The Swiss franc continues to gain ground as the US dollar has weakened broadly in the wake of Fed Chair Powell’s comments on Wednesday. In the North American session, USD/CHF is trading at 0.9384, down 0.74%

US dollar slides as Powell signals 50-bp hike

It may not have been a dovish pivot, but the financial markets saw a green light after Jerome Powell’s comments on Wednesday. Powell’s speech was essentially a rehash of the Fedspeak we’ve heard over the past several weeks, but his broad hint that the Fed would ease the December rate hike to 50 basis points (after four straight hikes of 75 bp) gave investors the excuse to buy equities.

Powell said that slowing down at this point “is a good way to balance the risks,” as the Fed Chair is trying to slow the economy while simultaneously avoiding a recession. The markets responded by pricing in a 50-bp rate hike at 80%, up sharply from 65% before Powell’s remarks. This sent financial markets higher but pushed the US dollar sharply lower, with USD/CHF dropping close to 1% on Wednesday.

Powell’s message was balanced, reiterating that rates could rise higher than anticipated for a longer period to tame inflation. The Fed remains committed to lowering inflation, and Powell said “substantially more evidence” was needed to convince the Fed that inflation was actually declining. The markets, however, chose to go on an equity spree, buoyed by expectations that the Fed has decided to ease the pace of rate hikes.

This week’s data continues to raise concerns about the Swiss economy. The KOF Economic Barometer slowed to 89.5, down from 90.0 and shy of the estimate of 91.3. The ZEW Expectations survey also slowed to -57.5, down from -53.1 and well off the consensus of -41.9.

Retail sales for October, released today, were a huge disappointment at -2.5%. This followed a 2.6% gain in September and missed the consensus of 3.3%. The Swiss franc has enjoyed a superb November, as the USD/CHF has plunged 5.5%. If this trend continues, we could see the Swiss National Bank express some concern about the rising Swiss franc, which could drag down the key export sector.

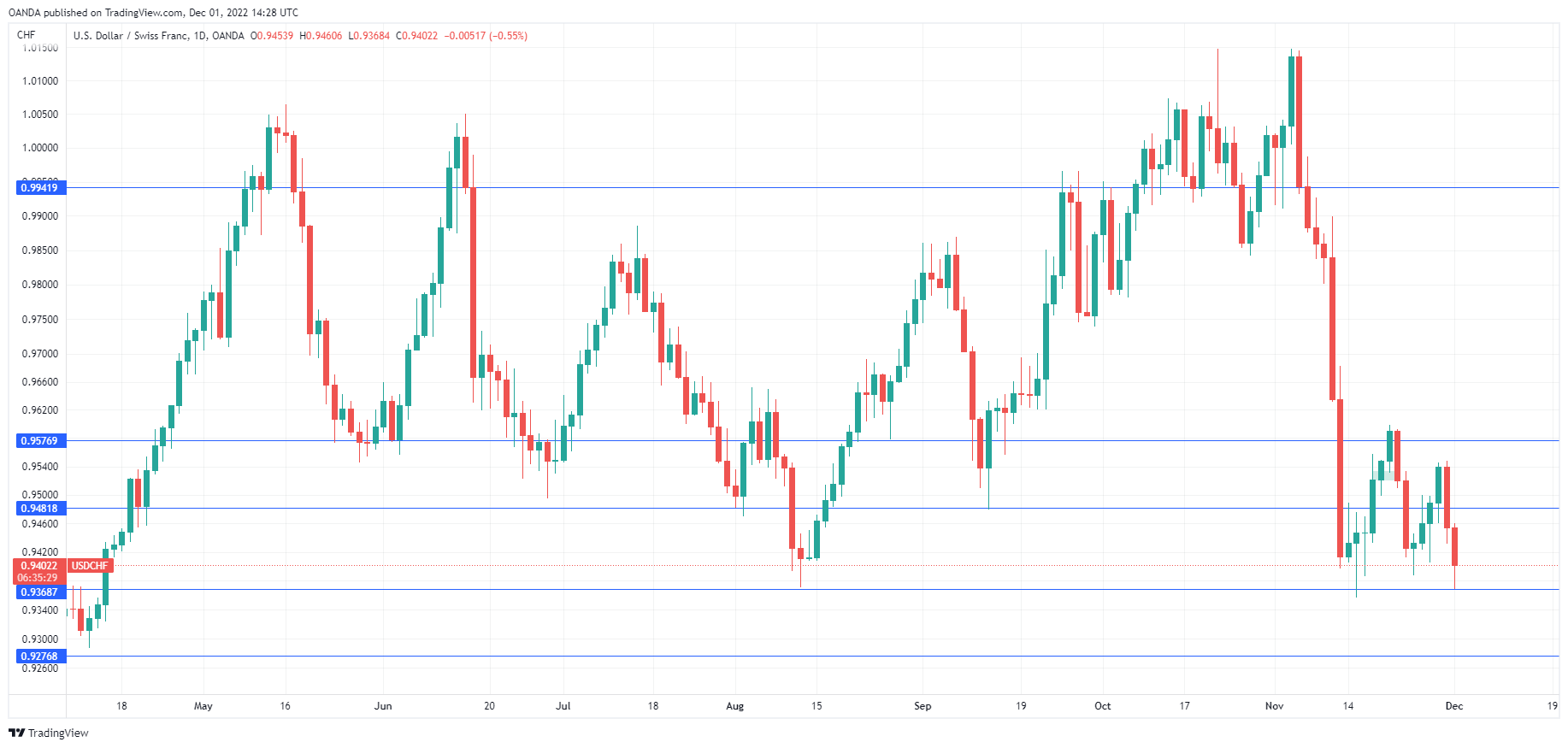

USD/CHF Technical

- USD/CHF is putting pressure on support at 0.9366. The next support level is 0.9277

- There is resistance at 0.9482 and 0.9577