-24

Slowing sales forecast bearish for Tencent price

Tencent stock declined after the company forecast slowdown in sales in 2019. Will the Tencent price continue declining?

Hong Kong based media and entertainment group Tencent Holdings (OTC:TCEHY) forecast sharp slowdown in video advertising sales in China in 2019. Its chief executive officer of video streaming business told Tuesday the growth rate of advertising sales on China's video platforms would decrease from 37% previously to 19%. Online advertising contributed 13.4 billion yuan ($1.94 billion), or nearly 16% of Tencent's total revenue in the first quarter of 2019. Gaming, news and video were the largest contributor to sales, accounting for 33% of revenue in the three months to March. Total revenue in the first quarter rose 16% - about a third of its pace in the same period a year earlier and the slowest revenue growth in the first quarter in 15 years. Lower revenue forecast is bearish for Tencent stock price.

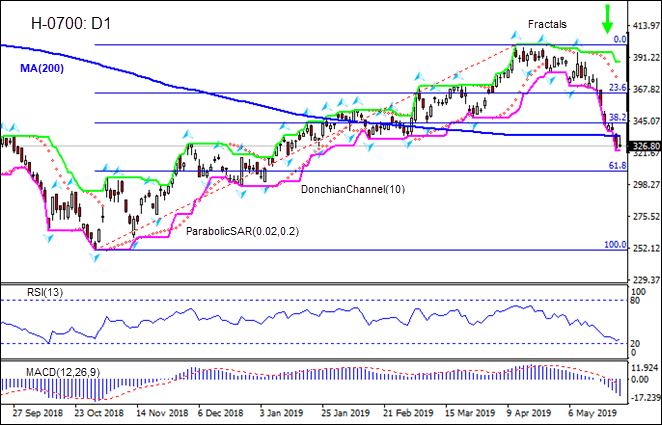

On the daily timeframe the H-0700: D1 has closed below the 200-day moving average MA(200) which is falling. This is bearish.

The Parabolic indicator gives a sell signal.

The Donchian channel indicates downtrend: it is tilted lower.

The MACD indicator gives a bearish signal: it is below the signal line and the gap is widening.

The RSI oscillator is rising after failing to breach into the oversold zone.

We believe the bearish momentum will continue after the price breaches below the lower boundary of Donchian channel at 323.15. This level can be used as an entry point for placing a pending order to sell. The stop loss can be placed above the Parabolic signal at 370.48. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (370.48) without reaching the order (323.15), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

- Technical Analysis Summary

- Position Sell

- Sell stop Below 323.15

- Stop loss Above 370.48

Market Overview

US equities retreat deepened

Dollar weakened on soft housing and manufacturing data

US stock market retreat deepened on Thursday as hopes for near term resolution of US-China tariff dispute dimmed. The S&P 500 fell 1.2% to 2822.24. The Dow Jones Industrial Average lost 1.1% to 25490.47. NASDAQ Composite index dropped 1.6% to 7628.28. The dollar weakened on Markit reports its flash readings of U.S. manufacturing and services indexes declined in May, while new home sales declined 6.9% in April. The live dollar index data show the US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.3% to 97.846 and is lower currently. Futures on US stock indexes point to lower openings today.

CAC 40 underperforms European indexes

European stocks pullback turned into tumble on Thursday. EUR/USD turned higher while GBP/USD ended flat with both pairs rising currently. The Stoxx Europe 600 index fell 1.4% led by auto maker shares. Germany’s DAX 30 dropped 1.78% to 11952.41. France’s CAC 40 slumped 1.8% and UK’s FTSE 100 lost 1.4% to 7231.34 as Prime Minister May unveiled a “new” Brexit deal widely expected to be rejected by the U.K.’s Parliament.

Hang Seng leads Asian indexes gains

Asian stock indices are mixed after a sell off on Wall Street overnight. Nikkei slipped 0.2% to 21117.22 as yen continued climbing against the dollar. Chinese shares are higher after President Trump said Thursday the US could ease up on its ban against Huawei as “some part” of a wider trade deal with China: the Shanghai Composite Index is up 0.02% and Hong Kong’s Hang Seng Index is 0.5% higher. Australia’s All Ordinaries index extended losses 0.6% with Australian dollar little changed against the greenback.

Brent extending losses

Brent futures prices are edging lower today. Prices sank yesterday: July Brent crude dropped 4.6% to $67.76 a barrel on Thursday.