The selling took a break on Monday as the S&P 500 added a modest 0.3%.

While green is green, the index was far higher in the session's first hour. Unfortunately, potential buyers remain skittish given the recent price action, and most are adopting a wait-and-see attitude.

While it is fun to see prices race higher, buyers’ reluctance is a good sign if a person believes in buying fear and selling greed. At this point, the only ones feeling greedy are the bears. Everyone else is filled with trepidation as they wait for the next shoe to drop.

But as far as contrarian trading signals go, the market’s pessimism suggests this is the time to look for buying opportunities.

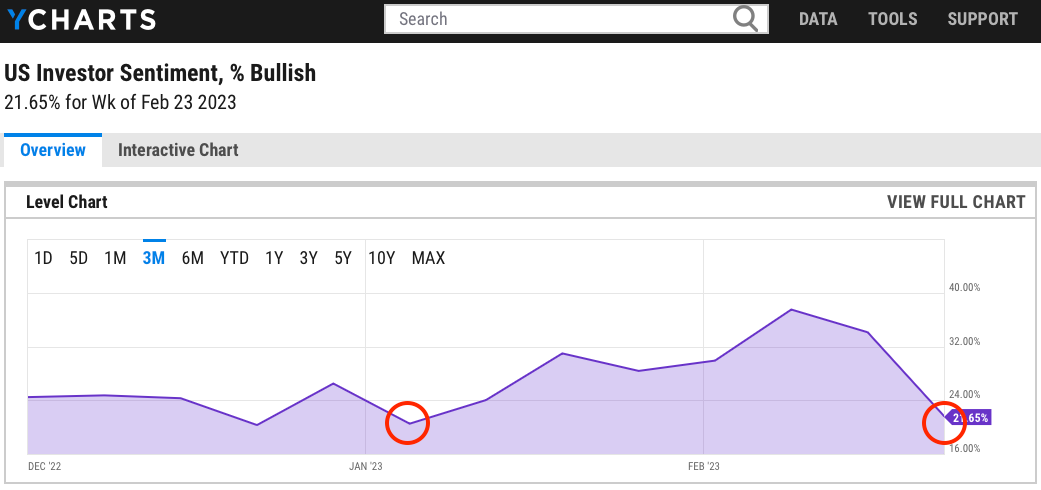

The last time the AAII sentiment survey had this few bulls was back in early January, which, as it turned out, was a great time to buy stocks because the index rallied nearly 10% over the next few weeks.

Are we on the verge of the next turning point? As everyone knows, there are no guarantees in the market, but the odds favor a near-term bounce, and that’s what I’m getting ready for.

Buying bounces is never easy because there are always false positives, but if we start small, get in early, and keep a nearby stop, the cost of being wrong is small.

And if we scale up our position when the real rebound finally arrives, the rewards will dwarf the small losses we take in the meantime.

Fortune favors the bold, and savvy traders get greedy when everyone else is scared.