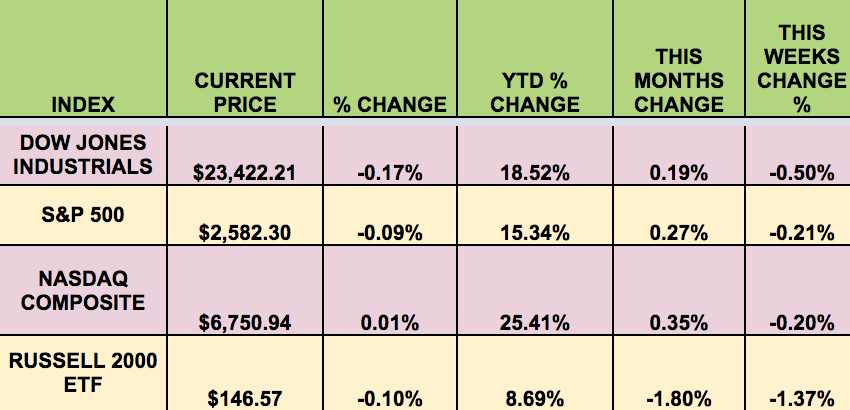

Markets: The market fell this week, with all 4 indexes down, and the small caps lagging, as investors worried about the future of promised corporate tax cuts following dueling plans unveiled by Republican lawmakers.

Dividend Stocks Update: These high dividend stocks go ex-dividend this coming week: WKLP, ARR, Collectors Universe Inc (NASDAQ:CLCT), Corenergy Infras (NYSE:CORR), EVA, LKSD, Five Oaks Invst (NYSE:OAKS), Sabra Healthcare REIT Inc (NASDAQ:SBRA), SunCoke Energy Partners LP (NYSE:SXCP), Terra Nitrogen Company LP (NYSE:TNH), Artisan Partners Asset Management Inc (NYSE:APAM), Royal Dutch Shell (LON:RDSa) B PLC (NYSE:RDSb), Reaves Utility IF (NYSE:UTG).

Tax Bill Update: U.S. Senate Republicans released a tax plan on Thursday that differed from a version put forth by the House of Representatives on several key fronts, including putting off corporate tax cuts for a year. Failure to cut corporate taxes would increase concerns about the administrations ability to pass legislation and could shake markets that have been banking on lower tax rates to boost company earnings. The S&P 500 on Friday stood at 18.1 times expected earnings, the highest since 2004. (Reuters)

Both the House and Senate plans contain nearly $1.5 trillion in debt in the first 10 years. Unless they eliminate the deficit beyond that, the legislation will be subject to a 60-vote threshold under Senate rules, which could doom it to failure. (Bloomberg)

State and Local Tax Deductions, and Mortgage Interest

Whats in place now:

You can generally deduct the amount you pay for state and local tax income taxes, including property taxes, on your federal income tax return. You can also deduct the interest you pay each year on mortgage debt up to $1 million, a cap that can cover multiple

homes. Plus, you can generally deduct up to $100,000 in interest you pay on a home-equity loan or line of credit.

What the House proposed:

No more state and local tax deductions, though you could continue to deduct up to $10,000 each year in property tax. For people buying in the future (which the bill defines as Nov. 2, 2017, or later), mortgage interest deductions would be allowed only on loans up to $500,000. Moreover, only debt from primary residences would count toward that limit, and you could not include any interest from home equity loans or lines of credit that you took out on that new home.

What the Senate proposed:

No more state and local tax deductions and no exception for property taxes, either. The mortgage interest deduction, however, would survive in its current form.

Student Loan Interest Deduction:

Whats in place now:

Currently, people with incomes below certain thresholds can deduct up to $2,500 of student loan interest each year.

What the House proposed:

The House wants to do away with the student loan interest deduction.

What the Senate proposed:

The Senate would keep things as they are now. (Source: NY Times)

Former Fed Chief Greenspan feels that “now is not the time for fiscal stimulus”, with the US at full employment. Neutral observers agree that the House GOP tax bill would make the national debt worse. The nonpartisan Congressional Budget Office estimates the federal deficit would increase by $1.7 trillion over 10 years under the plan, including the impact of higher borrowing costs.

Under the tax bill, the CBO expects debt held by the public would rise to 97.1% of gross domestic product by 2027, compared with 91.2% under the existing tax structure. Debt-to-GDP currently stands at about 75%.

The House GOP bill would permanently cut the corporate tax rate to 20% from 35%, consolidate income tax brackets for individuals from seven to four and repeal or limit many deductions. The Senate tax bill would change the rate on taxable income for some of the seven individual tax brackets. It would also slash the corporate rate to 20%, but the cut wouldn’t take effect until 2019. (Source:CNN)

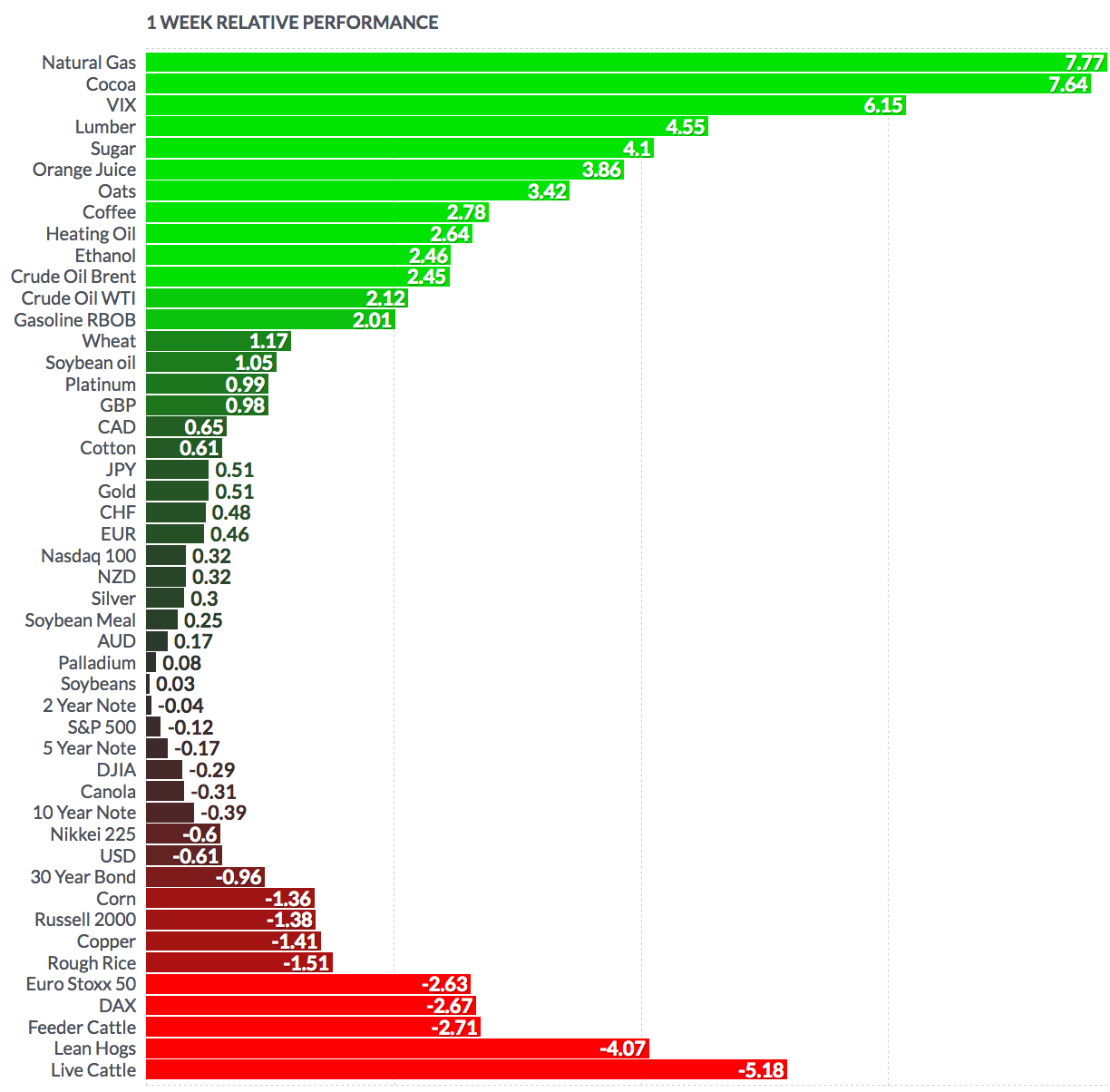

Volatility: The VIX was up 23% this week, and finished at $11.26, its highest close since early September.

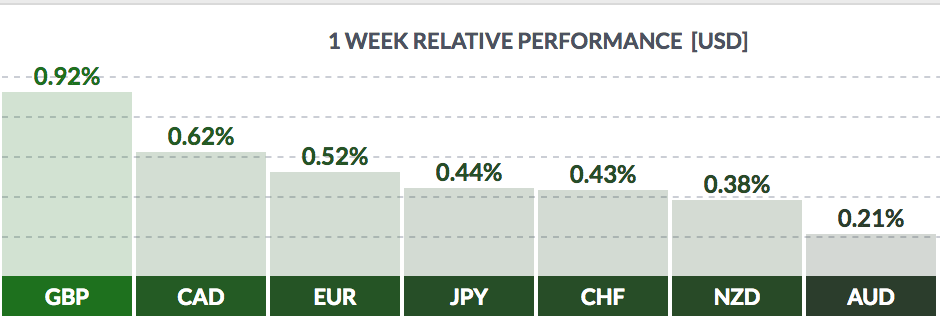

Currency: The $ fell vs. most major currencies this week, with the British Pound and the Canadian Loonie leading the pack:

Market Breadth: 16 of the Dow Jones 30 stocks rose this week, vs. 15 last week. 53% of the S&P 500 rose, vs. 50% last week.

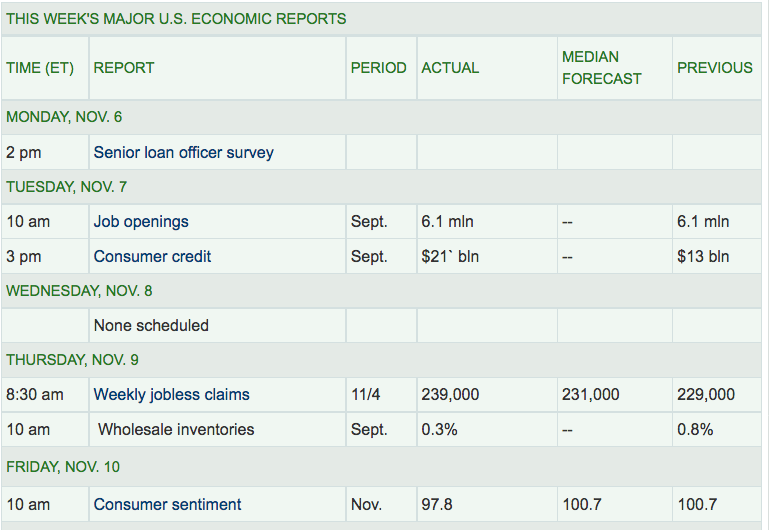

Economic News: Consumer Sentiment fell unexpectedly, from its previous high. The Personal Savings Rate fell to a 10 year low. Consumer Credit rose to its highest point since 2009.

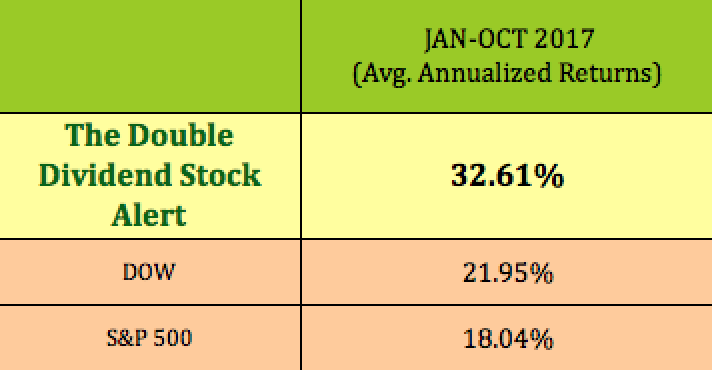

Our latest monthly Dividend Stocks Blog article (OCT):

Week Ahead Highlights: Q3 Earnings season continues,with Home Depot (NYSE:HD), Cisco, and Walmart (NYSE:WMT) finishing up the last of the DOW 30 earnings reorts. Many S&P 500 retailers will be reporting TJX Companies Inc (NYSE:TJX), Target Corporation (NYSE:TGT), L Brands (NYSE:LB), and Bed Bath & Beyond Inc (NASDAQ:BBBY).

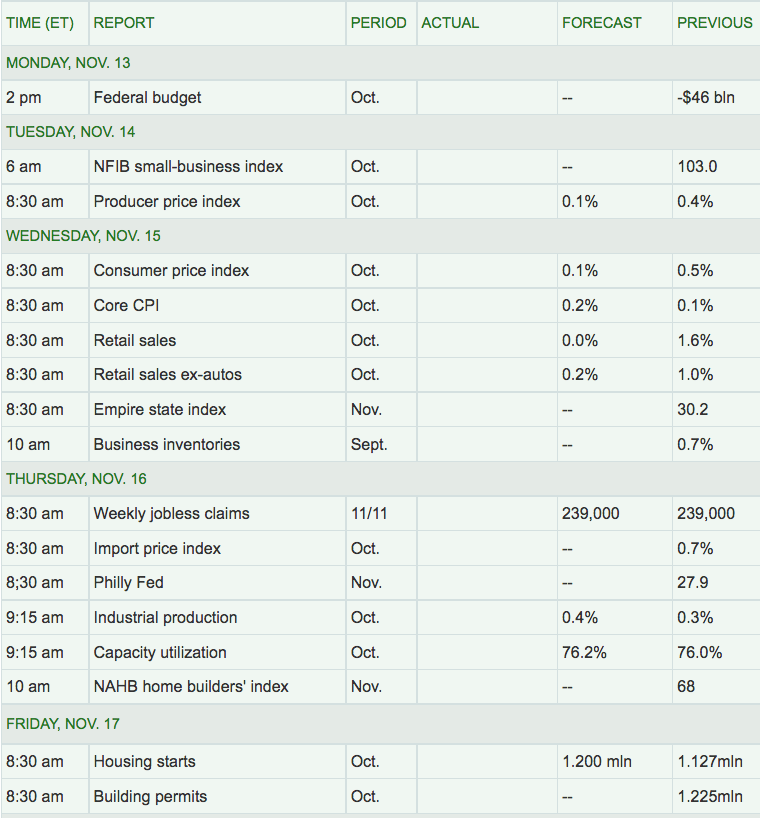

Next Week’s US Economic Reports: There will be several Housing reports due out next week. We’ll also get a look at CPI inflation figures, as well as October Retail sales.

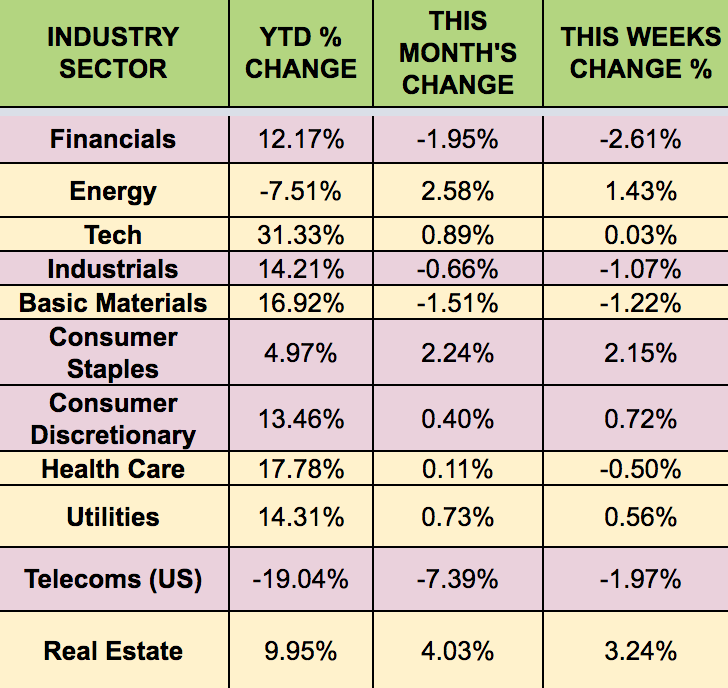

Sectors: Real Estate and Consumer Staples led this week, with Financials trailing.

Futures: WTI Crude futures rose 2.12% this week, natural gas also gained 7.7%. Oil was buoyed this week after Saudi Arabia detained 201 individuals including princes, businessmen and government officials after a three-year investigation, alleging that an estimated $100 billion of state funds have been embezzled. The actions helped to push oil prices to more than two-year highs this week. (Source: MarketWatch)