What exactly are we to do in this levitating market? Buy more? Pull back? Do nothing?

I get why most folks are uneasy these days—they’re seeing the stock market, and particularly tech stocks, heading into the stratosphere, while the economy that supports them is a mess. Stocks can’t hang in midair forever, the thinking goes. Eventually they’ll plunge to earth.

A (Pleasant) Surprise in a Lousy Year

Don’t buy this argument. Because in the weird market we’re in, stocks can not only hover but actually rip higher and hand us growing dividends, too. Let me show you what I mean, starting with the economy.

Sure, GDP cratered 34.3% in the lockdown-riddled second quarter, but it rebounded 38% in the third quarter to get back to near its pre-crisis level. Still, our economy is still behind, so shouldn’t stocks be behind as well?

Remember that stocks are forward looking—they’re not priced based on present earnings but future earnings growth. And since the first half of 2020 saw some shocking earnings declines due to the lockdown, the strong implication here is that the first half of 2021 will see tremendous earnings growth just because the comparables are so low, never mind the effect that three (and possibly more) vaccines in the coming months will have on consumer spending.

From Travel to E-Commerce—and Back Again?

What’s more, consumer spending has reshuffled, giving more support to both the S&P 500 and the tech sector than most investors believe.

When you dive into the third-quarter data, you see that earnings declines are mostly concentrated where you’d expect them: in the travel and leisure sectors. But it’s important to remember that travel-spending declines are destined to be short-lived. When vaccines are out and people can travel again, pent-up demand will spur earnings in the sector.

Now, if we saw a massive growth in travel-related stocks before those higher earnings were released, you could say this sector has gotten out of hand. But in reality, that’s not the case.

Travel Stocks Still Trail the Market

The airline-industry-focused US Global Jets ETF (NYSE:JETS), which holds major carriers like Delta Air Lines (NYSE:DAL), Southwest Airlines (NYSE:LUV) and JetBlue Airways (NASDAQ:JBLU), remains behind the broader market. This shows that investors are waiting for clearer evidence of the big earnings boost a return to travel will provide. But this doesn’t mean it’s time to run out and buy JETS—or load up on any travel-related stocks, because any profit gains in that sector will likely be tempered.

In theory, it makes sense that you’d see a shift of discretionary spending from e-commerce to travel as soon as people aren’t stuck in the house anymore. But this implies that a big driver of the e-commerce shift has been vacation money that people simply redirected to online purchases. But there’s more to this story.

More Than Travel Goes Online

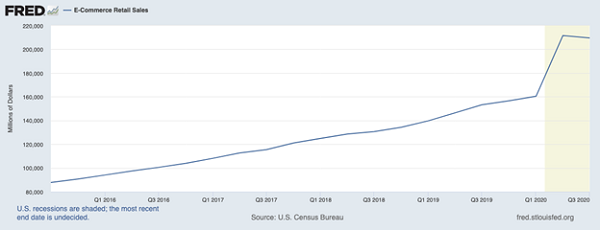

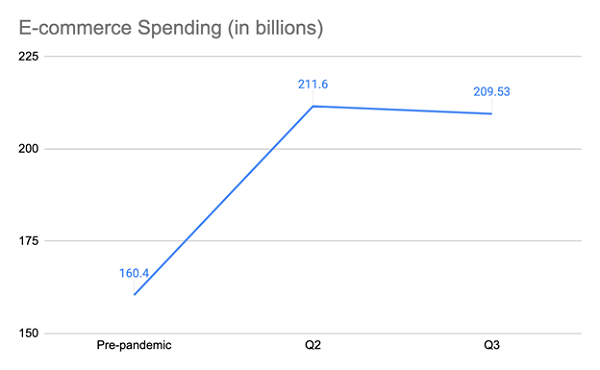

E-commerce data shows a steady shift in spending from offline to online until COVID-19, when that trend accelerated. People who had bought little to nothing online were now buying groceries through the web. The Internet had become a place to buy essentials, not just discretionary goods.

The pace of this spending growth is essential to understanding how durable this trend is. Since the 32% jump in online spending began at the start of the shutdown, and with that spending staying high throughout the third quarter, we can see that the increase wasn’t driven by discretionary spending (or it would have shown up later), and it wasn’t driven solely by one-time panic buying of essentials (or it wouldn’t have lasted into the third quarter).

In other words, Americans’ pivot to e-commerce will likely continue, which justifies the tech sector’s big gains for 2020 (since those companies are largely connected to online shopping) while also justifying the S&P 500’s lower but still-strong returns (since the companies producing many of the products consumers are buying are benefiting from the shift to e-commerce).

The bottom line? Now is not the time to worry about a bubble, in either tech or the market as a whole, even if the big deals in stocks we saw earlier this year are over.

Disclosure: Brett Owens and Michael Foster are contrarian income investors who look for undervalued stocks/funds across the U.S. markets. Click here to learn how to profit from their strategies in the latest report, "7 Great Dividend Growth Stocks for a Secure Retirement."