Supermarket Income REIT PLC (LON:SUPR) reported strong H119 earnings growth on the back of its growing portfolio, contracted RPI-linked rental uplifts, and well-controlled costs. The Q219 DPS was increased by 3.2%, in line with RPI. Rental growth also drove revaluation gains, sufficient to offset property acquisition costs in the period. EPRA NAV total return in the six-month period was 3.1% or an annualized 6.3%.

Contracted RPI uplifts drive rental and DPS growth

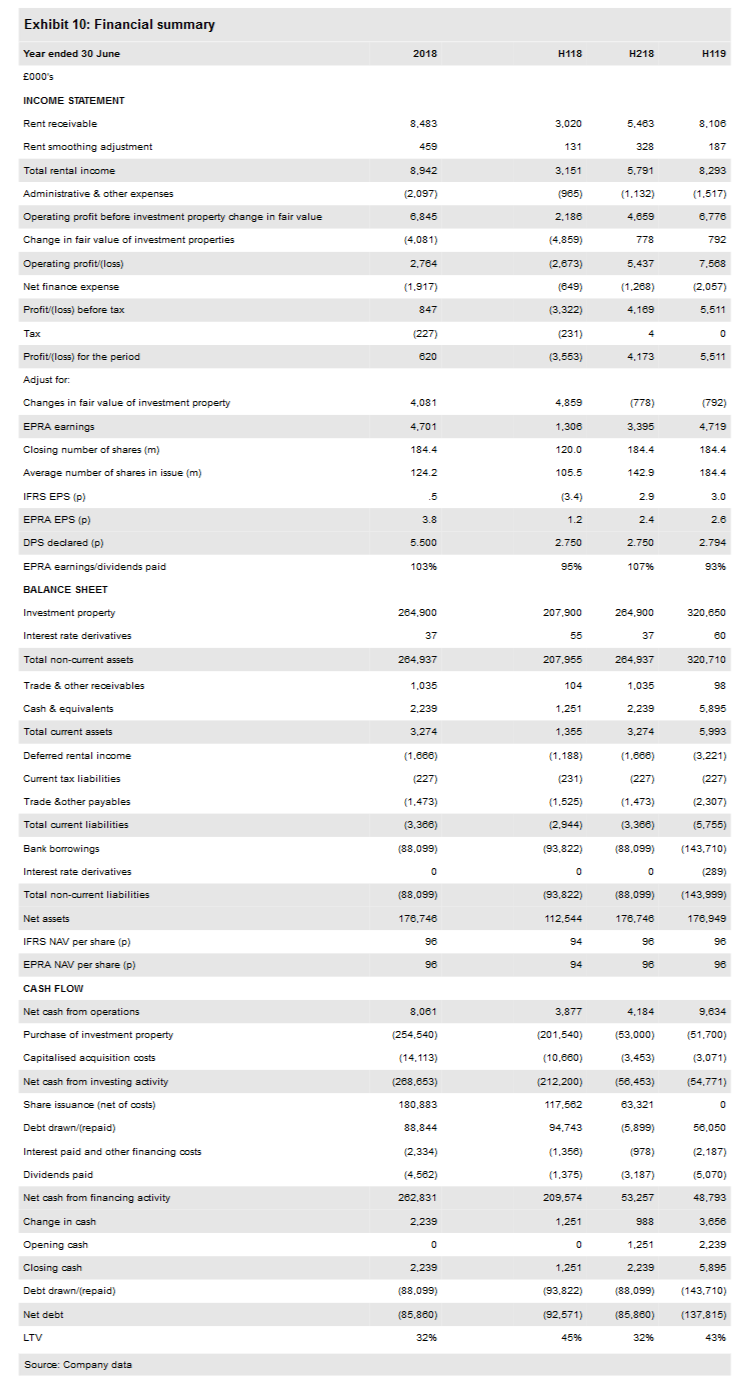

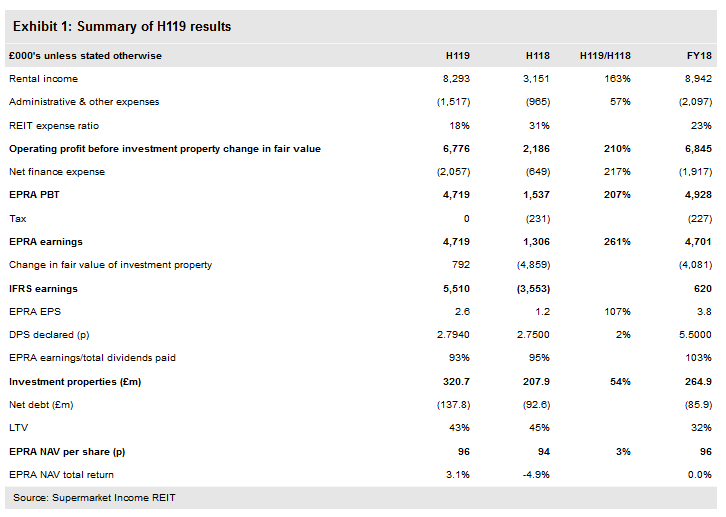

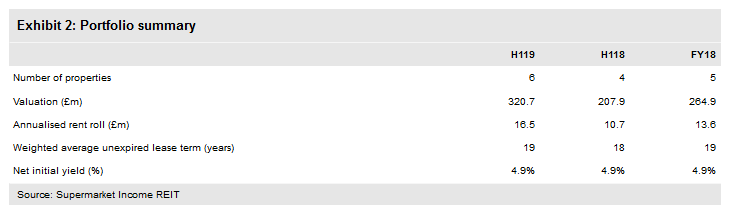

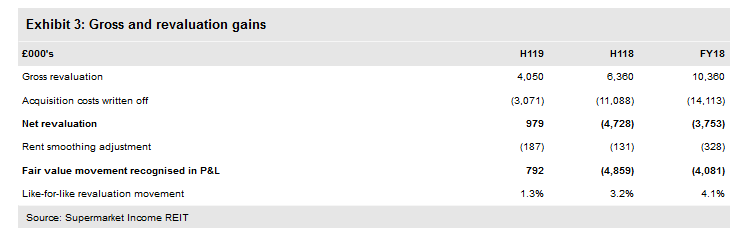

During H119 all key financial metrics increased strongly. The portfolio value reached £320.7m (end-FY18: £264.9m), including the acquisition of a sixth asset for £51.7m. The portfolio annualized passing rent reached £16.5m. All of the properties are on let on long leases (a weighted average unexpired lease term of 19 years) with upwards only RPI-linked rent reviews. The two rent reviews completed in the period (average annual RPI uplifts of 3.2%) generated like-for-like rental growth of 1.6%, driving 1.3% gross revaluation gains, more than sufficient to offset property acquisition costs. A third rent review has since been concluded (also at 3.2%) and others will follow in coming months. With the EPRA cost ratio falling further (to a relatively low 18%), EPRA earnings rose to £4.7m, covering dividends paid by 93%, with the company expecting full or close to full dividend cover for the year. EPRA NAV per share was unchanged at 96p compared with end-FY18.

Targeted investment

SUPR is building a diversified portfolio of UK supermarket assets, with long leases and upwards only RPI-linked rents, let to quality tenant covenants. It predominantly targets omnichannel stores (combining in-store and online fulfillment) that can benefit from both the expected growth of grocery sales and the increasing popularity of online, in strong locations, with asset management potential. The investment adviser brings a high level of experience and knowledge of the sector, and its principals have been involved in more than £4.0bn of supermarket transactions over the past decade. RPI-linked rent uplifts, strong tenant covenants, and long lease lengths provide secure income growth prospects and good potential for capital growth.

Valuation: Attractive, growing yield potential

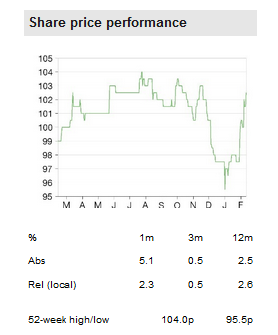

The Q219 DPS of 1.419p annualizes at 5.58p, representing a prospective dividend yield of 5.5% with visible potential for growth. A comparison with a narrower group of long income-focused REITs shows that SUPR offers an above-average yield with a similar P/NAV.

Business description

Supermarket Income REIT, listed on the special funds' segment of the London Stock Exchange, invests in supermarket property, let to leading UK supermarket operators, on long, RPI-linked leases. The investment objective is to provide an attractive level of income, with the potential for capital growth, with a 7–10% pa total shareholder return target over the medium term.

Visible income and growth potential

Supermarket Income REIT, which is listed on the special funds segment of the London Stock Exchange, invests in a diversified portfolio of supermarket property, let to leading UK supermarket operators on long, RPI-linked leases. The investment objective is to provide an attractive level of income, with the potential for capital growth and a 7–10% pa total shareholder return target over the medium term. The long, indexed-linked leases that SUPR targets provide a high degree of visibility to contractual income streams and strong income returns for supermarket property have underpinned a long record of positive total returns, making this a relatively low-risk segment of the UK commercial property market. The company has an independent board of non-executive directors and has appointed Atrato Capital as an investment adviser. The Atrato management team brings a very high level of experience and knowledge of the UK real estate sector, having advised on, structured and executed more than £4.0bn of supermarket transactions over the past decade.

The key financial highlights of the H119 results were:

Strong growth in all key financial metrics compared with H118, reflecting the growth in the portfolio since IPO in November 2017. Between IPO and end-H118 SUPR moved quickly to acquire its first four assets with an aggregate rent roll of £10.7m. A fifth asset was added in May 2018, taking the end-FY18 annualized rent roll to £13.6m. The sixth asset was acquired early in H119, in July, making a reasonably full contribution to the period, which saw rental income increase materially year-on-year to £8.3m (from £3.2m). This asset is the Morrison’s, Hillsborough, Sheffield acquired for £51.7m (before costs), adding £2.54m to the annualized rent roll.

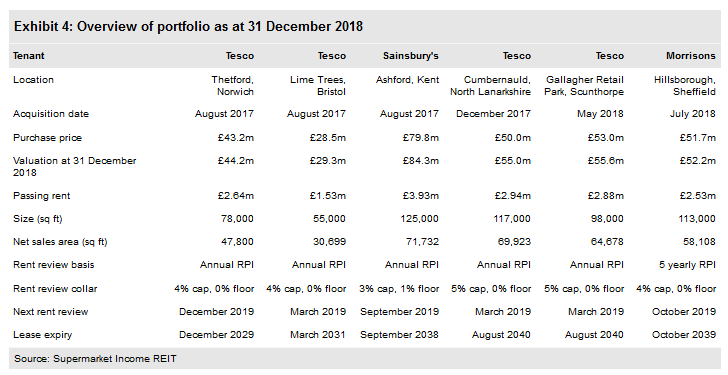

All of the properties are on let on long leases (a weighted average unexpired lease term of 19 years) with upwards only RPI-linked rent reviews. Annual reviews were completed during H119, covering £6.4m of contracted rents, and were settled with an average uplift of 3.2%, adding c £200k or 1.6% to annualized rent roll. A third review has since been concluded, adding an annual RPI increase of 3.2% to the c £1.5m of contracted rent from March 2019. Two further annual RPI-linked rent reviews will take place during H219 and the sixth asset, on a five-year RPI-linked rent review in October 2019, after the FY19 year-end (see Exhibit 4).

The REIT expense ratio declined to 18% (or 17% excluding certain non-recurring expenses) with the main driver of cost growth being the investment manager adviser fees levied at a competitive 0.95% of average net assets. The expense ratio is relatively low within the REIT sector and should decline further with future planned portfolio acquisitions.

Net finance expenses increased with borrowings, utilized to part fund portfolio additions. Gross drawn debt increased to £146.9m, with a current average cost of 2.5%. Net debt was £137.8m and the loan to value ratio (LTV) was 43.0%.

EPRA earnings increased to £4.7m, similar to that earned in the whole of FY18, and EPRA EPS, taking account of the increased number of shares in issue, increased to 2.6p.

The two quarterly dividends declared in H119 amount to 2.794p per share, with the second quarterly DPS increasing by 3.2% as flagged with the FY18 results (an annualized 5.676p per share). The company expects to declare aggregate DPS of 5.632p for FY19 as a whole, barring unforeseen circumstances, with DPS paid during the year amounting to 5.588p. In cash terms, H119 EPRA earnings covered dividends paid by 93% during the period and on the same basis, the company expects full or close to full dividend cover for the year.

The value of the portfolio increased by £55.8m to £320.7m compared with June 2018 (end-FY18), substantially reflecting the Morrison’s acquisition. Like-for-like revaluation gains of £4.1m, or 1.3%, reflected the underlying rental growth and were sufficient to more than offset acquisition costs. The blended portfolio net initial yield (NIY) was stable at 4.9%. IFRS earnings and NAV benefitted by a net £792k.

With EPRA earnings broadly matching dividends paid, and gross revaluation gains substantially offset by acquisition costs, EPRA NAV per share was unchanged compared with end-FY18 at 96p per share. Including DPS paid, the EPRA NAV total return during the half-year was 3.1% (an annualized 6.3%).

Focused investment policy

Exhibit 4 shows SUPR’s current portfolio in more detail. The key to income growth visibility is the selection of properties with RPI-linked rental uplifts and let on long unexpired lease terms to institutional grade tenants, although this is reinforced by a highly selective investment strategy that additionally focuses on:

Supermarkets fulfilling online delivery. With dedicated online-only fulfillment centers only really making commercial sense around high population density London, the major operators have built a network of omnichannel stores combining supermarkets (the dominant channel) with online (the fastest growing channel). SUPR expects continued online growth and predominantly targets omnichannel stores.

Top trading stores. SUPR targets top performing stores with a strong trading record, identified using the knowledge and experience of the investment adviser.

Large flexible sites. A low site cover, with significant non-sales space, provides opportunities to benefit from future asset management opportunities and which may offer good potential for alternative use over the longer term.

The investment adviser estimates that from a pool of c £20bn of supermarket properties that are not owned directly by operators, c £10bn meet SUPR’s strict selection criteria aimed at assets that can deliver sustainable value in a shifting retail environment. SUPR believes that a portfolio value of c £1bn is a reasonable objective over the long term, or a c 10% share of its target asset pool, compared with c £320m currently.

Contractual RPI rent increases provide visibility

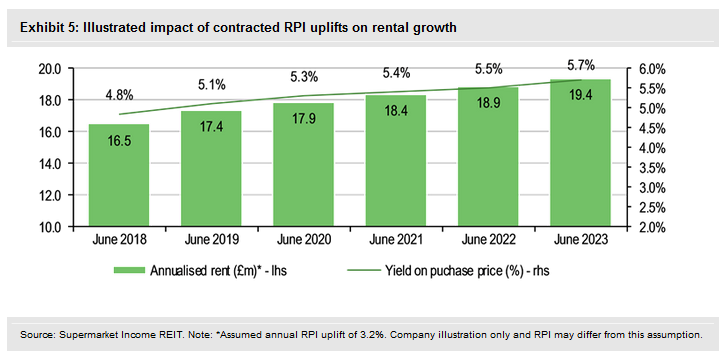

To better illustrate the potential impact of contractual RPI rent uplifts on rental income growth, SUPR has provided the data in Exhibit 5, which assumes an annual RPI change of 3.2%. Obviously, RPI may differ from this level, but we believe this to be a reasonable assumption and consistent with current experience. In practice, there is a ceiling to the earnings benefit represented by the rent review caps on uplifts, of up to 5%.

With the illustrated growth in rents, the yield on property purchase values also increases. However, if we assume no change in property valuation yields, the external market valuations of the properties would be expected to increase further. We estimate that applying an unchanged 4.9% valuation yield to the illustrated FY23 rental income would add c £50m to the portfolio valuation, or c 27p per share.

There is potential for yields to positively tighten

In addition to the potential for property valuations to increase with rental growth at unchanged yields, the investment adviser highlights the scope for supermarket property yields to reduce, relative to other classes of commercial property potentially in absolute terms, which would have a positive effect on supermarket property valuations.

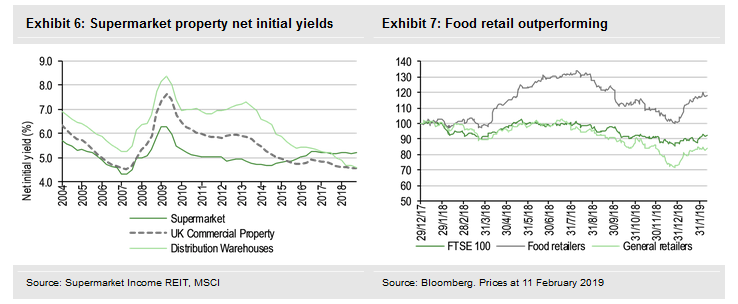

Supermarket property has historically been priced at yields below the UK all-property sector; however, this has not been the case since c 2015 (see Exhibit 6). Supermarket property yields have increased in recent years, even as the broader UK commercial property market and the distribution warehouse subsector has seen yields decline. The period of yield widening for supermarket property obviously corresponds to a period of intense competition among the supermarket operators, against a background of continuing growth in online retail and its transformational impact on traditional retail distribution. However, unlike some of the pressures being felt elsewhere in the retail sector, UK consumer spending on grocery products has grown each year since 1999 and is forecast by IGD Retail Analysis to grow by a further 15% over the next five years, from £190bn in 2018 to £218bn in 2023. All of the major operators are currently seeing sales growth even if the discounters continue to grow fastest, helped by new store openings. The robustness of the food retail sector can be seen in a share price comparison with general retailers and the FTSE100 in Exhibit 7.

Reinforcing this more positive view on the covenant strength provided by the supermarket operators is the recent upgrade of the Fitch rating of Tesco (LON:TSCO) to investment grade and the investment adviser expects that if the proposed acquisition of Asda by Sainsbury goes ahead, all of the main operator/tenants are likely to be rated as such. The investment manager views the acquisition, currently the subject of a Competition and Markets Authority inquiry, as a positive development, and believes that consolidation within the operator sector has the potential to further support tenant covenants. It does not anticipate any competition issues with its Sainsbury’s Ashford store, and given that Sainsbury’s and Asda will continue to target a different customer segment, the combined group is expected to retain stores from both brands wherever possible.

Financials and valuation

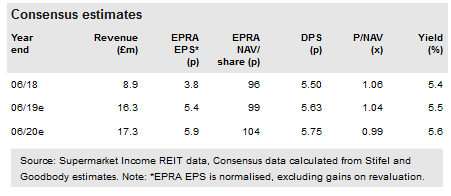

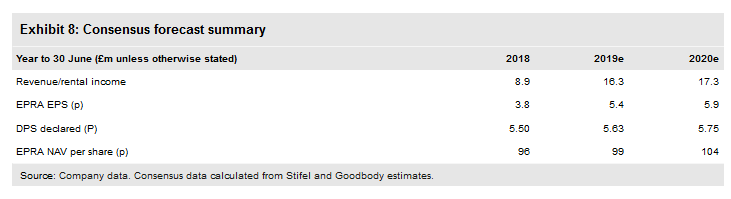

The 7–10% NAV total return targeted by SUPR is the product of rental income increasing with RPI, supporting dividend growth and, to the extent that property valuation yields do not change, NAV growth. We would also expect SUPR to target further acquisitions, funded by a mix of new debt and equity funding. Edison does not produce forecasts for SUPR but its outlook, without acquisitions, is reflected in the current market consensus expectation for SUPR as shown in Exhibit 8.

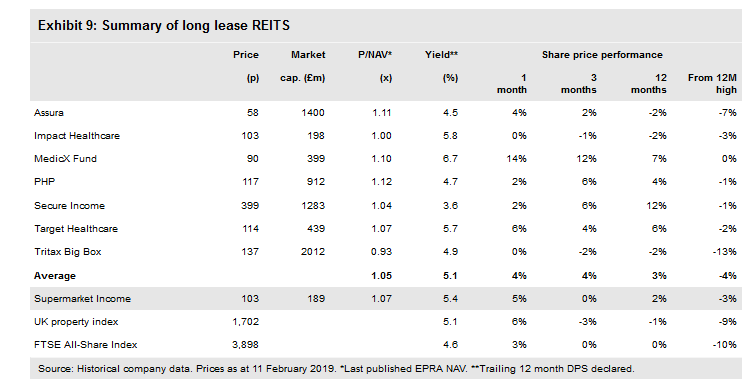

SUPR is one of a group of companies within the broad property sector that focuses on income returns derived from long leases. As can be seen in Exhibit 9, this group

of companies has outperformed the broader property sector as well as the FTSE All-Share Index over the past 12 months which we attribute to the continuing search for yield by investors and a recognition that within the property sector, income returns have historically been a less volatile component of overall returns than capital returns. SUPR’s average unexpired lease term of 19 years is above the average for this group and its RPI-linked rent growth provides investors with considerable visibility of income with protection against inflation. The current quarterly DPS annualizes at 5.676p per share which represents a yield of 5.6%, above the average 5.1% for the group, while at 1.07x the SUPR P/NAV is only slightly above the average 1.05x. We note the potential, discussed above, for yield tightening in the supermarket sector to lift NAV.