Which stocks could magnify S&P 500’s gains in case it rallies? Take a look at a part of our Stock Pick Update. We have included two Financials and one Materials stock this time.

In the last five trading days (Jan. 6-12) the broad stock market has extended its record-breaking run-up. The S&P 500 index has reached new record high of 3,826.69 on Friday following new stimulus package hopes.

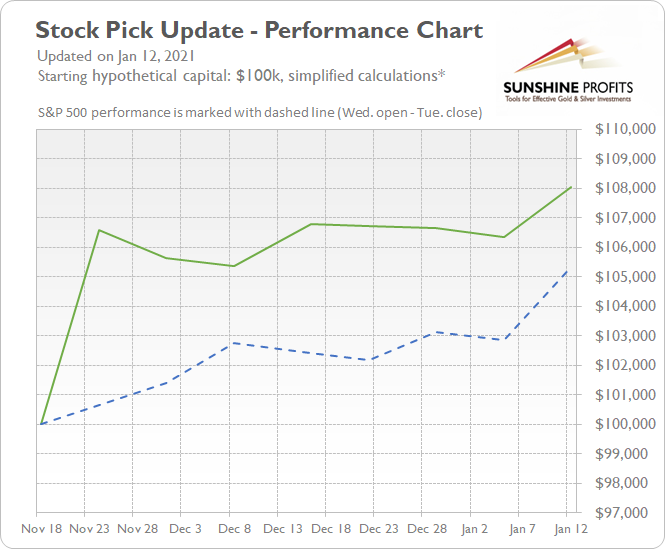

The S&P 500 has gained 2.40% between the Jan. 6 open and the Jan. 12 close. In the same period of time our five long and five short stock picks have gained 1.59%. Stock picks were relatively weaker than the broad stock market’s performance last week. However, our long stock picks have gained 3.35% outperforming the index. Short stock picks have resulted in a loss of 0.17%.

There are risks that couldn’t be avoided in trading. Hence, the need for proper money management and a relatively diversified stock portfolio. This is especially important if trading on a time basis – without using stop-loss/profit target levels. We are just buying or selling stocks at open on Wednesday and selling or buying them back at close on the next Tuesday.

If stocks were in a prolonged downtrend, being able to profit anyway, would be extremely valuable. Of course, it’s not the point of our Stock Pick Updates to forecast where the general stock market is likely to move, but rather to provide you with stocks that are likely to generate profits regardless of what the S&P does.

Our last week’s portfolio result:

Long Picks (Jan. 6 open – Jan. 12 close % change): ECL (+1.65%), CE (+3.80%), KMI (+7.87%), VLO (+1.45%), NVDA (+1.98%)

Short Picks (Jan. 6 open – Jan. 12 close % change): PLD (-1.43%), SPG (+1.70%), DUK (-1.13%), PEG (+1.97%), HON (-0.27%)

Average long result: +3.35%, average short result: -0.17%

Total profit (average): +1.59%

Stock Pick Update performance chart since Nov 18, 2020:

Let’s check which stocks could magnify S&P’s gains in case it rallies, and which stocks would be likely to decline the most if S&P plunges. Here are our stock picks for the Wednesday, Jan. 13 – Tuesday, Jan. 19 period.

We will assume the following: the stocks will be bought or sold short on the opening of today’s trading session (Jan. 13) and sold or bought back on the closing of the next Tuesday’s trading session (Jan. 19).

We will provide stock trading ideas based on our in-depth technical and fundamental analysis, but since the main point of this publication is to provide the top 5 long and top 5 short candidates (our opinion, not an investment advice) for this week, we will focus solely on the technicals. The latter are simply more useful in case of short-term trades.

First, we will take a look at the recent performance by sector. It may show us which sector is likely to perform best in the near future and which sector is likely to lag. Then, we will select our buy and sell stock picks.

There are 11 stock market sectors: Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Technology, Communications Services, Utilities and Real Estate. They are further divided into industries, but we will just stick with these main sectors of the stock market.

We will analyze them and their relative performance by looking at the Select Sector SPDR ETFs.

Based on the above, we decided to choose our stock picks for the next week. We will choose our five long and five short candidates using trend-following approach:

- buys: 2 x Financials, 2 x Materials, 1 x Consumer Discretionary

- sells: 2 x Real Estate, 2 x Communication Services, 1 x Consumer Staples

Buy Candidates

AXP American Express Company (NYSE:AXP) – Financials

- Stock remains above its medium- and short-term upward trend lines

- Possible breakout above the previous high

- The resistance level is at $124 and support level is at $113

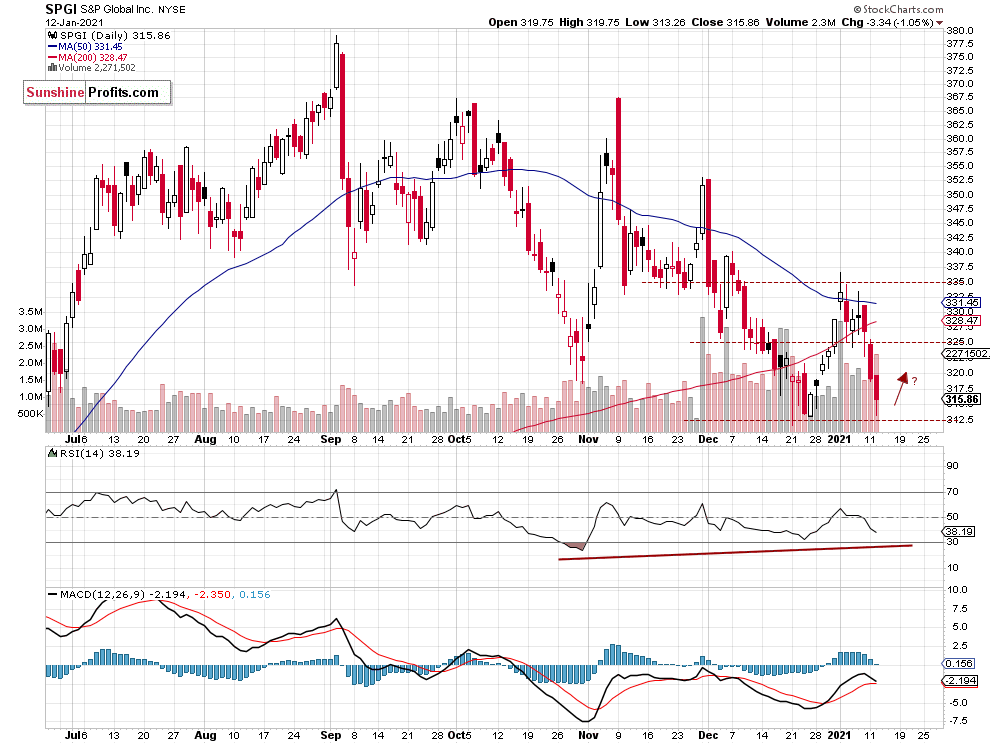

SPGI S&P Global Inc (NYSE:SPGI. – Financials

- Possible upward reversal from the support level of $212-213

- The resistance level is at $325 – short-term upside profit target level

SHW Sherwin-Williams Co (NYSE:SHW) – Materials

- Stock broke above the short-term downward trend line – uptrend continuation play

- The support level is at $710 and resistance level is at $740-750

Summing up: The above trend-following long stock picks are just a part of our whole Stock Pick Update. The Financials and Materials sectors were relatively the strongest in the last 30 days. So that part of our 10 long and short stock picks is meant to outperform in the coming days if the broad stock market acts similarly as it did before.