After three decades of epic deficit spending and three years of extraordinary money creation, Japan’s economy is enjoying a rollicking inflationary boom. Just kidding. Exactly the opposite is happening:

Japan households’ inflation expectations hit three-year low – BOJ:

(Reuters) – Japanese households’ sentiment worsened in the three months to March and their expectations of inflation fell to levels before the Bank of Japan deployed its massive asset-buying programme three years ago, a central bank survey showed.

The survey’s bleaker outlook keeps alive expectations of additional monetary stimulus even as BOJ Governor Haruhiko Kuroda maintained his optimism that the world’s third-largest economy was recovering moderately.

Kuroda, however, warned that he was closely watching how a recent surge in the yen and slumping Tokyo stock prices could affect the outlook.

“Global financial markets remain unstable as investors are becoming increasingly risk averse due to uncertainty over the outlook of emerging and resource-exporting economies,” Kuroda said in a speech at an annual meeting of trust banks on Monday.

“The BOJ won’t hesitate to take additional easing steps if needed to achieve its inflation target,” he said.

The BOJ’s quarterly survey on people’s livelihood showed the ratio of households who expect prices to rise a year from now stood at 75.7 percent in March, down from 77.6 percent in December and the lowest level since March 2013.

A separate index measuring households’ confidence about the economy stood at minus 22.5 in March, worsening from minus 17.3 in December to the lowest level since March 2015.

The gloomy outcome underscores the dilemma the BOJ faces as it battles mounting external headwinds for the economy with its dwindling policy tool-kit.

The BOJ’s adoption of a massive asset-buying programme, dubbed “quantitative and qualitative easing,” in April 2013 was intended to spur public expectations that prices will rise, and in turn, encouraging households and firms to spend.

That has failed to materialise, forcing the central bank to add negative interest rates to QQE in January in a fresh attempt to accelerate inflation towards its ambitious 2 percent target.

The move has failed to arrest a worrying spike in the yen or boost business confidence. Japan’s economy contracted in October-December last year and analysts expect it to post only feeble growth, if any, in January-March. Inflation has also ground to a halt, keeping the BOJ under pressure to ease again in coming months.

A separate poll by private think tank Japan Center for Economic Research, among the most comprehensive surveys conducted on Japanese analysts, showed 39 of the 44 analysts surveyed projecting that the next BOJ move would be further monetary easing.

But Japan is a unique case; easy money is generating excellent growth and rising inflation pretty much everywhere else. Just kidding again. The US, after multiple QEs and a doubling of federal debt, is looking a lot like Japan:

Consumers’ Inflation Expectations Fell Again in March, Fed Says:

U.S. consumers’ expectations for inflation declined in March following a rise from record lows the month before, according to Federal Reserve Bank of New York data released Monday.

The numbers, which have been highlighted recently as a potential cause for concern by top officials including Fed Chair Janet Yellen and New York Fed President William Dudley, may add to the debate over downside risks to the U.S. central bank’s 2 percent inflation target. These risks have contributed to policymakers’ cautious approach to tightening monetary policy this year following a decision in December to raise interest rates for the first time in almost a decade.

The median respondent to the New York Fed’s March Survey of Consumer Expectations expected inflation to be 2.5 percent three years from now, down from 2.6 percent in the February survey. In January, expected inflation three years ahead was 2.45 percent, marking the lowest level in data going back to June 2013.

The New York Fed divides survey respondents into two groups based on a short aptitude test: high-numeracy and low-numeracy. Expected inflation among high-numeracy respondents, which tends to be more stable than that for low-numeracy respondents, declined to a record low in March.

The drop came despite a rise in expected gasoline prices. The median survey respondent in March expected the cost of gas to be 7.3 percent higher a year.

This is odd, since oil prices have stabilized and a consensus seems to be forming around the idea that inflation is about to pick up. Some talking heads are even wondering how the Fed will respond to the above-target inflation that’s coming. See Just how much of an overshoot on inflation will the Fed tolerate?

So what’s with all the pessimistic consumers?

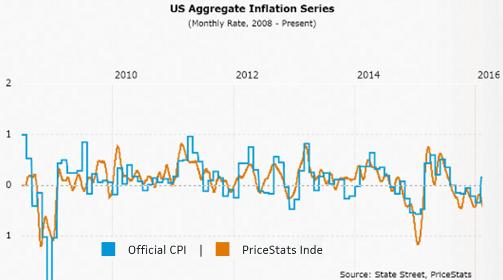

Well, a data series from PriceStats (related to MIT’s Billion Prices project, I think) that measures a wide variety of prices in real time has the answer: Prices are actually falling faster than the official CPI number indicates, and have not picked up as oil has stabilized. In fact, the US has been in deflation for the past five months.

So it’s no surprise that people who are actually buying the stuff that’s falling in price would register this fact and answer surveys with deflationary sentiments. It’s also no surprise that central banks, which presumably see the same data, would be looking for ways to ease even further (Japan and Europe) or walk back their previous threats to tighten (the US Fed) — apparently in the hope that increasing the dose will cure the credit addiction.