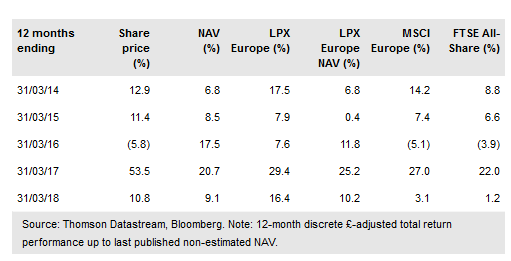

Standard Life (LON:SLA) Private Equity Trust PLC (LON:SLPE) (SLPET) continues to follow a long-term, conviction approach to selecting primarily European private equity buyout funds, managing its exposure through the primary and secondary fund markets. Having broadened its investment policy in 2017, SLPET added exposure to a domestic US manager by acquiring a secondary position in Onex Partners IV in H118, and recently made a new primary commitment to MSouth Equity Partners IV, with the manager undertaking due diligence on a number of other US funds. SLPET has achieved above-average NAV returns among its fund of fund peers over one, three and five years, and has also outperformed UK and European stock market indices over these periods. SLPET has a competitive ongoing charge versus peers and its 3.8% yield ranks at the top of the peer group.

Investment strategy: Focused fund selection

To achieve SLPET’s long-term total return objective, the manager primarily focuses on identifying and investing in Europe’s leading private equity buyout funds. The result is a portfolio consisting of 35-40 active funds run by experienced private equity managers with strong track records of generating attractive investment returns, giving exposure to an underlying portfolio of c 350 private companies. The manager follows a systematic, disciplined approach, involving rigorous screening and due diligence to evaluate primary fund offerings, with additional portfolio analysis conducted on secondary market investments, which are used to adjust portfolio exposures and to maintain SLPET’s capital efficiency.

To read the entire report Please click on the pdf File Below: