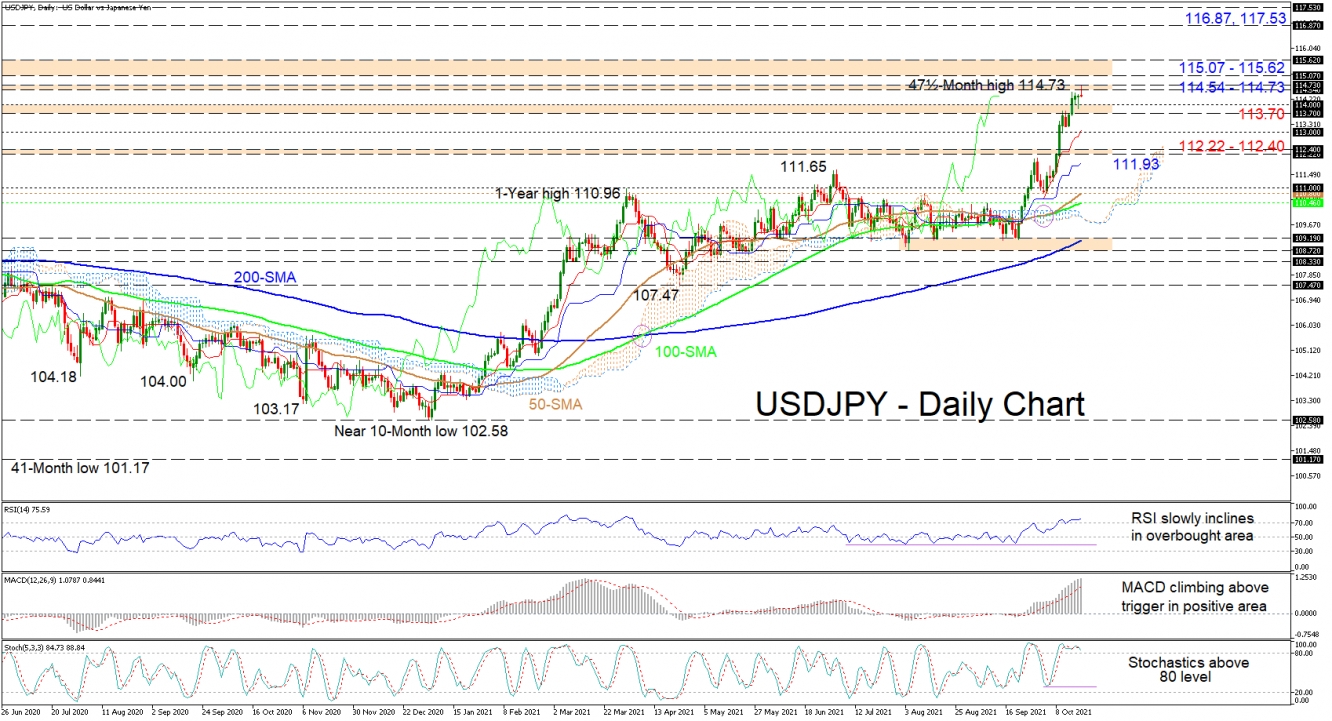

Nonetheless, the climbing simple moving averages (SMAs) are endorsing the bullish picture.

The Ichimoku lines are indicating that positive momentum is growing, while the short-term oscillators are still leaning towards the upside. The MACD, deep in the positive region, is persisting above its red trigger line, while the RSI, which is in overbought territory, is demonstrating a tendency to push higher. Currently, the stochastic lines are tangled above the 80 overbought level, not providing a clear price preference.

In the positive scenario, an immediate obstacle impeding the extension of the one-month rally is the 114.54-114.73 barrier. However, if buyers successfully overstep this slender resistance, upside limitations could arise from the neighbouring boundary of 115.07-115.62, involving multiple highs from mid-January to mid-March of 2017. Should bullish impetus intensify, the price may then propel for the 116.87 and 117.53 highs, identified in January of 2017.

Alternatively, if price gains become capped ahead of the 115.00 handle, preliminary support could develop around the 113.70 - 114.00 region. Dropping below this, upside defences could stem from the 113.00 hurdle, and the 112.22-112.40 boundary, moulded between the highs from April 2019 and February 2020. From here, a deeper price retracement could get snagged around the blue Kijun-sen line at 111.93 before challenging the zone of support between the 111.00 level and the 100-day SMA at 110.46.

Summarizing, USDJPY is sustaining a bullish tone above the 113.00 barrier and the SMAs. For positive forces to flourish, the price would need to pilot past the 115.62 threshold, while a drop beneath the 113.00 handle could start to feed negative price movements.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

USD/JPY Advances But Stumbles Near 4-Year Highs

ByXM Group

AuthorTrading Point

Published 10/20/2021, 07:25 AM

Updated 02/07/2024, 09:30 AM

USD/JPY Advances But Stumbles Near 4-Year Highs

USDJPY’s one-month rally off 109.19 may be running out of steam in the vicinity of the resistance band of 114.54-114.73, formed between the October 2018 and November 2017 rally peaks.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.