Technology stocks are anticipated to report a sluggish third-quarter 2019, primarily owing to softness in the semiconductor space.

Continued impact of Huawei ban, higher tariffs and weak China market are likely to have affected third-quarter financials. Moreover, softness in NAND pricing and sluggishness in data center demand are anticipated to get reflected in the industry players’ third quarter results.

Nevertheless, improving trend in PC shipments, increasing proliferation of IoT and growing clout of cloud-based applications are likely to have acted in favor.

Mixed Q3 Earnings Picture So Far

The third-quarter earnings picture so far for technology stocks, is somewhat mixed.

The market’s positive reaction to reports from semiconductor players, including the likes of Qorvo, Intel (NASDAQ:INTC) and Taiwan Semiconductor, holds promise.

Per data from Semiconductor Industry Association, global semiconductor sales in July and August were down 15.5% and 15.9% year over year, respectively. However, sales rebounded 3.4% in September, which is anticipated to have impacted third-quarter financial performance.

However, Texas Instruments (NASDAQ:TXN) third-quarter revenues were affected by weakening end-market conditions, due to macro-economic headwinds and U.S.-China trade tensions. Additionally, restriction on sales to Huawei dampened results of companies like Xilinx (NASDAQ:XLNX), which provided sluggish guidance.

Meanwhile, companies in cloud computing domain including, Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) and IBM (NYSE:IBM) delivered mixed third-quarter results. On the other hand, Microsoft (NASDAQ:MSFT) provided stellar results on expanding Azure clientele.

Moreover, earnings beat delivered by Apple (NASDAQ:AAPL), PayPal and Facebook (NASDAQ:FB) remain noteworthy.

In this backdrop, let’s take a sneak peek into five technology companies that are scheduled to report quarterly earnings on Nov 6. Notably, per the Zacks model, a combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Square, Inc. (NYSE:SQ) third-quarter 2019 results are likely to reflect strengthening seller base on initiatives to boost user experience and integrations among the company’s product lines.

Although Square sports a Zacks Rank #1, an Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

Notably, the Zacks Consensus Estimate for third-quarter earnings has been steady at 20 cents over the past 30 days. (Read more: Factors Setting the Tone for Square's Earnings in Q3)

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

CGI Inc. (NYSE:GIB) fourth-quarter fiscal 2019 performance is likely to have benefited from uptick in contract bookings. Moreover, positive trends in digital transformation in healthcare and financial services are likely to have bolstered adoption of the company’s IT services and consequently the top line in the third quarter.

Although CGI has a Zacks Rank #2, an Earnings ESP of 0.00% makes surprise prediction difficult.

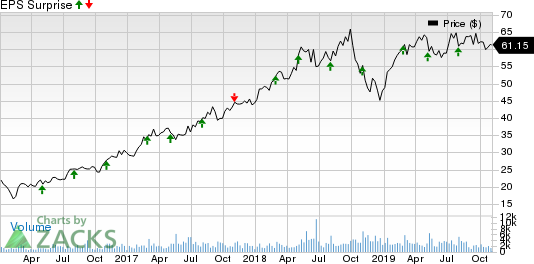

CGI Group, Inc. Price and EPS Surprise

CGI Group, Inc. price-eps-surprise | CGI Group, Inc. Quote

Notably, the Zacks Consensus Estimate for fourth-quarter earnings has been steady at 92 cents over the past 30 days.

ANSYS, Inc. (NASDAQ:ANSS) third-quarter 2019 performance is anticipated to have benefited from robust demand for simulation software solutions, particularly from automotive, avionics and aerospace end-markets.

This Zacks Rank #3 stock has an Earnings ESP of 0.00%, which makes surprise prediction difficult.

Notably, the Zacks Consensus Estimate for third-quarter earnings has been steady at $1.25 over the past 30 days. (Read more: ANSYS Gears Up for Q3 Earnings: What's in Store?)

RealPage, Inc. (NASDAQ:RP) third-quarter 2019 results are likely to reflect momentum in on-demand property management solutions on higher adoption of spend management solutions, and growing clout of Kigo vacation platform. Moreover, strength in asset optimization and resident services offerings hold promise.

The company has an Earnings ESP of 0.00% and a Zacks Rank #3, which makes surprise prediction difficult.

Notably, the Zacks Consensus Estimate for third-quarter earnings has been steady at 45 cents over the past 30 days.

GoDaddy Inc. (NYSE:GDDY) third-quarter 2019 results are likely to reflect growing adoption of its domain products, and strength in GoCentral and Open-Xchange platforms. However, rising expenses amid intensifying competition are likely to have affected profitability in the quarter under review.

Notably, our proven model doesn’t conclusively predict an earnings beat for GoDaddy for this time around. The company has an Earnings ESP of 0.00% and a Zacks Rank #4 (Sell).

GoDaddy Inc. Price and EPS Surprise

Markedly, the Zacks Consensus Estimate for third-quarter earnings has been steady at 22 cents over the past 30 days.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Square, Inc. (SQ): Free Stock Analysis Report

RealPage, Inc. (RP): Free Stock Analysis Report

GoDaddy Inc. (GDDY): Free Stock Analysis Report

CGI Group, Inc. (GIB): Free Stock Analysis Report

ANSYS, Inc. (ANSS): Free Stock Analysis Report

Original post

Zacks Investment Research