Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,410, and profit target at 2,200, S&P 500 index).

Our intraday outlook is now bearish, and our short-term outlook is bearish. Our medium-term outlook remains neutral, following S&P 500 index breakout above last year's all-time high:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): neutral

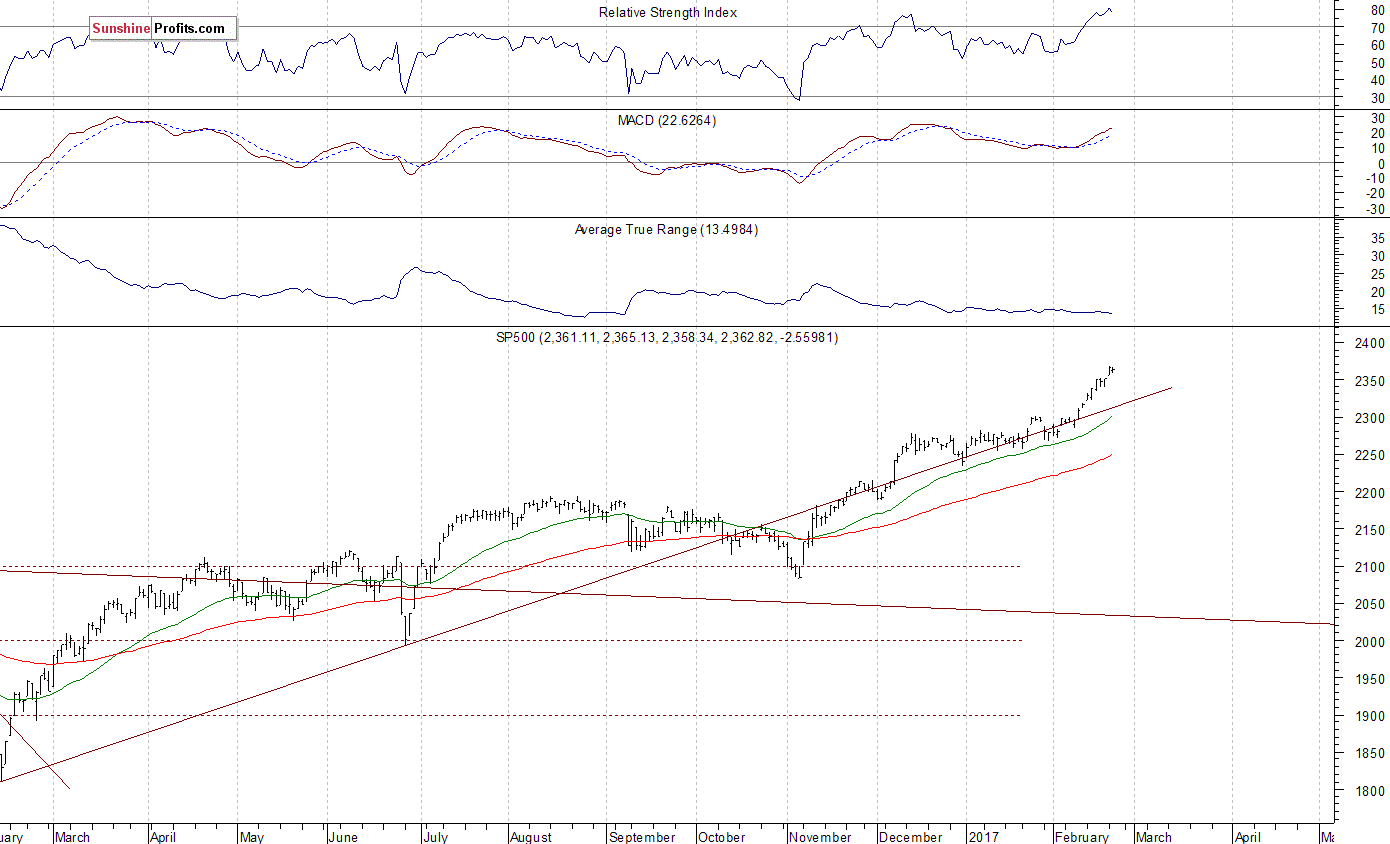

The main U.S. stock market indexes were virtually flat on Wednesday, following recent move up, as investors took some short-term profits off the table. The S&P 500 index remained close to its Tuesday's new record high of 2,366.71. The Dow Jones Industrial Average continued its uptrend, as it got closer to the level of 20,800, and the technology NASDAQ Composite index remained close to 5,900 mark. All three major indexes trade along their record highs. Will the market extend its year-long medium-term uptrend even further before some more meaningful downward correction?

The nearest important level of support of the S&P 500 index is at around 2,350-2,355, marked by Tuesday's daily gap up of 2,351.16-2,354.91. The next level of support of the S&P 500 index is at around 2,320, marked by last Monday's daily gap up of 2,319.23-2,321.42. The support level is also at around 2,300-2,310, marked by previous level of resistance and previous daily gap up of 2,311.08-2,311.10.

We can see some short-term volatility following three-month-long rally off last year's November low at around 2,100. Is this a topping pattern before downward reversal? The uptrend accelerates, and it looks like a blow-off top pattern accompanied by some buying frenzy. The S&P 500 index trades above its medium-term upward trend line, as we can see on the daily chart:

Expectations before the opening of today's trading session are virtually flat, with index futures currently between 0.0% and +0.1%. The European stock market indexes have been mixed so far. Investors will wait for some economic data announcements today: Initial Claims at 8:30 a.m., FHFA Pricing House Index at 9:00 a.m., Crude Inventories at 11:00 a.m.

The S&P 500 futures contract trades within an intraday uptrend, as it retraces some of its yesterday's move down. The nearest important level of resistance is at around 2,360-2,365, marked by record high. On the other hand, support level remains at 2,345-2,355, marked by recent consolidation. The next support level is at 2,335-2,340, marked by some previous local lows. There have been no confirmed negative signals so far. However, we can see short-term overbought conditions, along with negative technical divergences. Is this a topping pattern or just some short-term consolidation before another leg up?

The technology NASDAQ 100 futures contract follows a similar path, as it currently trades close to record high. It has reached yet another new all-time high above 5,350 mark. The technology sector stocks have been relatively stronger than the broad stock market recently following better-than-expected quarterly earnings releases.

The nearest important support level is at around 5,325-5,330, marked by recent local lows, and the next support level is at 5,280-5,300, among others. On the other hand, resistance level is at 5,350-5,355. The market trades within a short-term consolidation, as the 15-minute chart shows:

Concluding, the broad stock market fluctuated along its Tuesday's record high yesterday, as the S&P 500 index lost 0.1%. Will the uptrend continue despite some clear short-term overbought conditions? Or is this a topping pattern before downward correction?

Our speculative short position from December 14 has been closed a week ago on Tuesday, at the stop-loss level of 2,330 (S&P 500 index). We lost 61.65 index points on that trade, betting against year-long medium-term uptrend off last year's February local low. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

There have been no confirmed negative signals so far. However, we still can see medium-term overbought conditions accompanied by negative technical divergences. Therefore, we continue to maintain our speculative short position (opened on Wednesday, February 15 at 2,335.58 - opening price of the S&P 500 index).

Stop-loss level is at 2,410 and potential profit target is at 2,200 (S&P 500 index). You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF (NYSE:SPY) - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

To summarize: short position in S&P 500 index is justified from the risk/reward perspective with the following entry prices, stop-loss orders and profit target price levels:

S&P 500 index - short position: profit target level: 2,200; stop-loss level: 2,410

S&P 500 futures contract (March) - short position: profit target level: 2,197; stop-loss level: 2,407

SPY ETF (SPDR S&P 500 (MX:SPY), not leveraged) - short position: profit target level: $220; stop-loss level: $241

SDS ETF (ProShares UltraShort S&P500, leveraged: -2x) - long position: profit target level: $15.47; stop-loss level: $12.98