Economic recovery optimism is in full swing as the new week kicks off, driving Asian and European markets firmly higher whilst overshadowing concerns of rising COVID numbers and second wave fears.

According to the World Health Organisation, a record of 212,000 new daily coronavirus cases were reported, with the US, Brazil and India reporting the largest number of increases. However, the US reported 53,000 which is a slight improvement on the 57,000 daily cases reported on Friday. Still, with July 4th celebrations dominating across the weekend, there is a good chance that this number will rise again in the coming weeks. What is clear is that the US never got the outbreak under control before reopening the economy, putting the world’s largest economy in the firing line for a second wave.

China blue-chips at 5 year high

Even as the coronavirus statistics show concerningly high increases the mood in the market remains bullish as investors place firm belief in the view that a revival in Chinese activity will help sustain global economic growth.

Chinese blue chips soar almost 5%, adding to a 7% jump last week, taking the stocks to a 5 year high. High volumes suggest that investors are tactically opting for a stronger and speedier recovery in Asia over the US.

This week as a whole is relatively quiet on the economic data front, compared to last week. Today German factory orders showed that the largest economy in the Eurozone was rebounding with orders increasing +10% short of the 15% forecast, but still a vast improvement on May’s -28% decline. Looking ahead Eurozone investor sentiment and retail sales will be in focus.

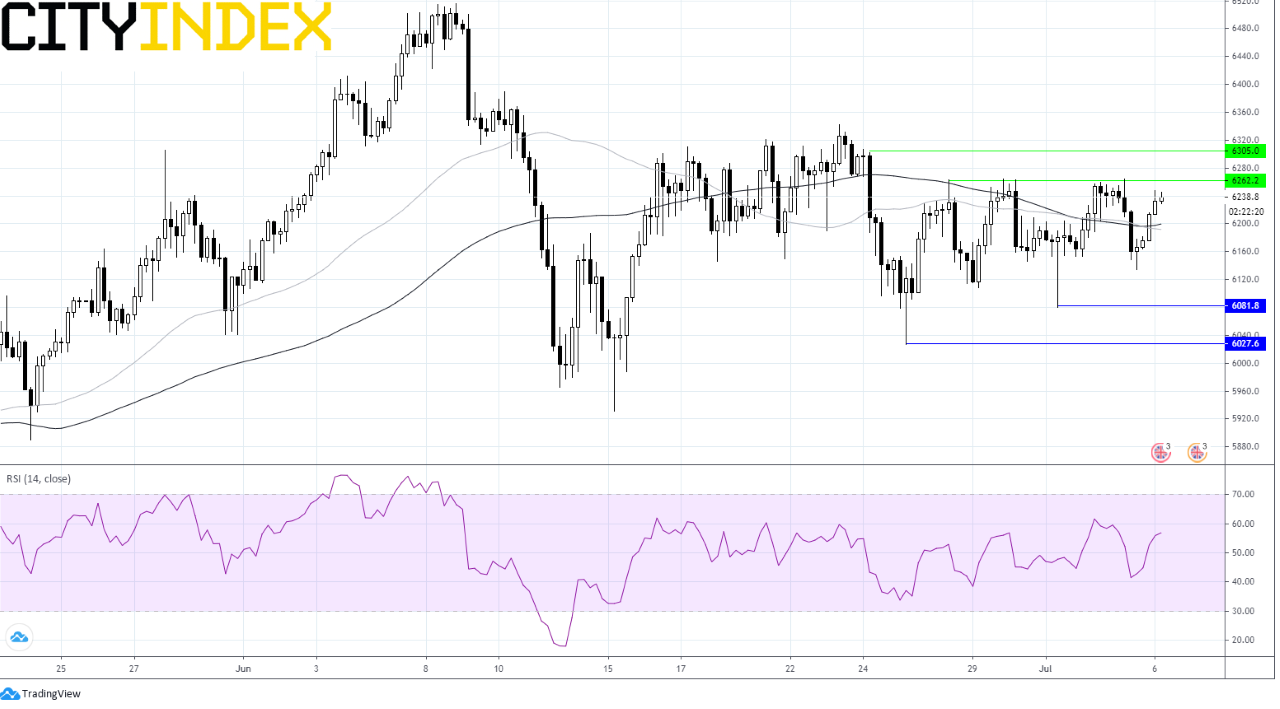

GBP slumps on negative rates talk

The pound is a notable decliner versus euro in early trade after a report surfaced that BoE Governor Andrew Bailey and Co are still seriously considering negative interest rates in the UK in order to boost the economic recovery. Negative rates would pressurize already squeezed lending margins at the banks. The banks could lag other sectors on the open.

This weekend saw the UK hospitality sector reopen with pubs, restaurants and har dressers among those that could reopen. With more and more of the economy reopening the economic rebound should start to gather pace in the UK after a very slow few month.

UK construction PMI is due to show that the contraction in the sector slowed, increasing from 28.9 to 47.

The final US service sector PMI is also due late today. Expectations are also for the contraction to have slowed. Meanwhile, the closely watched ISM nonmanufacturing PMI is expected to reach 50, the level which separates expansion from contraction.