“Warnings From Behind The Curtain” almost sounds like the title of a good “Cold War” fiction novel. However, this time, the story is of warnings for investors not often discussed by the mainstream media.

Notably, there is a necessary clarification that must get made. Warnings have different degrees of outcomes.

For example, a warning label that says “only wash in cold water” has an outcome that results in a shirt that will now only fit a toddler. Conversely, the warning label on a hairdryer explicitly states, “do not use while taking a shower.” The consequence of ignoring such a warning is costly.

The same applies to warnings in the stock market for investors. A “warning” when stocks are not extremely overvalued, excessively bullish, or extended is not as critical as when they are. Therefore, the first thing we need to understand is how important are the warnings we are seeing?

Extended, Excessively Bullish And Over Valued

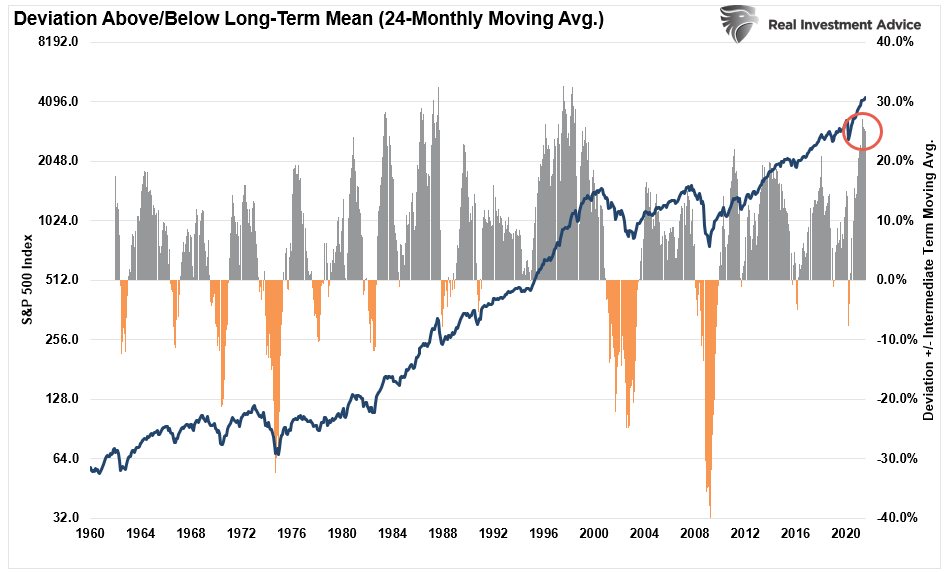

The advance in the market over the last 12-years is the result of years of monetary accommodation and near-zero interest rates. As such, it is no surprise the deviation of the market from its long-term moving averages is extreme.

The critical thing to remember is that “mean reversions” are a constant throughout history. Therefore, the greater the deviation in one direction, the greater the reversion will be.

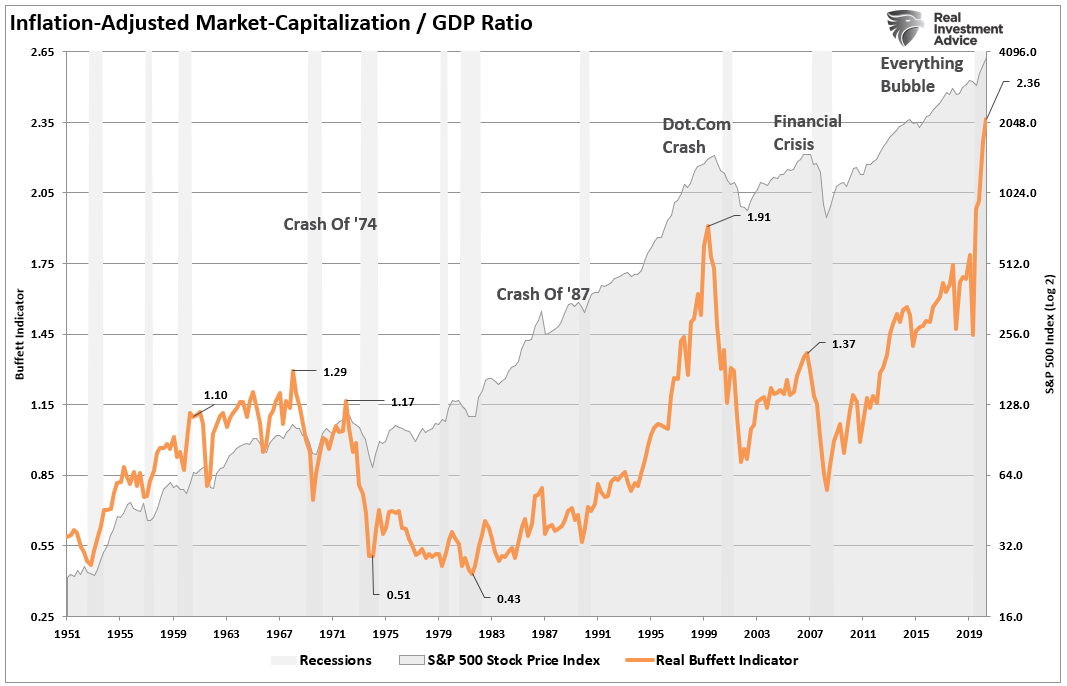

Besides getting extremely extended, the market is also excessively overvalued. There are two critical takeaways from the chart below.

- The market is currently trading more than twice what the economy can generate in revenue growth for companies. (There is a long-term correlation between the rate of economic growth and earnings.)

- Valuations are terrible “market timing” indicators but are vastly crucial concerning future returns.

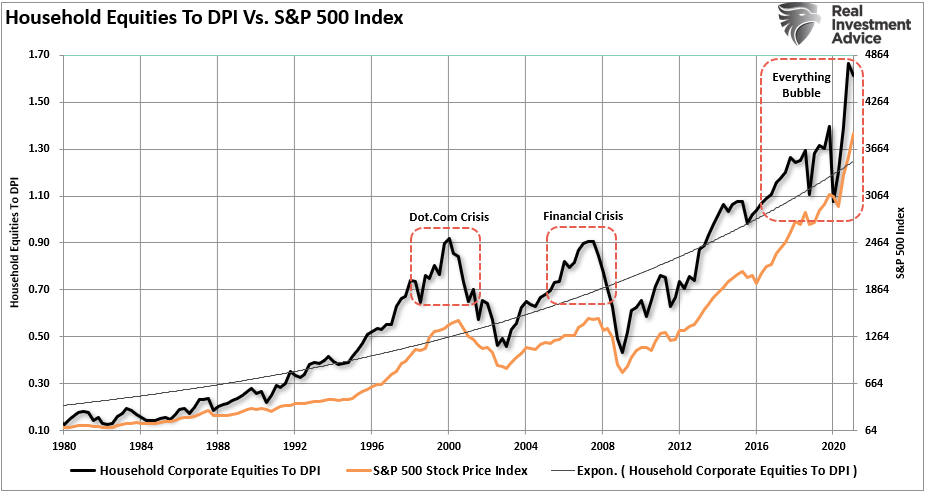

Lastly, investors are convinced there is “no risk” in the market because the Fed provided an “insurance policy” against loss.

Such is the very definition of “moral hazard.”

Investor exuberance is evident from the massive increase of household equity ownership as a percentage of their disposable personal income. The current deviation from the long-term exponential growth trend rivals every previous bubble in history.

Yes, this time could be different. But, unfortunately, it just usually isn’t.

Behind The Curtain Warnings

“Behind The Curtain” warnings are not widely discussed in the mainstream media and are generally relegated to more opaque analysis.

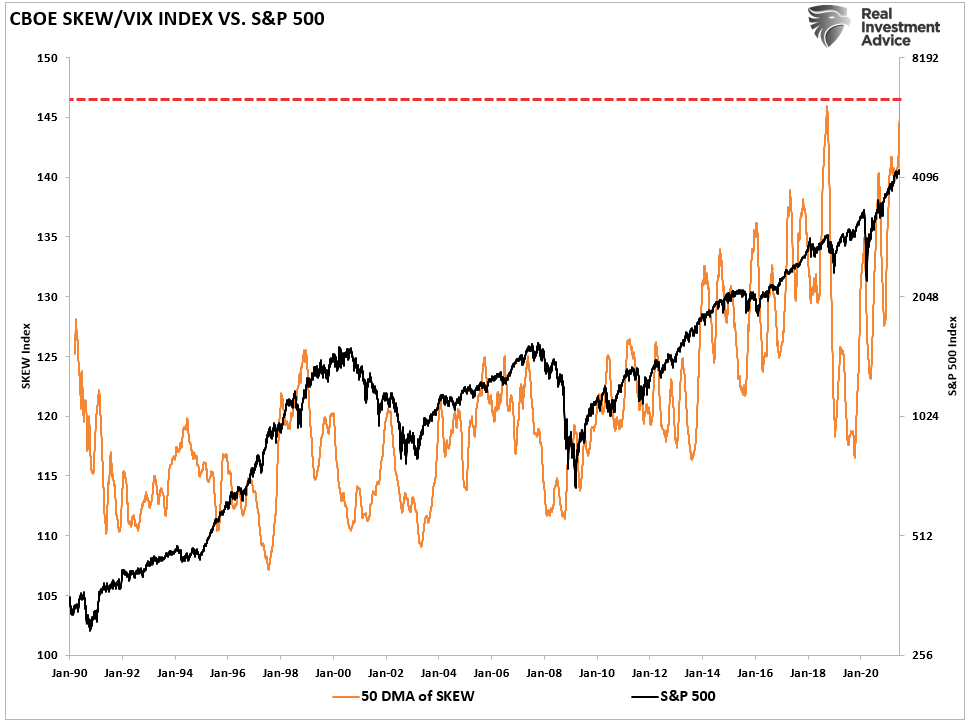

One such indicator is the CBOE SKEW index. The index measures the perceived tail risk of the distribution of S&P 500 investment returns over a 30-day horizon. It is similar to the VIX index, but instead of measuring implied volatility based on a normal distribution, it measures the implied risk of future returns realizing outlier behavior.

A SKEW value of 100 indicates the options market perceives a low risk of outlier returns. Conversely, values above 100 reflect an increased perception of risk for future outlier events.

On Friday, the reading was 170. The chart below smooths the SKEW with a 50-DMA which is now the highest level on record.

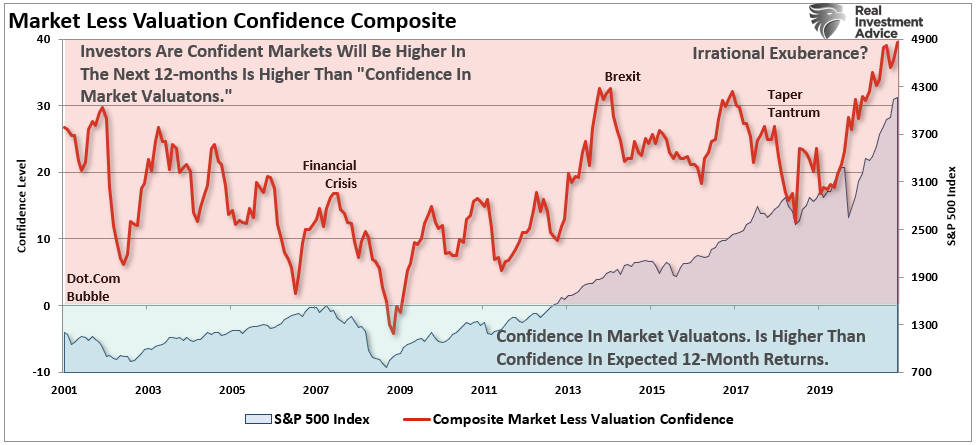

Another measure, as noted this past weekend, is the Bespoke “irrational exuberance” indicator that subtracts “Valuation Confidence” from the “One Year Confidence” survey data. That reading exploded higher recently for both institutional and individual investors.

“When the reading is positive, it means confidence that the market will be higher one year from now is higher than confidence in the valuation of the market. The opposite is the case when the reading is in negative territory.” – Bespoke

The key takeaway is that “investors simultaneously think the market is overvalued but likely to keep climbing.”

In simplistic terms, investors are as bullish as they can get.

A Glut Of Money-Losing Shares

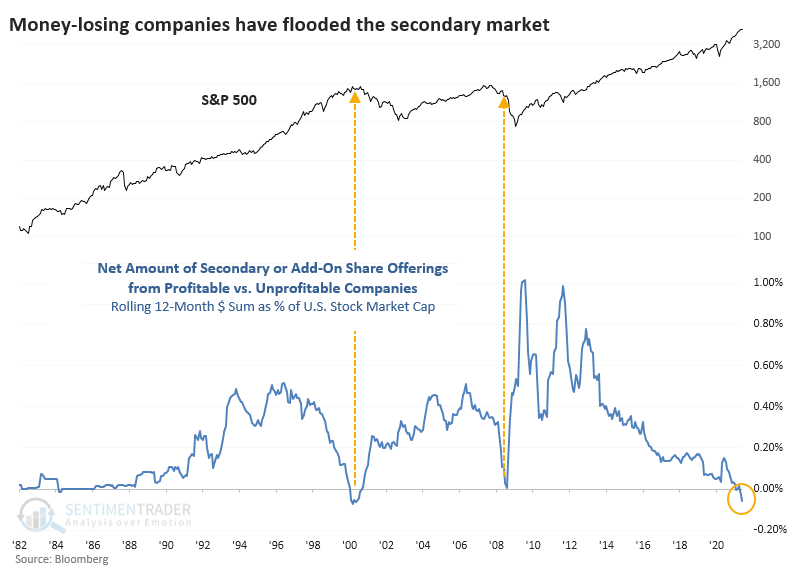

During a market-mania, Wall Street rushes to bring new companies to market to fill the “demand” from seemingly insatiable investors. That demand for “product” eventually leads Wall Street to start pushing money-losing companies into the public markets. As noted by Sentiment Trader last week:

“A rising tide lifts all boats in life and markets. And the rising tide of money lifts the fortunes of many companies that otherwise would have sunk long ago. As the Wall Street Journal notes:

‘The frenzied stock-buying activity that saved AMC Entertainment (NYSE:AMC) Holdings Inc. from bankruptcy is opening up a potential escape hatch for other troubled borrowers as well. More companies with steep financial challenges seek a lifeline from equity markets, eager to capitalize on the surge of interest in stock buying from nonprofessional investors.

"But equity markets now are more open to supporting troubled issuers, in large part because of risk-hungry individual investors eager to speculate, according to bankers and investors following the trend.'”

Not surprisingly, the explosion in IPOs is the result of the demand from investors. Bloomberg noted that 254 profitable companies issued secondary or add-on shares over the past 12 months. But 748 unprofitable companies did the same.

“All of this issuance amounted to the pricing of more than $27 billion worth of offerings. That, too, is a record amount dating back 40 years.” – Sentiment Trader

Notably, the amount of equity issuance is minuscule relative to the total market capitalization, but it is the “investor appetite” that makes it possible. Historically, that “exuberance” is a classic hallmark of a market peak.

Nobody Rings A Bell

An old Wall Street adage says, “no one rings a bell at the top of the market.”

Near peaks of market cycles, investors get swept up by the underlying exuberance. That exuberance breeds the “rationalization” that “this time is different.”

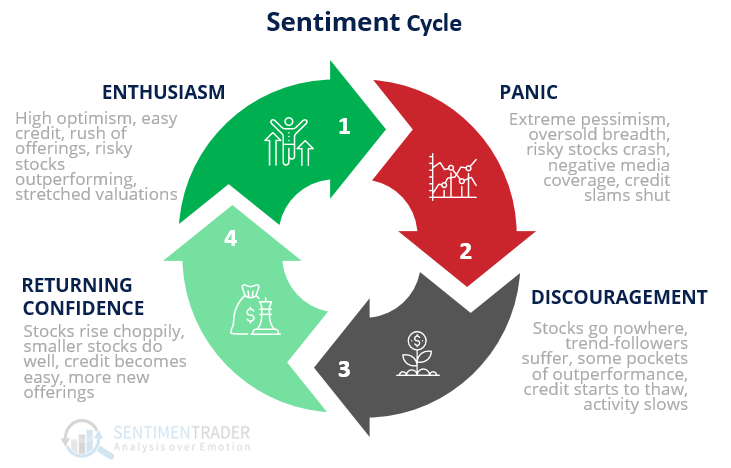

How do you know the market is exuberant currently? Sentiment Trader had a great graphic on this last week.

“This type of market activity is an indication that markets have returned their ‘enthusiasm’ stage. Such is characterized by:

- High optimism

- Easy credit (too easy, with loose terms)

- A rush of initial and secondary offerings

- Risky stocks outperforming

- Stretched valuations”

Currently, we are seeing every box checked. Irrational exuberance from investors, easy credit with investors taking out personal loans to buy stocks, and risky stocks outperforming. The level of exuberance currently matches previous major market peaks, the only missing ingredient is a catalyst to start the reversal.

The biggest problem is that investors are crowded into a theatre with a single exit. When the selling starts, the exit will become very narrow, very fast.

This Time Is Different

As noted by Jason Zweig, this is a “stock ‘gamblers’ market.”

“You could have made good money even with bad stock picks. It was like betting on black, without limits, at a roulette wheel on which 37 of the 38 pockets are black.

Why waste time and energy educating yourself while sheer ignorance pays off so easily?”

Yes! This time is indeed different. But so was every previous overly exuberant bull market in history.

- Decimalization will destroy all breadth figures (2000)

- The terror attacks will permanently alter investors’ time preferences (2001)

- The pricking of the internet bubble will forever change option skews (2002)

- Easy money renders sentiment indicators useless (2007)

- The financial crisis means relying on any historical precedents are invalid (2008)

- The Fed’s interventions mean any indicators are no longer helpful (2010 – present)

These all certainly sound like logical assumptions, and, at the time, were seemingly accurate. That is, until they weren’t. As noted, market reversions are brutal events that reset investor thinking.

While this time is undoubtedly different due to unprecedented interventions, it is likely these “behind the curtain” warnings should not get ignored.

“Where ignorance is bliss, ‘tis folly to be wise,” wrote the British poet Thomas Gray. One of these days, perhaps sooner rather than later, stocks will stop going up and the importance of understanding what you own will reassert itself. For the time being, though, investors who used to think of themselves as wise may continue to look foolish.” – Jason Zweig