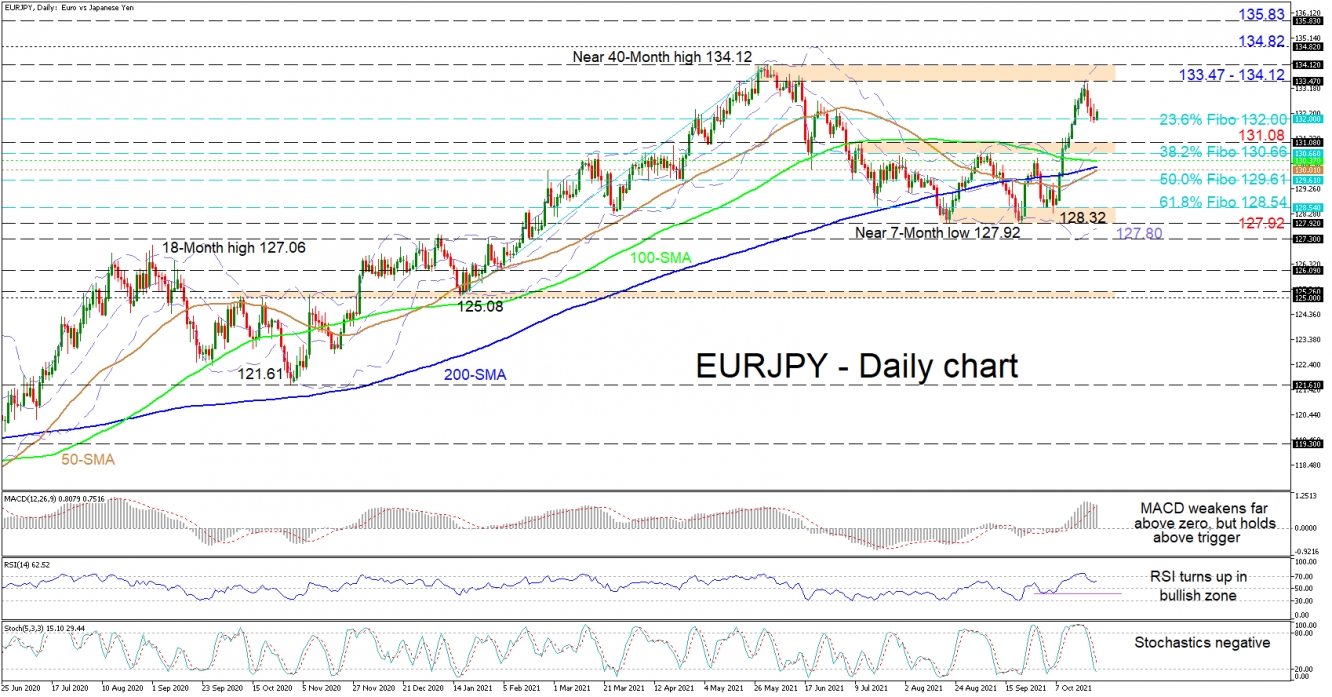

A definitive trend is not being endorsed by the 50- and 100-day simple moving averages (SMAs), which are converging with the 200-day SMA.

The short-term oscillators are conveying mixed signals in directional impetus. The MACD and the stochastic oscillator are reflecting the price retreat in the pair and have yet to confirm any pickup in positive pressures, while the minor improvement in the RSI is signalling a growing buying interest.

If the positive forces intensify, initial upside limitations could stem from the resistance section shaped between the 133.47 fresh high and the near 40-month peak of 134.12. Conquering this and extending above the upper Bollinger band, the pair could hit the 134.82 border before buyers aim for the 135.83 high, achieved around the early part of February 2018.

Otherwise, if bearish powers return and drive the price beneath the 23.6% Fibo at 132.00, sellers could encounter a reinforced support area amongst the 131.08 inside swing high and the 38.2% Fibo of 130.66. If the price slips further, a nearby buffer zone from the 100-day SMA at 130.37 until the 50-day SMA at 130.01, and the looming 50.0% Fibo at 129.61 slightly lower could deter the decline from powering on. However, should the bears secure an advantage, they could then challenge the support base from the 61.8% Fibo of 128.54 until the near 7-month low of 127.92.

Summarizing, EURJPY appears to be regaining some buoyancy as it lifts off the 23.6% Fibo of 132.00. Should the price persist above the 130.66-131.08 barricade and the SMAs, the short-term picture may continue to exhibit a modest upside preference.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/JPY: Buyers Resurface At 23.6% Fibonacci Level

ByXM Group

AuthorTrading Point

Published 10/26/2021, 06:28 AM

Updated 02/07/2024, 09:30 AM

EUR/JPY: Buyers Resurface At 23.6% Fibonacci Level

EURJPY’s minor pullback is finding its feet at the 132.00 handle, that being the 23.6% Fibonacci retracement of the up leg from 125.08 until 134.12, after its latest rally that began at 128.32 lost steam just shy of the 133.47-134.12 resistance zone.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.