This year’s selling looked excessive in developed-market shares ex-U.S., and so the crowd continued to snap up stocks in this bucket during the trading week through Friday, Nov. 25. The rally delivered the strongest weekly gain for the major asset classes, based on a set of ETFs. But the return of risk-on sentiment may be short-lived if the eruption of widespread protests in China against COVID restrictions in recent days continues.

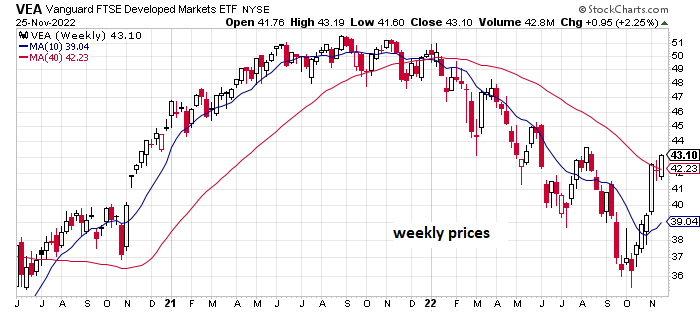

Meanwhile, foreign shares ex-U.S. extended a rally that started in mid-October via Vanguard Developed Markets Index Fund ETF Shares (NYSE:VEA), which rose 2.3%, the fifth weekly advance in the past six.

Expectations that the Federal Reserve will soften its next round of rate hikes at the Dec. 14 policy meeting have helped boost risk-on sentiment recently. But the events in China over the weekend suggest that a new round of geopolitical risk may revive demand for safe havens. It’s unclear how much of the turbulence in China will spill over to global markets, but the initial reaction in the new trading week is to sell first and ask questions later.

“It will take more time to understand the impact of the reported public opposition to COVID curbs and the official response, but the latest developments add to uncertainty for offshore investors and may weigh on sentiment,” says Mark Haefele, chief investment officer at UBS Global Wealth Management.

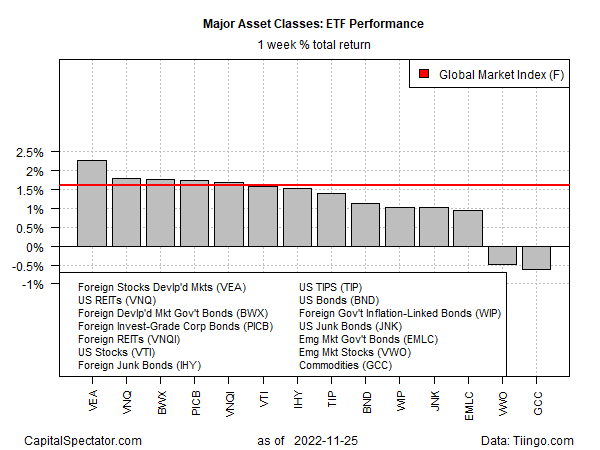

Last week’s trading suggests risk-on sentiment was reviving with most asset classes posting healthy gains. The downside outliers: shares in emerging markets (Vanguard FTSE Emerging Markets Index Fund ETF Shares (NYSE:VWO)) and commodities (WisdomTree Continuous Commodity Index Fund (NYSE:GCC)).

The Global Market Index (GMI.F), an unmanaged benchmark, maintained by CapitalSpectator.com, posted a strong gain last week. This index holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class-portfolio strategies. GMI.F rose 1.6% during the trading week through Friday, Nov. 28 (red line in chart below).

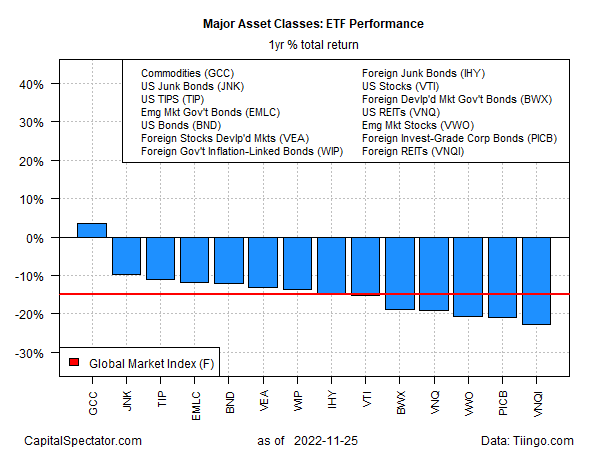

For the one-year trend, however, a bearish cloud continues to weigh on markets. With the exception of commodities (GCC), all the major asset classes are posting losses for the trailing one-year window.

GMI.F continues to post a one-year loss too, closing down 14.9% compared to the previous year.

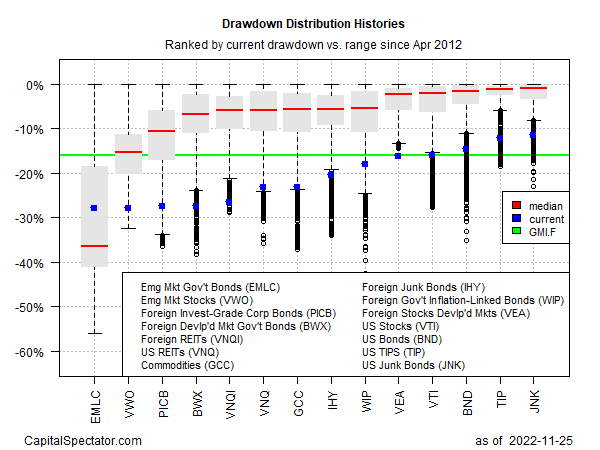

Looking at the major asset classes through a drawdown lens still reflects hefty declines from previous peaks. The softest drawdown at the end of last week: U.S. junk bonds (SPDR® Bloomberg High Yield Bond ETF (NYSE:JNK)), which closed with a 11.6% peak-to-trough decline. The deepest drawdown at last week’s close: bonds issued by governments in emerging markets (VanEck J.P. Morgan EM Local Currency Bond ETF (NYSE:EMLC)), which ended trading with a 28.0% slide below its previous peak.

GMI.F’s drawdown: -16.1% (green line in chart below).