- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Which stocks will surge next?

SPY Trends And Influencers November 17, 2018

Last week’s review of the macro market indicators noted heading into November Options Expiration the equity markets showed a good bounce on the week but with a weak finish Friday. Elsewhere looked for Gold (GLD (NYSE:GLD)) to consolidate its move higher while Crude Oil (USO (NYSE:USO)) continued to move lower. The US Dollar Index (DXY) was resuming its move higher while US Treasuries (iShares 20+ Year Treasury Bond (NASDAQ:TLT)) were pausing in their downtrend. The Shanghai Composite (ASHR) and Emerging Markets (iShares MSCI Emerging Markets (NYSE:EEM)) might be pausing in their downtrends.

Volatility (VXX) continued to settle down in a slow fade, removing some downward pressure on equities, but it remained slightly elevated. The equities themselves were mixed with the SPY strongest and in a short term uptrend, while the IWM was pausing in its move higher and the QQQ was the weakest but broadly consolidating after the pullback.

The week played out with Gold pulling back early then rebounding late in the week while Crude Oil found support mid week and drifted higher. The US Dollar topped Monday and pulled back while Treasuries held in a tight range slightly higher. The Shanghai Composite consolidated over a key moving average while Emerging Markets gave up some gain but held over prior lows.

Volatility popped back over 20 and held there, adding the bias lower for equities. The Equity Index ETF’s reacted big moves lower Monday and continued until finding some footing Thursday and bouncing. What does this mean for the coming week? Lets look at some charts.

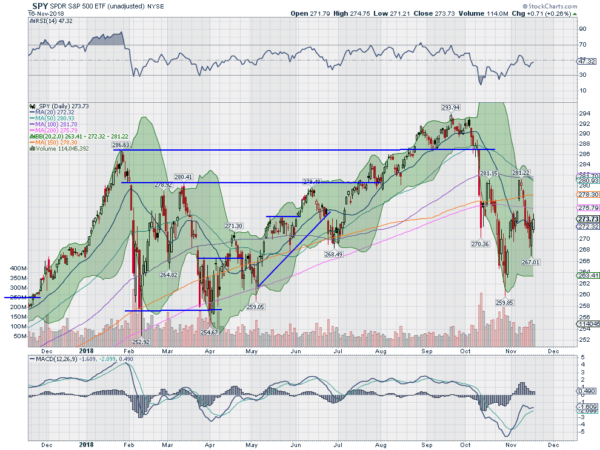

SPY (NYSE:SPY) Daily, SPY

The SPY was pulling back from a short term top, looking like a digestive move, as the week started. Monday it fell hard though, closing a gap and it continued lower through Wednesday. A gap down at the open Thursday reached another gap and it rose all day closing it. Friday saw follow through and a close back over the 20 day SMA.

Continuation from here would mark a higher low to go with the marginally higher high. Another higher high would go a long way in forging a reversal out of this pullback cycle. The daily chart has a RSI moving up toward the mid line with the MACD avoiding a cross down and turning up, nearing a move to positive. Both support the possibility.

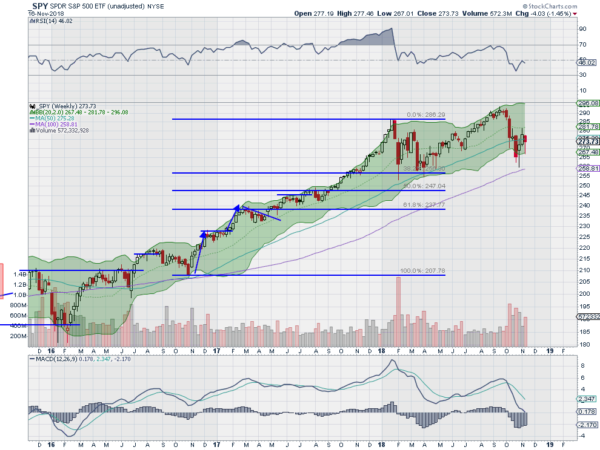

The weekly chart shows a down week, but with a long lower shadow. The RSI is pulling back from the mid line on this timeframe with the MACD falling, and about to turn negative. There is support lower at 272.50 and 271.40 followed by 269 and 265. Resistance above comes at 274.50 and 276 followed by 277.50 and 279. Case Building for Reversal out of Consolidation.

SPY Weekly, SPY

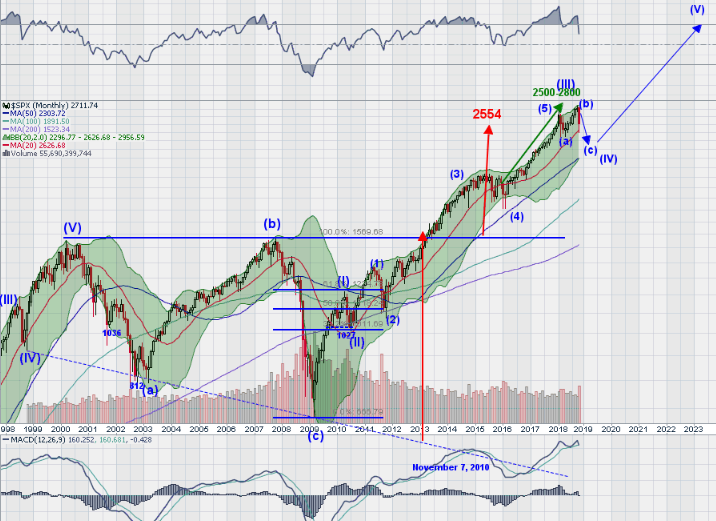

With November Options Expiration in the rear view mirror and traders looking forward to a short Thanksgiving week, equity markets are hinting at reversing higher. Elsewhere look for Gold to continue in its short term uptrend while Crude Oil pauses in its downtrend. The US Dollar Index is resuming its move higher while US Treasuries continue to consolidate in their downtrend. The Shanghai Composite is staging a possible reversal while Emerging Markets are trying to buck their downtrend.

Volatility looks to remain slightly elevated but drifting lower, easing the downward pressure on the equity index ETF’s SPY, IWM and QQQ. Their charts show some signs of reversing in the short timeframe, while on the longer timeframe the consolidation is more obvious. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Related Articles

Despite its venerable age, the Dow Jones Industrial Average (DJIA) remains a cornerstone of financial market benchmarks, frequently cited alongside the S&P 500 and Nasdaq-100...

As for the economy, the federal government (the Bureau of Economic Analysis) released its third estimate of real gross domestic product (GDP) growth recently at 3.4% (annual rate)...

by Jack FischerDuring LSEG Lipper’s fund-flows week that ended March 27, 2024, investors were overall net redeemers of fund assets (including both conventional funds and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.