Here are the latest developments in global markets:

· FOREX: The yen was building on yesterday’s gains versus other major currencies on Friday, as rising fears of a global trade war acted as a catalyst for the currency to attract safe-haven flows. Versus the dollar, the Japanese currency recorded a 16-month high of 104.62.

· STOCKS: Equity indices were a sea of red in every region, as the new US tariffs aimed at China reignited concerns that the situation could escalate into a full-blown trade war between the world’s two largest economies. In the US, the Dow Jones led the charge lower yesterday, shedding 2.9% of its value, while the S&P and the Nasdaq Composite plunged by 2.5% and 2.4% respectively. Futures tracking the Dow, S&P, and Nasdaq 100 are all flashing red currently. The carnage was even worse in Asia. In Japan, the Nikkei 225 and the Topix collapsed by 4.5% and 3.6% correspondingly, as the gains in the yen clouded even further the outlook for Japanese exporting firms. In Hong Kong, the Hang Seng tumbled by 2.8% while in China, the CSI 300 dropped by almost 2.9%. Risk aversion looks set to roll into European trading as well, with futures tracking all the major benchmarks being well-into negative territory, signaling a much lower open today.

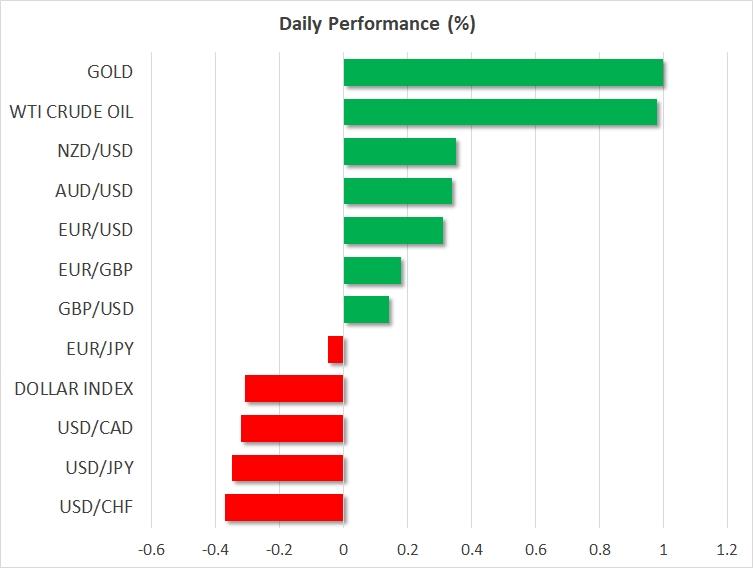

· COMMODITIES: Oil prices surged even despite the broader decline in equity markets. WTI and Brent crude are trading higher by 1.0% and 0.9% respectively. The catalyst for the gains may have been remarks by the Saudi Energy Minister Khalid al-Falih, who noted his country’s willingness to continue coordinating with Russia and other producers in 2019 to rebalance the oil market. Today, attention will fall on the Baker Hughes oil rig count, for an update on the state of US production. In precious metals, gold prices gained 1.0% as risk aversion refueled demand for the safe haven asset. The yellow metal reached a four-week high earlier on Friday, and is currently trading fractionally below the $1340/ounce resistance zone. An intensification in trade risks could see gold extend its gains, and in case of further advances, resistance may be encountered initially at $1350, and subsequently near its recent highs at $1366.

Major movers: Yen on the rise on the back of trade fears

The yen’s perceived safe-haven status allowed it to advance versus other major currencies in an environment of rising trade tensions. At 0730 GMT, dollar/yen was 0.35% down at 104.89, having earlier touched 104.62, its lowest since November 2016. Euro/yen and pound/yen also traded lower, with the former recording a seven-month low of 128.94 at its lowest, though it later pared a considerable part of its earlier losses. Elsewhere and yen-related, Japanese core inflation came in at 1.0% y/y in February as expected. This compares to January’s 0.9% and the Bank of Japan’s target of 2%.

US President Donald Trump signed a presidential memorandum on Thursday targeting tens of billions of dollars of Chinese products with tariffs, though this wouldn’t go into effect right away. Market participants fret a trade war between China and the US, the world’s two largest economies, and expressed their fears by boosting the yen and selling off risk-on assets such as equities. Another safe-haven perceived currency rising versus the dollar is the Swiss franc.

A Chinese response to US tariffs on steel and aluminum products came on Friday, with the country’s commerce ministry saying it was planning measures against up to $3 billion of imports from the US. Should the two countries engage in tit-for-tat retaliatory practices then the equity rout is likely to continue. Meanwhile, Cui Tiankai, the Chinese Ambassador to the United States said “We will retaliate” in a video posted on the embassy's Facebook (NASDAQ:FB) page.

Adding to the unstable environment, Trump replaced H.R. McMaster as national security adviser with John Bolton, a known hawk who has in the past supported using military force against North Korea and Iran.

Euro/dollar and pound/dollar were up by 0.3% and by around 0.2%, at 1.2337 and 1.4112 respectively. The Bank of England yesterday completed its meeting on monetary policy keeping rates unchanged, though it was seen as coming closer to delivering a 25bps rate hike in May. As a result, sterling gained versus the dollar and the euro, hitting a one-and-a-half-month high of 1.4216 versus the former before eventually retreating to finish the day lower, and rising to its highest since June last year versus the latter, though it also wasn’t able to sustain gains.

The aussie and the kiwi were up versus their US counterpart, though they were also losing ground versus the yen, falling to near one-and-a-half-year lows. Australia and New Zealand heavily rely on commodity exports and stand to lose substantially should a global trade war emerge.

Finally, it is notable that the Turkish lira took a beating as Japanese retail investors unwound investments in higher-yielding currencies such as the aforementioned. Apart from losing ground versus the yen, the lira also retreated versus other currencies such as the greenback, with dollar/lira at one point rising to a record high of 4.0346. The pair later gave up part of its gains, but it was still up by 1.0% at 3.9710 at the time of writing.

Day ahead: Trade war saga remains at the forefront; US and Canadian data due out

Given the latest US tariffs, attention is likely to remain predominantly on the risk of a tit-for-tat trade war between China and the US. China has already unveiled a list of US exports amounting to $3 billion that it plans to levy its own tariffs on, including agricultural products and steel. What is most critical is how the US will respond back to those countermeasures, if China does finally implement them. Recently, US Trade Representative Robert Lighthizer said that any Chinese retaliation will be met with fresh US actions, amplifying concerns that the situation could spiral out of control rather quickly.

Any new comments today from the Trump administration, and especially from Lighthizer, will be particularly important for markets. Overall, risk aversion may continue to be the dominant theme in this environment and if so, one would expect to see similar market moves to yesterday. Namely, safe havens like the yen could continue to thrive, while riskier assets such as stocks may extend losses.

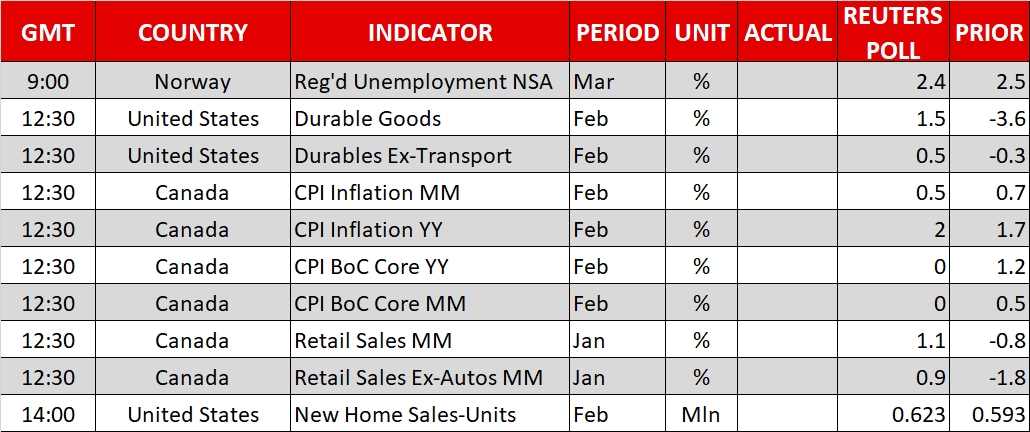

In terms of economic data, in the US, durable goods orders for February are due for release at 1230 GMT. Both the headline and the core figures are expected to have risen in monthly terms, a rebound following declines in January. While a notable recovery in durable goods could help the dollar to recover somewhat on the news, the currency’s broader direction will likely be decided by how the trade war narrative unfolds. The nation’s new home sales for February will also be released at 1400 GMT.

In Canada, inflation and retail sales data are due out at 1230 GMT as well. On the inflation front, the headline CPI rate is projected to have risen to 2.0% in yearly terms in February, from 1.7% previously, while no forecast is available for the core print. Meanwhile, retail sales are anticipated to have risen by 1.1% on a monthly basis in January, after falling 0.8% in the prior month. Overall, such prints would be encouraging news for the Bank of Canada, which has maintained a cautious tone in its recent meetings amid elevated trade risks. If indeed these data meet or exceed expectations, then the loonie could come under renewed buying pressure as markets price in a more aggressive tightening path by the Bank.

In energy markets, the Baker Hughes oil rig count at 1700 GMT will provide a fresh indication of whether US crude production continues to surge.

Elsewhere, the EU summit will conclude today and any fresh details regarding the Brexit transitional deal could prove cause for some volatility in sterling.

As for today's speakers, we have four on the schedule. Atlanta Fed President Raphael Bostic (voter) will deliver remarks at 1210 GMT, while 20 minutes later at 1230 GMT, we will hear from BoE MPC member Gertjan Vlieghe. Then at 1430 GMT, Minneapolis Fed President Neel Kashkari (non-voter) will step up to the rostrum, followed by Dallas Fed President Robert Kaplan (non-voter) at 1530 GMT.

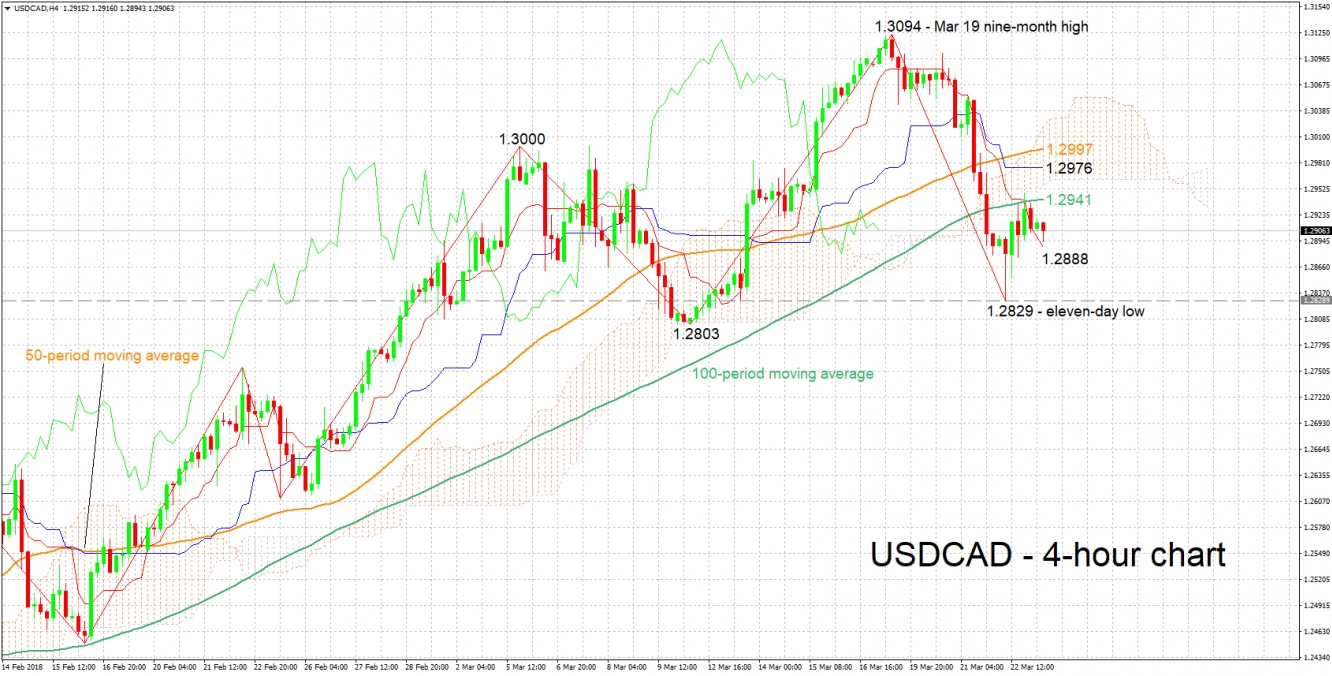

Technical Analysis: USDCAD negative momentum losing steam

USDCAD has lost some ground after reaching a nine-month high of 1.3094 on March 19. The Tenkan- and Kijun-sen lines are negatively aligned in support of a negative bias, though the fact that the Kijun-sen has flatlined hints to a negative momentum that has lost steam.

Upbeat CPI and retails sales numbers out of Canada later today could boost the loonie, pushing USDCAD lower and thus refueling the bearish short-term momentum. Support to declines might come around the current level of the Tenkan-sen at 1.2888 – this was a congested area earlier in March – with a violation turning the focus to the range around Thursday’s 11-day low of 1.2829 for additional support.

Disappointing data on the other hand are likely to lead to gains in USDCAD. The area between 1.2941 and 1.3022, encapsulating the 100-period moving average on the lower bound and the Ichimoku cloud top on the upper bound, while encapsulating the Ichimoku cloud bottom (1.2955), Kijun-sen (1.2976), and the 50-period MA (1.2997) as well, could be of importance, acting a barrier to price advancing.

Developments on the trade front also have the capacity to move the pair.