Sysco Corporation (NYSE:SYY) reported first-quarter fiscal 2020 results, with both top and bottom lines rising year over year. Further, earnings beat the Zacks Consensus Estimate for the fourth straight time, while sales missed the same.

Quarter in Detail

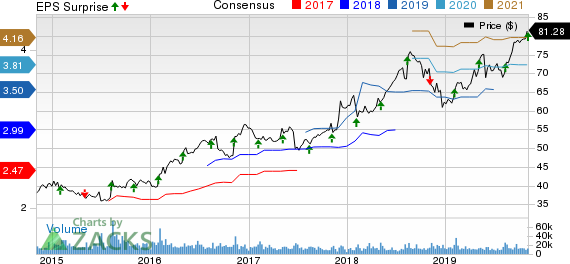

Adjusted earnings of 98 cents per share increased 8.6% year over year and surpassed the Zacks Consensus Estimate by a penny. The earnings performance was backed by improved adjusted operating income, which in turn gained from focus on driving local case volumes and solid cost management.

This global food products maker and distributor reported sales of $15,303 million, which inched up 0.6% year over year. However, the figure fell short of the Zacks Consensus Estimate of $15,535 million. This marked the company’s seventh straight quarter of top-line miss. Foreign exchange fluctuations hurt sales by 0.6% during the quarter.

Gross profit in the quarter improved 1.4% to $2,943.4 million, courtesy of higher sales. Further, gross margin expanded 15 basis points (bps) to 19.23%. Currency headwinds weighed on gross profit by 0.8%. Adjusted operating income rose 7.3% to $ $741.9 million, while adjusted operating margin improved 30 bps to 4.85%.

Segment Details

U.S. Foodservice Operations: During the quarter, segment sales advanced 2.5% to $10,658.6 million. Local case volumes within U.S. Broadline operations inched up 1.5% (including organic sales growth of 1.4%) and total case volumes rose 0.5% (wherein organic sales increased 0.4%). Gross profit grew 2.6% to $2,144.9 million, while gross margin expanded 2 bps to 20.12%.

Results were somewhat negatively impacted by food-cost inflation of nearly 2.9% in U.S. Broadline, particularly in categories like meat, poultry, dairy and produce. Adjusted operating expenses escalated 0.4% but the adjusted operating income rose 6.1% to $865.5 million.

International Foodservice Operations: Segment sales slipped 0.3% to roughly $2,912.4 million in the quarter. Foreign exchange fluctuations hurt segment sales by 3.3% during the quarter. On a constant-currency basis, sales grew 3%.

Adjusted gross profit rose 2.1% to $628.2 million, though gross margin fell 20 bps to 20.87%. Currency headwinds weighed on segment gross profit by 3.7%. Adjusted operating expenses declined 2.7%. Adjusted operating income grew 3.8% to $99 million. Operating income in the segment was affected by currency movements to the tune of 2.4%.

Other Updates

Sysco ended the quarter with cash and cash equivalents of $455.5 million, long-term debt of $8,637.7 million and total shareholders’ equity of $2,454.7 million.

During the first quarter, the company generated cash flow from operations of $171.6 million and incurred net capital expenditure of $170.8 million. Free cash flow amounted to $0.8 million.

Price Performance

This Zacks Rank #3 (Hold) stock has gained 12.5% in the past six months compared with the industry’s growth of almost 5%.

Don’t Miss These Solid Food Stocks

US Foods Holding Corp (NYSE:USFD) , with a Zacks Rank #1 (Strong Buy), has a long-term earnings per share growth rate of 9.3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

J&J (NYSE:JNJ) Snack Foods (NASDAQ:JJSF) , with a Zacks Rank #2 (Buy), has an impressive earnings surprise record.

McCormick & Company (NYSE:MKC) , with a Zacks Rank #2, has a long-term earnings per share growth rate of 8%.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Sysco Corporation (SYY): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

J & J Snack Foods Corp. (JJSF): Free Stock Analysis Report

US Foods Holding Corp. (USFD): Free Stock Analysis Report

Original post

Zacks Investment Research