Square, Inc. (NYSE:SQ) recently unveiled a new debit card, Square Card, for small business owners (SMB). Square’s recent move is aimed at aiding businesses efficiently manage their cashflow by providing immediate access to their funds generated from sales.

To lure customers to the digital payment solutions space, Square will also offer a 2.75% discount on debit card purchases with other Square sellers. Notably, the company will be entitled to a transaction fee when transactions are made with the card.

Moreover, Square Card also boasts features that help businesses in segregating their expenses as personal or business-related. Thus, it will benefit SMBs in determining their actual profitability and file for their taxes accordingly.

We believe the company’s move is in sync with the company’s strategy to ramp up banking initiatives. Further, to make things convenient, the card can be used at places that accept Mastercard (NYSE:MA) and cash easily withdrawn via an ATM.

Square’s Banking Initiatives

Apart from launching the card, Square recently re-applied for special industrial loan company license (“ILC”) with Federal Deposit Insurance Corp (FDIC). Notably, the approval of the license will allow Square to take federally insured customer deposits.

The company is planning to name its new division Square Financial Services, which will help small and underserved businesses by providing them deposit accounts and business loans.

Square also unveiled other products through Square Capital, which includes providing small business loans and enabling small business clients to make payment in installments. Notably, the Square Installments feature strengthens the company’s relationship with merchants and aids them in boosting sales.

The company’s ongoing endeavor to make an impact in the banking space is expected to bode well for it in the near term.

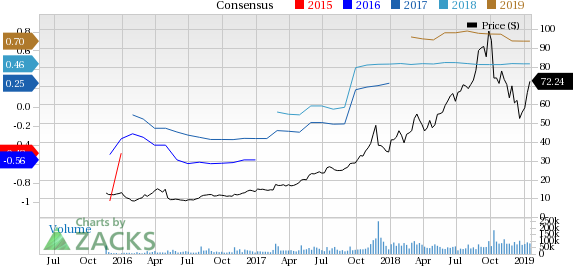

Square, Inc. Price and Consensus

Alphabet Inc. (GOOGL): Get Free Report

Square, Inc. (SQ): Get Free Report

PayPal Holdings, Inc. (PYPL): Free Stock Analysis Report

Apple Inc. (AAPL): Get Free Report

Original post

Zacks Investment Research