TELUS Corporation (NYSE:TU) reported solid first-quarter 2019 financial results with healthy performance across its wireless and wireline businesses. Both the top line and the bottom line increased year over year.

Net Income

Net income for the quarter increased 4.4% year over year to C$428 million or C$0.71 per share ($321.9 million or 53 cents). EBITDA growth was partially offset by higher depreciation and amortization due to increase in asset base, resulting from investments in broadband technologies and business acquisitions as well as increased financing costs.

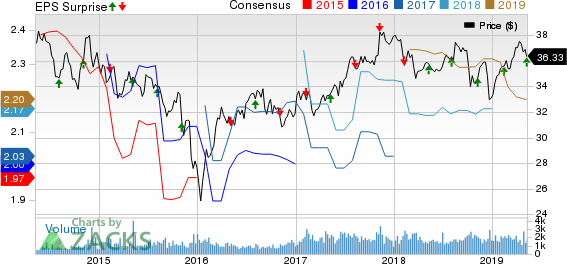

Adjusted net income was C$453 million or C$0.75 per share ($340.7 million or 56 cents) compared with C$435 million or C$0.73 per share in the year-ago quarter. The bottom line beat the Zacks Consensus Estimate by a penny.

TELUS Corporation Price, Consensus and EPS Surprise

Revenues

Quarterly operating revenues increased 3.8% year over year to C$3,506 million ($2,636.7 million), driven by higher wireless and wireline data services revenue growth. The top line, however, lagged the Zacks Consensus Estimate of $2,641 million.

Other Details

EBITDA was C$1,379 million, up 8.7% year over year backed by higher revenue growth and wireless equipment margins, growth in wireline data service margins, the implementation of IFRS 16 on certain expenses as well as EBITDA contribution from customer care and business services (CCBS) and TELUS Health businesses. However, this was partially offset by declines in wireline legacy voice and legacy data services. Adjusted EBITDA increased 8.6% year over year to C$1,415 million.

Segmental Performance

Operating revenues from Wireless increased 1.9% year over year to C$1,937 million ($1,456.7 million) driven by higher network and equipment revenues. Network revenues increased 1.4% to C$1,492 million driven by 4.9% subscriber growth, partially offset by decline in mobile phone ARPU. Equipment and other service revenues were C$427 million, up 3.9% year over year, mainly due to growth in higher-value smartphones in the sales mix and increase in revenues per handset. The segment’s adjusted EBITDA of C$917 million increased 8.4% from the prior-year quarter, reflecting higher network revenue growth driven by a larger customer base, lower employee benefits expense, higher equipment margins and the implementation of IFRS 16 on certain expenses. Adjusted EBITDA margin was 47.4% compared with 44.5% in the year-ago quarter. Capital expenditures decreased 2.7% year over year to C$177 million.

Wireline operating revenues increased 6.4% year over year to C$1,638 million ($1,231.9 million) driven by higher data services revenue growth, partially offset by decline in legacy voice and legacy data services revenues. Data services revenues were C$1,219 million, up 11.9%. This was attributable to higher CCBS revenues, owing to growth in business volumes resulting from both organic growth and business acquisitions, and increased Internet and improved data service revenues. Voice service (local and long distance) revenues were C$253 million, down 10%. Other service and equipment revenues were C$98 million, remaining stable year over year. The segment’s adjusted EBITDA of C$498 million increased 9% from the prior-year quarter figure. This was due to increase in contribution from CCBS business from organic growth, higher Internet margins, and improved TELUS Health margins inclusive of business acquisitions. Adjusted EBITDA margin was 30.4% compared with 29.7% in the year-ago quarter. Capital expenditures were up 0.2% year over year to C$469 million.

Cash Flow & Liquidity

During the first quarter, TELUS generated C$790 million ($594.1 million) of cash from operating activities compared with C$838 million in the year-ago quarter. For the reported quarter, its free cash flow decreased 65.5% year over year to C$153 million ($115.1 million).

As of Mar 31, 2019, the Canadian telecommunications company had C$588 million ($440.3 million) of net cash and temporary investments, with C$14,434 million ($10,809.1 million) of long-term debt.

Zacks Rank & Stocks to Consider

TELUS currently has a Zacks Rank #4 (Sell). A few better-ranked stocks in the broader industry are Deutsche Telekom (DE:DTEGn) AG (OTC:DTEGY) , Consolidated Communications Holdings, Inc. (NASDAQ:CNSL) and VEON Ltd. (NASDAQ:VEON) . While Deutsche Telekom sports a Zacks Rank #1 (Strong Buy), Consolidated Communications and VEON carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deutsche Telekom has long-term earnings growth expectation of 9%.

Consolidated Communications has long-term earnings growth expectation of 2%.

VEON currently has a forward P/E (F1) of 5x.

Conversion rate used:

C$1 = $0.752060 (period average from Jan 1, 2019 to Mar 31, 2019)

C$1 = $0.748861 (as of Mar 31, 2019)

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 7 stocks to watch. The report is only available for a limited time.

See 7 breakthrough stocks now>>

Deutsche Telekom AG (DTEGY): Free Stock Analysis Report

TELUS Corporation (TU): Free Stock Analysis Report

Consolidated Communications Holdings, Inc. (CNSL): Free Stock Analysis Report

VimpelCom Ltd. (VEON): Free Stock Analysis Report

Original post

Zacks Investment Research