A weekly excerpt from the Macro Review analysis sent to subscribers on 10 markets and two timeframes.

Last week’s review of the macro market indicators noted heading into August Options Expiration the equity markets were showing some signs of tiring, especially the IWM. Elsewhere looked for Gold ($GLD) to continue higher while Crude Oil consolidated at resistance. The US Dollar Index bounce looked like it might be over while US Treasuries (NASDAQ:TLT) were biased higher in the short run.

The Shanghai Composite and Emerging Markets (NYSE:EEM) were both looking better to the downside short term in their uptrends. Volatility had crept up but was stretched, worth paying closer attention to it in the short run. This changed the bias to lower for the equity index ETF’s SPY, IWM and QQQ. Their charts all showed some signs of weakness in the short term, especially the IWM, but less weakness longer term especially the QQQ.

The week played out with gold starting lower before rebounding and rising to new highs only to finish the week unchanged while crude oil broke support and headed lower. The US dollar held in a tight range for the week while Treasuries also started lower but reversed to end at a higher high. The Shanghai Composite gapped down to start Monday but improved all week while Emerging Markets caught a bid and consolidated.

Volatility had another wider range week spiking Thursday after pulling back earlier, removing support for equities. The Equity Index ETF’s all started the week with a gap higher but then faded and after a strong down day Thursday ended the week lower. The SPY and QQQ finished above the 100 day SMA while the IWM continued to show relative weakness, testing 3 month lows. What does this mean for the coming week? Lets look at some charts.

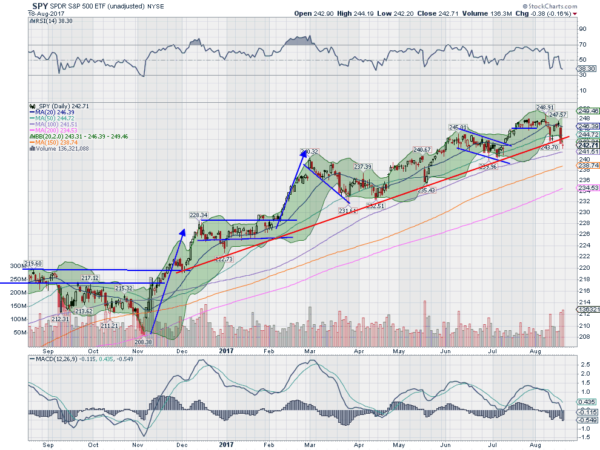

The SPY entered the week at support of a rising trend line. It gapped higher Monday continuing up in small body candles to a top Wednesday, back over its 20 day SMA. Wednesday’s candle with an upper shadow was a possible Evening Star reversal signal and it did confirm lower with a strong down day Thursday. This dropped it below that 9 month trend line and it finished slightly lower again Friday.

The Friday candle, a Spinning Top, made a lower low, but was outside of the Bollinger Bands®. A move higher Monday would confirm this as a reversal. A similar Options Expiration to that of March, April and May. The daily chart shows the price holding over the 100 day SMA as all the SMA’s are parallel as they rise. The RSI is dipping into the bearish zone while the MACD is falling and crossed to negative. Still some short term weakness.

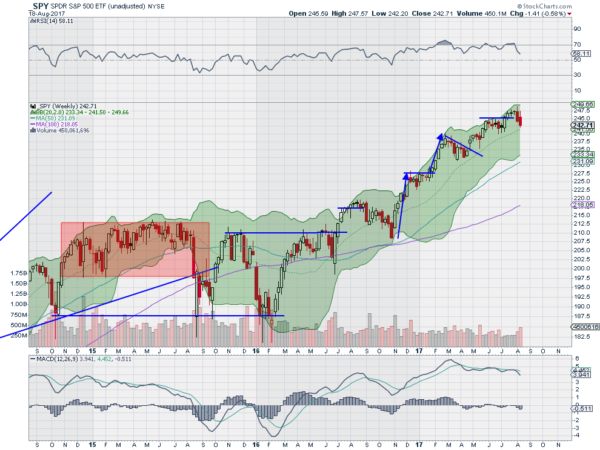

On the weekly chart the SPY looks much stronger. The 2 red candles leading toward the 20 week SMA do suggest more downside, but the RSI is in the bullish zone with the MACD positive, both are falling. There is resistance at 244 and 245 followed by 246 and 248. Support lower sits at 242 and 240 followed by 238 and 237.10. Short Term Weakness in Uptrend.

With August options Expiration completed the equity Index ETF’s suffered some short term damage. Elsewhere look for Gold to continue in its uptrend with Crude Oil joining it moving higher. The US Dollar Index continues to move sideways in the downtrend while US Treasuries climb higher.

The Shanghai Composite looks to continue to drift higher as Emerging Markets consolidate in their uptrend. Volatility looks to remain closer to the normal range and off of the abnormal low levels of the spring and early summer. This removes any support for equities in the short run.

The equity index ETF’s SPY, IWM and QQQ, all continue to show weakness in the short term but with all at support levels and printing possible reversal candles. Longer term their uptrends remain intact. Use this information as you prepare for the coming week and trad’em well.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.