- Cautious tone as Russia plays down talks progress, maintains offensive in eastern Ukraine

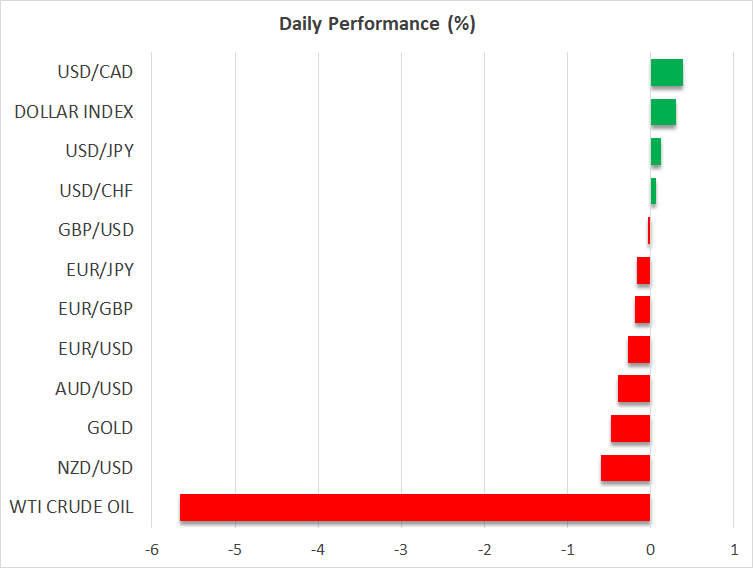

- Stocks mixed, dollar firmer despite Treasury yields drifting lower

- Oil plunges again after Biden administration says it may release more strategic reserves

Markets cling onto peace hopes as doubts emerge

The risk rally spurred on by optimism of a Russia-Ukraine ceasefire is looking a little shaky after both Washington and Moscow played down the significance of the apparent progress in the latest round of negotiations. Russian forces have reportedly intensified their attacks on Ukrainian cities, confirming the West’s scepticism about the pledge to scale down military operations around Kyiv.

The US believes Russian troops withdrawing from the capital are merely regrouping to prepare for a new offensive in the Donbas region.

But the Kremlin has also been dismissive of the claims of progress, with a spokesman for President Putin saying there was nothing “too promising” from the two-day talks in Turkey.

However, although the mood has dampened a little, investors remain cautiously upbeat about the prospect of some kind of a ceasefire. Neither side has abandoned the negotiating table and the talks will continue on Friday via a video-call, so this is sustaining the optimism for the time being.

China slowdown fears, dashed peace hopes weigh on stocks

US stock futures were edging higher on Thursday, suggesting Wall Street will resume its rally after the S&P 500’s four-day winning streak came to an end yesterday. Stocks in Europe were mixed but Asian equities were mostly in the red.

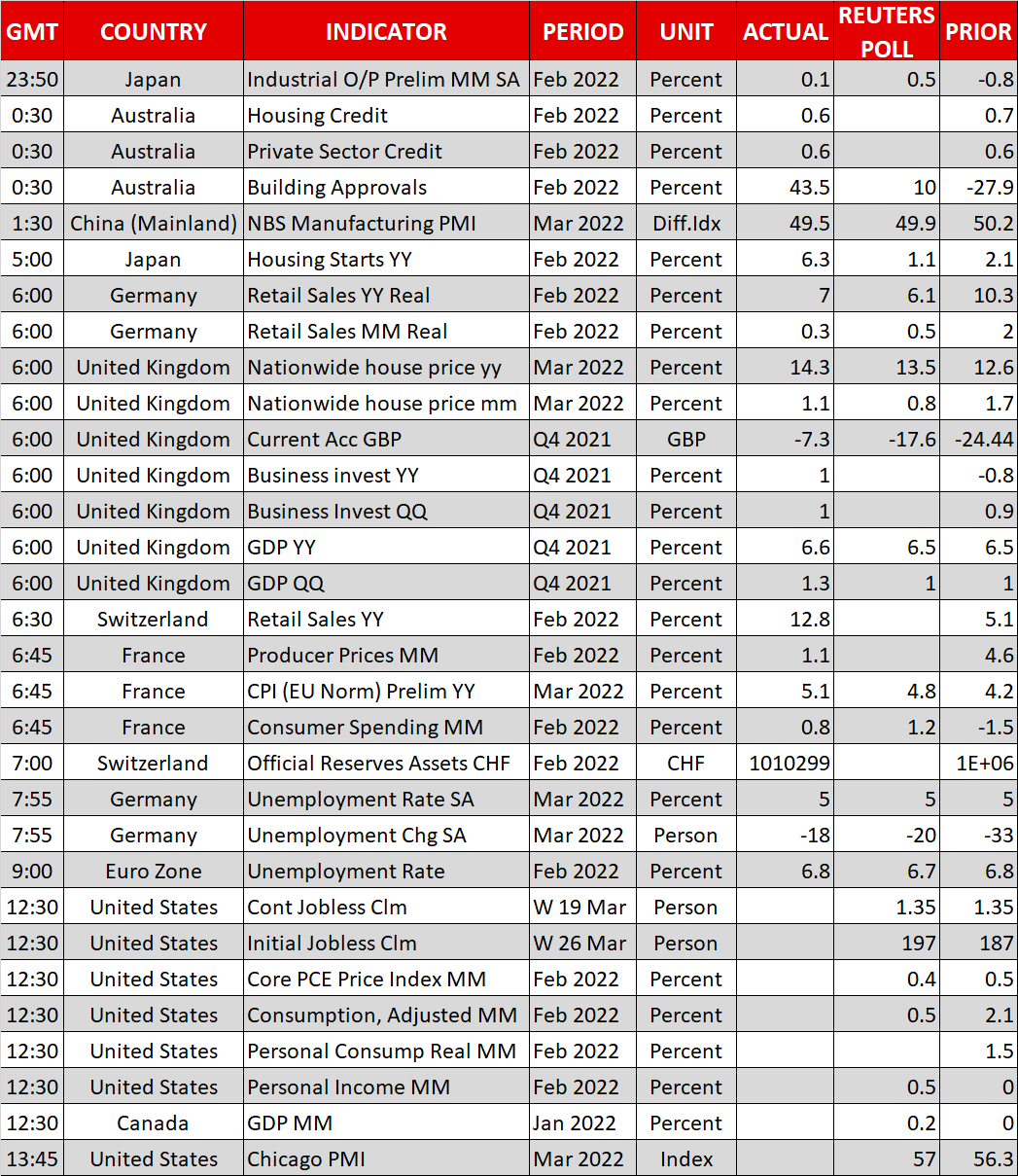

China’s manufacturing and non-manufacturing PMI prints were both simultaneously below 50 in March for the first time since the initial Covid-19 outbreak in February 2020. Soaring cases of Omicron have forced authorities to place several regions under lockdowns or new restrictions, most recently in Shanghai, and this is clearly weighing on not just industrial, but broader economic activity as well.

While the fallout from Ukraine probably won’t have a huge impact on Asian economies as they’re less affected by the sanctions, a slowdown in China could derail their recovery.

But the risk of recession is greatest in the euro area, which explains why European equities haven’t bounced back as strongly as US ones this month.

Euro gives up some gains

The Ukraine crisis has made the ECB’s policy dilemma a lot worse as the central bank ponders how soon to begin raising interest rates to fight surging inflation. March CPI readings out of Germany and Spain yesterday were much stronger than expected and investors have priced in a rise of more than 50 basis points in the ECB’s deposit rate by year-end.

For the euro, however, those bets might not necessarily provide much of a boost as rate hikes would probably come at a great economic cost. The single currency has made impressive gains on the back of the slight de-escalation in tensions between Ukraine and Russia and geopolitical headlines look set to remain in the driving seat for the time being.

The euro was paring some of its gains today, easing to around $1.1130. The pound was steadier at $1.3125, finding some support from an upward revision to the UK’s Q4 GDP estimate.

Dollar heads back up, BoJ doubles down on yield curve policy

The Japanese yen was mixed, firming against most majors, but was notably weaker versus the US dollar.

The Bank of Japan was active in the bond market again today, attempting to keep the 10-year yield from spiking above the 0.25% cap. Despite the need for increased intervention this week, the BoJ did not significantly alter its schedule for Q2 for the frequency of its operations, increasing them slightly for longer-term Japanese government bonds.

The dollar was recouping some of yesterday’s losses even as Treasury yields continued to retreat from the highs reached at the start of the week. Investors will be keeping an eye on the latest numbers on personal income and spending, as well as the core PCE price index due out of the US later today.

Oil prices under pressure from US plan

The commodity-linked currencies were underperforming on Thursday as oil prices took another dive.

The Biden administration is considering whether or not to release more of its strategic crude reserves to stem the jump in oil prices, which is exacerbating the cost-of-living squeeze for Americans. Reports suggest the US could release up to one million barrels of oil a day as OPEC has so far declined White House demands to boost supply.

OPEC is holding its monthly meeting with its non-OPEC allies today. But the cartel is almost certain to maintain the existing plan of raising production by 400,000 bpd each month.

WTI and Brent crude futures were last trading more than 5% lower on the day.