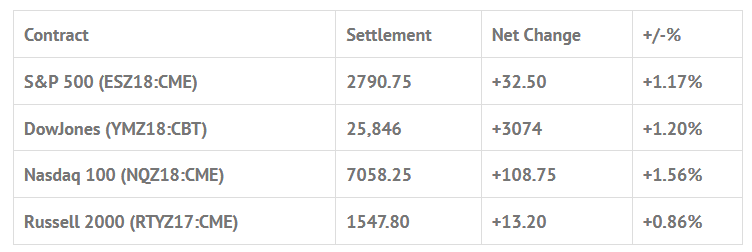

Index Futures Net Changes and Settlements:

Foreign Markets, Fair Value and Volume:

- In Asia 6 out of 11 markets closed lower: Shanghai Comp +0.42%, Hang Seng +0.29%, Nikkei -2.39%

- In Europe 12 out of 13 markets are trading lower: CAC -0.64%, DAX -0.67%, FTSE -0.67%

- Fair Value: S&P +0.52, NASDAQ +3.55, Dow +14.64

- Total Volume: 1.89mil ESZ & 1,122 SPZ traded in the pit

As of 8:00 AM EST

Today’s Economic Calendar:

Today’s economic calendar includes Motor Vehicle Sales, Redbook 8:55 AM ET, and John Williams (NYSE:WMB) Speaks 10:00 AM ET.

S&P 500 Futures: #ES Trade War Chop Shop

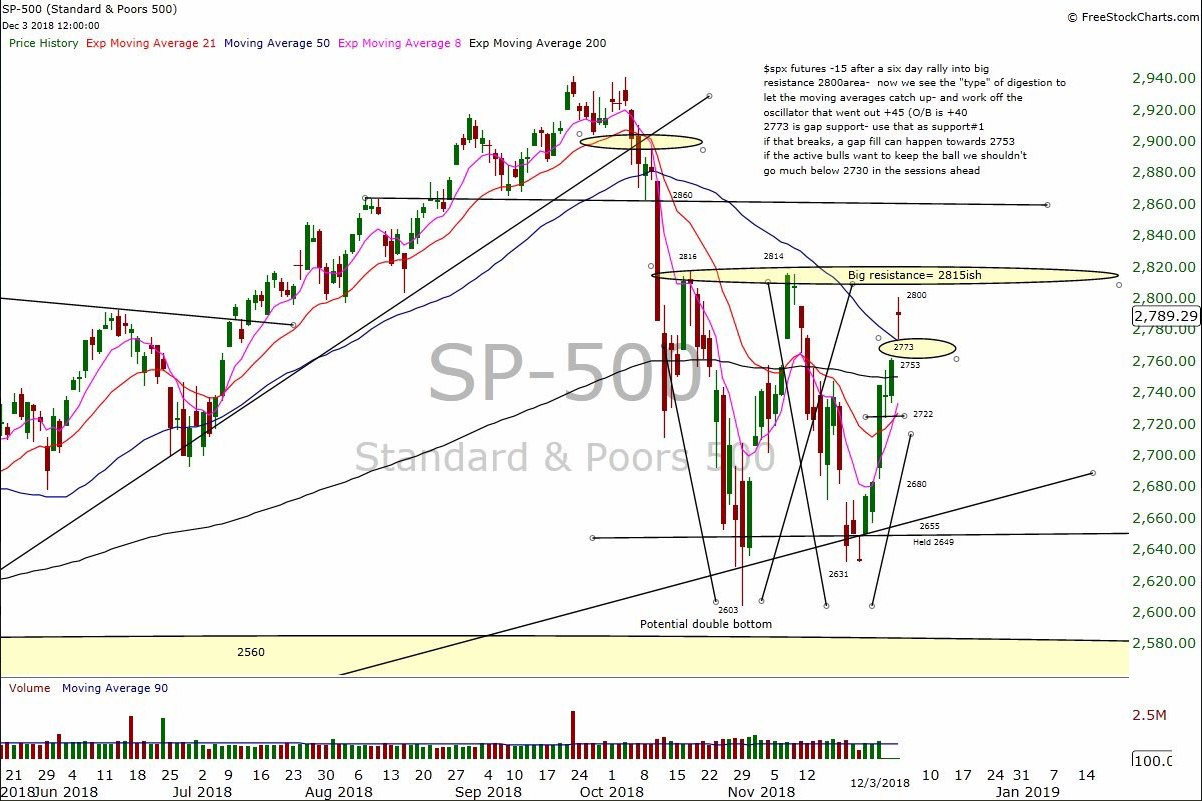

The S&P 500 futures traded up to 2814.00 during Sunday nights Globex session, and then sold back off down to the 2797.00 area, before opening Monday mornings day session at 2801.25. After the open the ES rallied up to 2802.50, and then made a sequence of of lower lows down to 2776.25. From there, the futures rallied back up to 2785.75, then double bottomed at the 2773.25 – 2773.75 area.

After the double bottom, ES rallied up to 2788.75, pulled back down to 2780.75, double topped at 2790.50, sold off down to 2774.76, and then rallied up to a double top at 2788.00. After a pullback down to 2781.00, the futures rallied up to 2793.50 as the MiM went to over $500 million to buy around 2:40 CT. The ES again pulled back down to 2790.50 as the MiM flipped to $720 million to sell, and then down ticked to 2784.75. The futures went on to trade 2788.50 on the 3:00 cash close, and settled the day at 2791.00, up +32.50 handles, or up +1.19%.

In the end the early pullback was all about the lack of buying power after the big rally Sunday night. In terms of the overall tone, the futures acted OK, but I would have liked it a lot more had the ES closed above 2800.00. In terms of the days overall trade, 1.89 million contracts traded, witch would be considered high for what we have been seeing over the last few days.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. Any decision to purchase or sell as a result of the opinions expressed in the forum will be the full responsibility of the person(s) authorizing such transaction(s). BE ADVISED TO ALWAYS USE PROTECTIVE STOP LOSSES AND ALLOW FOR SLIPPAGE TO MANAGE YOUR TRADE(S) AS AN INVESTOR COULD LOSE ALL OR MORE THAN THEIR INITIAL INVESTMENT. PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS.