Very little happened in the precious metals market yesterday, but something major happened in stocks. And it has important implications for PMs.

In my gold price forecast yesterday, I wrote the following about the S&P 500 Index:

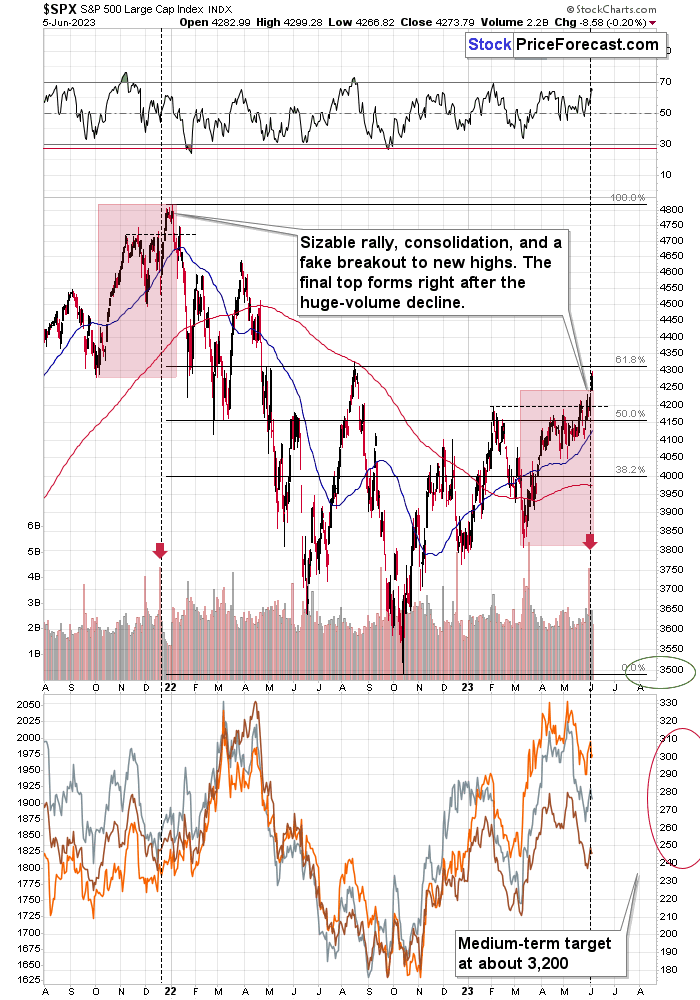

The debt-ceiling deal rally took stocks to new highs, and they are about to encounter very strong resistance in the form of the mid-2022 high. This level is likely to hold due to the part of the cycle in which the market is most likely in (“return to normalcy”), and also due to the analogy to the previous situation when stocks first declined on huge volume and then rallied to new highs.

That happened in late-2021 and it was followed by the all-time high in the S&P 500.

Back then the precious metals sector rallied, but that was due to the escalation of the situation in Ukraine, so that stocks-PMs link is not applicable right now.

On a side note, please note that the S&P 500 is more or less, where it was trading in April 2022 and so is gold. And yet, miners are well below their April 2022 levels. Did I already emphasize miners’ weakness enough times already?

Given the similarity between now and what happened right before the all-time high, and the likelihood that the link between stocks and the precious metals sector (in particular junior mining stocks) is currently intact (they move mostly together), the implications of all the above is very bearish for the following weeks and months.

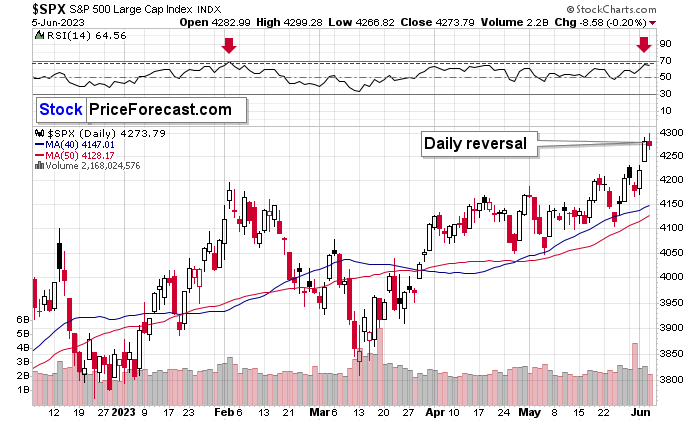

The above is up-to-date. Stocks moved higher on an intraday basis during yesterday’s session but ultimately ended lower, thus forming a daily reversal.

The move was not accompanied by huge volume, which would confirm the bearish nature of the “shooting star candlestick” reversal, but we saw a quite similar reversal after the previous sizable rally that took the RSI indicator close to the 70 level. In fact, the recent high in this indicator is the highest reading since the February top.

Interestingly that was not only right before a decline in stocks themselves, but if you look at the lower part of the first chart, you’ll see that it was also right before the decline in gold, silver, and mining stocks. Crude oil formed a top at that time as well.

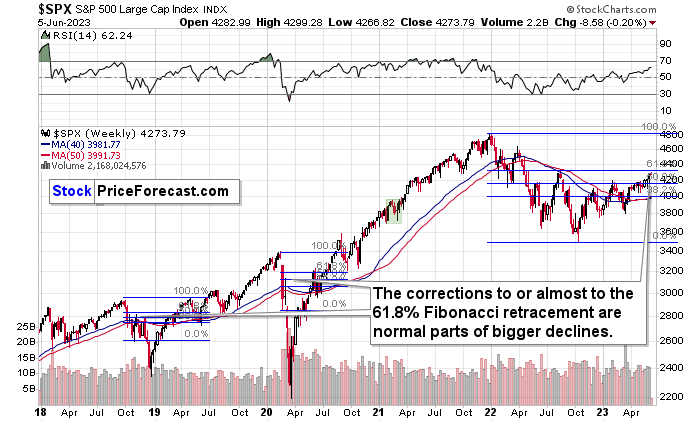

Also, there’s more to the 61.8% Fibonacci retracement level that is just above yesterday’s intraday high than “just” the fact that it’s the classic resistance level. And I’m putting “just” in quotation marks because that’s actually a strong resistance on its own – not a weak one.

The thing is that we already saw this kind of resistance really stopping the corrections within bigger downtrends.

During the 2018 decline, stocks first corrected to the 61.8% Fibonacci retracement, and it was only then that they were ready to slide – more than previously.

In 2020, things were very chaotic and volatile, and stock prices corrected slightly more than 50% of their initial decline before sliding – much more than during the initial part of the decline.

Now, the above-mentioned 50% is obviously not 61.8%, but it does confirm the point that Fibonacci retracements are important resistance levels for stocks in general. And since stocks are already above their 50% retracement and they just moved very close to their 61.8% retracement, the odds are that the top is in or at hand.

The bearish indications are further strengthened by the presence of the previous 2022 high just above the 4,300 level.

Consequently, it’s highly likely that the top in stocks is in or at hand.

- But PR, why is this so interesting again?

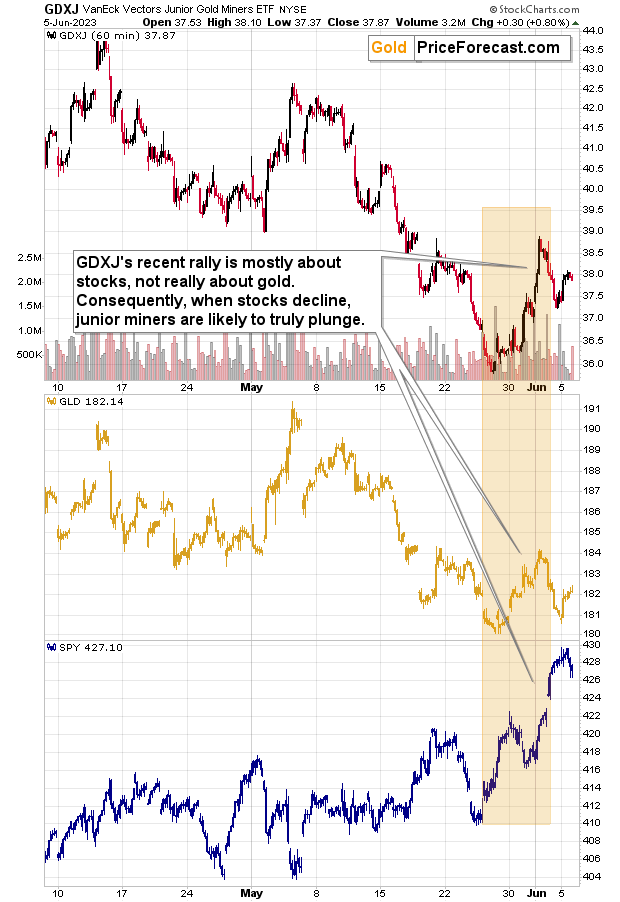

Because stocks appear to have been the driving force behind junior miners’ recent rally.

Please take a look at the above short-term chart featuring the VanEck Junior Gold Miners ETF (NYSE:GDXJ), GLD (NYSE:GLD), and SPY (I’m using ETFs to have an apples-to-apples comparison).

GLD moved higher recently, but not THAT high. Stocks (SPY), on the other hand, rallied sharply recently. Just like junior miners did. Juniors’ rally was just a verification of the breakdown below the early-May low, but still, it was quite sharp – just like what we saw in stocks.

My point here? Stocks’ rally was likely the only thing that helped to push miners’ prices so high recently (and compared to the previous decline, the rally wasn’t meaningful, it was notable only on a short-term basis), which means that when stocks stop their rally, miners’ are likely to return to their previous (down)trend.

And here’s the catch: stocks are not only likely to stop rallying; they are likely to decline and decline much more than they did in 2022!

This means that the same thing that made junior miners move higher last week is likely to push them lower in the following weeks and months. The magnitude of the bearish impact is likely to be many, many times bigger than what we saw on the upside recently.

Consequently, since the recent price action in stocks and miners confirmed the strong short-term link between them, and we are likely witnessing a top in stocks, we can see just how big the opportunity is, as far as profiting from the upcoming slide is concerned.

Many will be surprised, but you are prepared.