Stocks finished lower yesterday after another big move higher earlier in the day. The S&P 500 was trading up by more than 1% and finished down around 50 bps. It was worse for the NASDAQ, finishing down 1% on the Q)s.

The consolidation continues with the index retesting the breaking of the flag pattern I noted in Wednesday’s writings. The index tested the bottom of the flag twice and then turned sharply lower. The test came early, around 9:50 and 10:15 AM, and that was the best it could do with the index selling off the rest of the day.

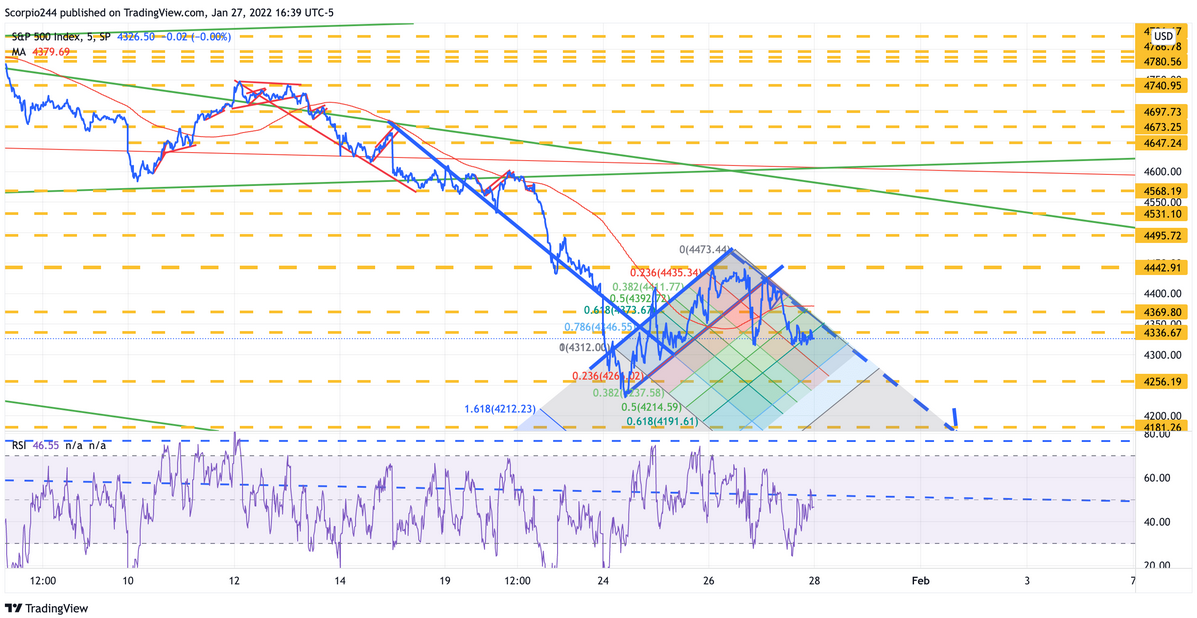

S&P 500

I’m wondering if the index has taken a turn now, and the recent rally off Monday’s lows was the bounce everyone has been looking for. The chart below shows the nice linear path the S&P 500 took down and the nice channel up off of the Monday. Yesterday, the path appears to have taken a turn and resumed the lower move. Unfortunately, there is no way to know until we see Monday’s low fall.

Russell

The Russell managed to close right on support at 1,930 yesterday. If that level falls, the next support level comes at 1,860. After that, we could be looking at 1,640.

Semi

The SMH had a terrible day falling by more than 4%. The steep decline took the ETF below the uptrend, which started in May 2021. The next level that needs to hold after that comes at $249.

Tesla

Meanwhile, Tesla (NASDAQ:TSLA) fell 11.5% yesterday after reporting solid results. Nothing was wrong with the results; I just think there was nothing to get excited about and no big announcements. The stock broke some critical support at $840 and the May 2021 uptrend. $775 is the next significant level to watch out for.

Block

Block (NYSE:SQ), or whatever it goes by now. Square finished the day down yesterday, almost 5% and closed right near support of $105. It sure looks like this stock wants to return to $83 and its pre-pandemic levels.

Ford

So I will try this again. The last time I said Ford (NYSE:F) was going lower, it decided to rally sharply. So here Ford is again back at support at just above $19. I think this time, it finally fills the gap at $15.55.

AMD

Well, China finally approved Advanced Micro Devices' (NASDAQ:AMD) acquisition of Xilinx (NASDAQ:XLNX), but AMD fell by 7% yesterday. Its an all-stock deal, so perhaps everyone is finally worried about the future dilution. The stock closed just above support, around $100. If that level goes, you can look for $89.