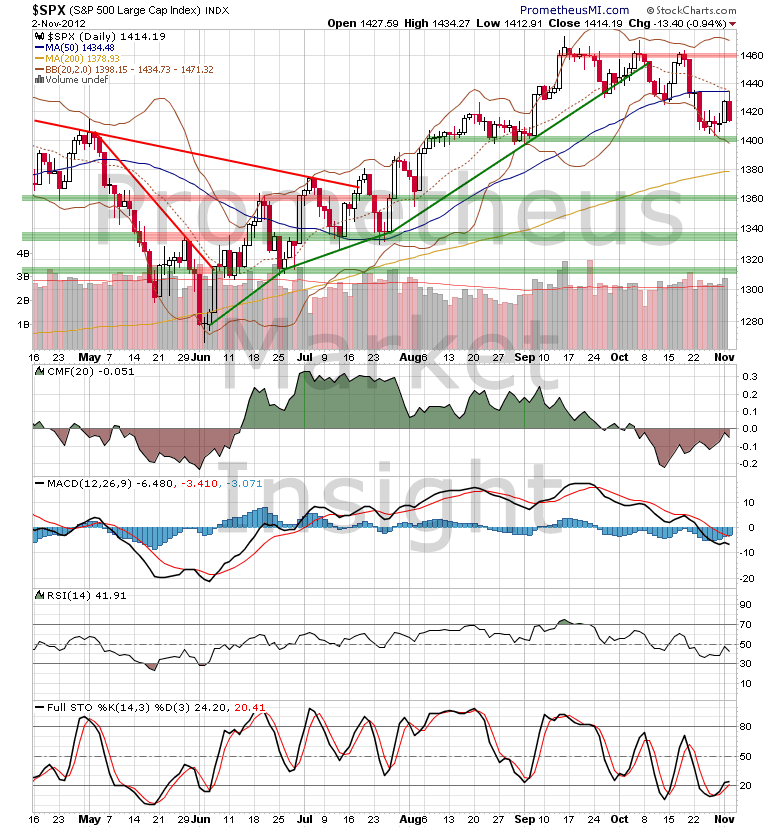

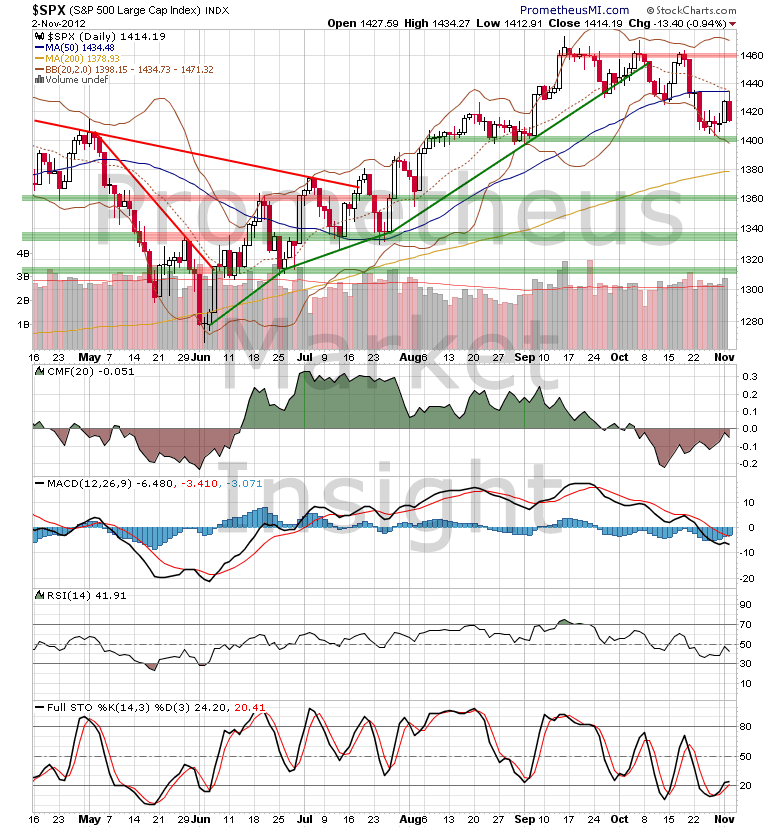

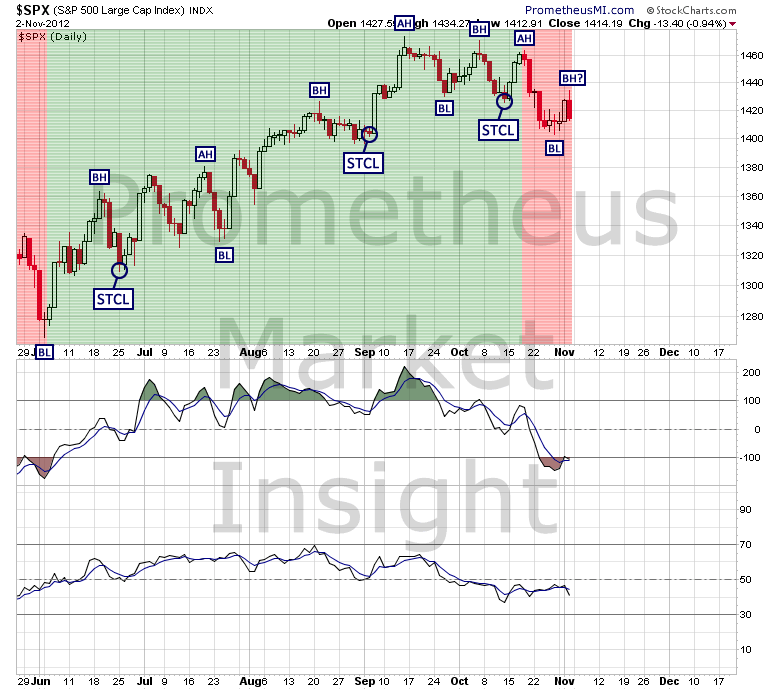

The S&P 500 index reversed early gains to close sharply lower Friday, approaching recent short-term lows below previous highs of the cyclical bull market from 2009. After failing to break above the 1,460 level three times in September and October, the volatile uptrend from June has struggled to rebound off of congestion support in the 1,400 area, indicating that the rally is losing strength.

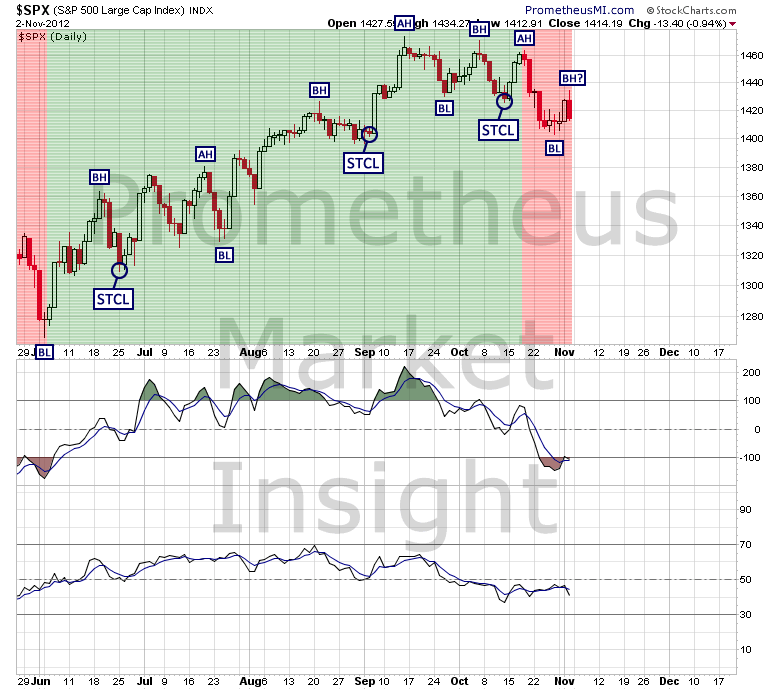

With respect to cycle analysis, the sharp decline Friday indicates that the beta high (BH) may have already formed, although we would need to see a move down to new short-term lows to confirm that development.

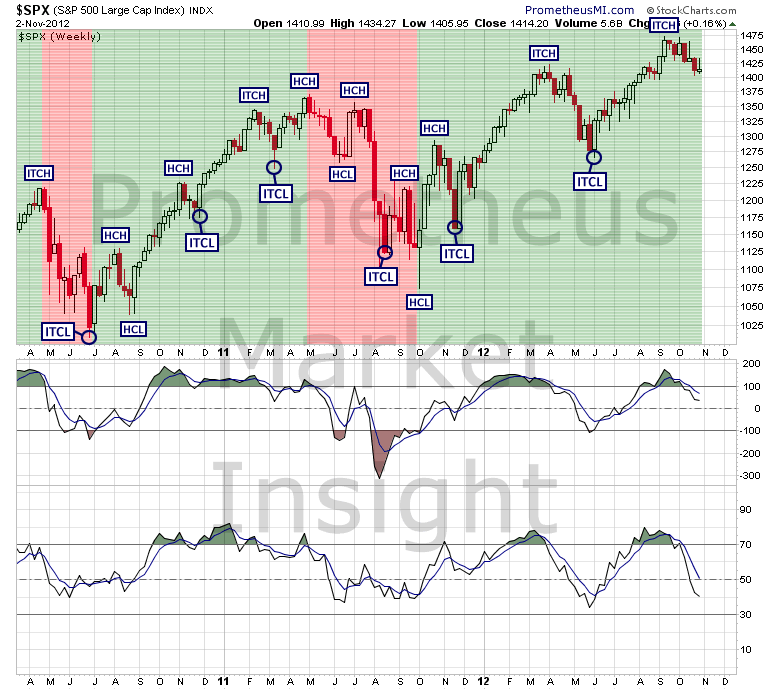

Although the current short-term cycle has a bearish translation, the intermediate-term cycle from June continues to exhibit a bullish translation and the next important test of the cyclical bull market will occur after the next intermediate-term cycle low (ITCL) is in place.

The character of the rebound off of the forthcoming ITCL will provide the next signal with respect to long-term direction, so it will be important to monitor market behavior closely during the next several weeks.

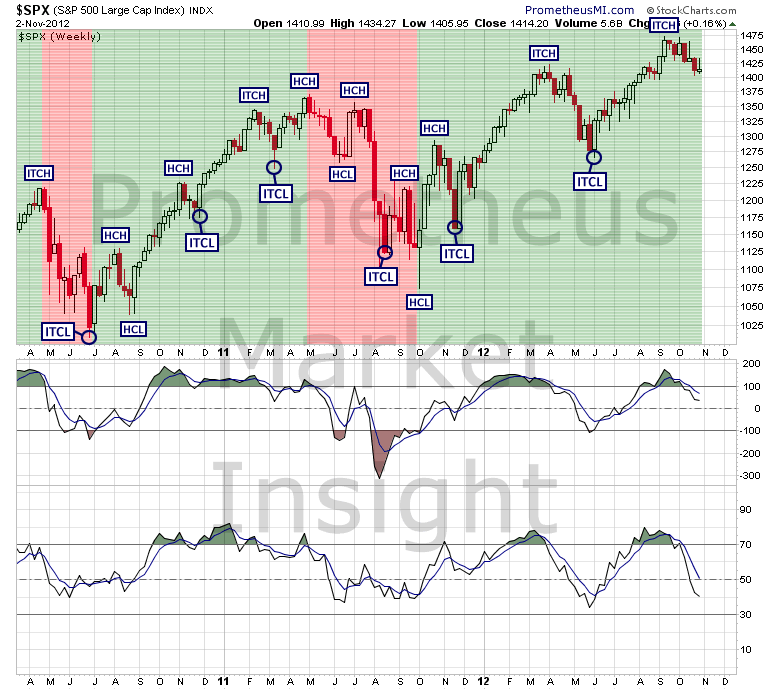

With respect to cycle analysis, the sharp decline Friday indicates that the beta high (BH) may have already formed, although we would need to see a move down to new short-term lows to confirm that development.

Although the current short-term cycle has a bearish translation, the intermediate-term cycle from June continues to exhibit a bullish translation and the next important test of the cyclical bull market will occur after the next intermediate-term cycle low (ITCL) is in place.

The character of the rebound off of the forthcoming ITCL will provide the next signal with respect to long-term direction, so it will be important to monitor market behavior closely during the next several weeks.