Before we can forecast what’s most likely next, we must first look back at prior analyses. To that extent, three weeks ago, we found using the Elliott Wave Principle (EWP) for the S&P 500.

“as long as last week’s low at $4098 holds, the index can allow for a more direct rally to ideally $4315-4370, reaching our long-standing target set forth Mid-October last year.”

And last week we found,

“the pattern we are tracking, to ideally $4315-4370, is called an ending diagonal (ED) 5th wave. EDs are overlapping price structures as they consist of a 3-3-3-3-3 (abc-abc-abc-abc-abc) pattern instead of the typical non-overlapping 5-3-5-3-5 impulse pattern. Thus, under that scenario, yesterday’s high was orange W-a, and the current pullback is orange W-b. A W-c to ideally $4280-4290 should follow.”

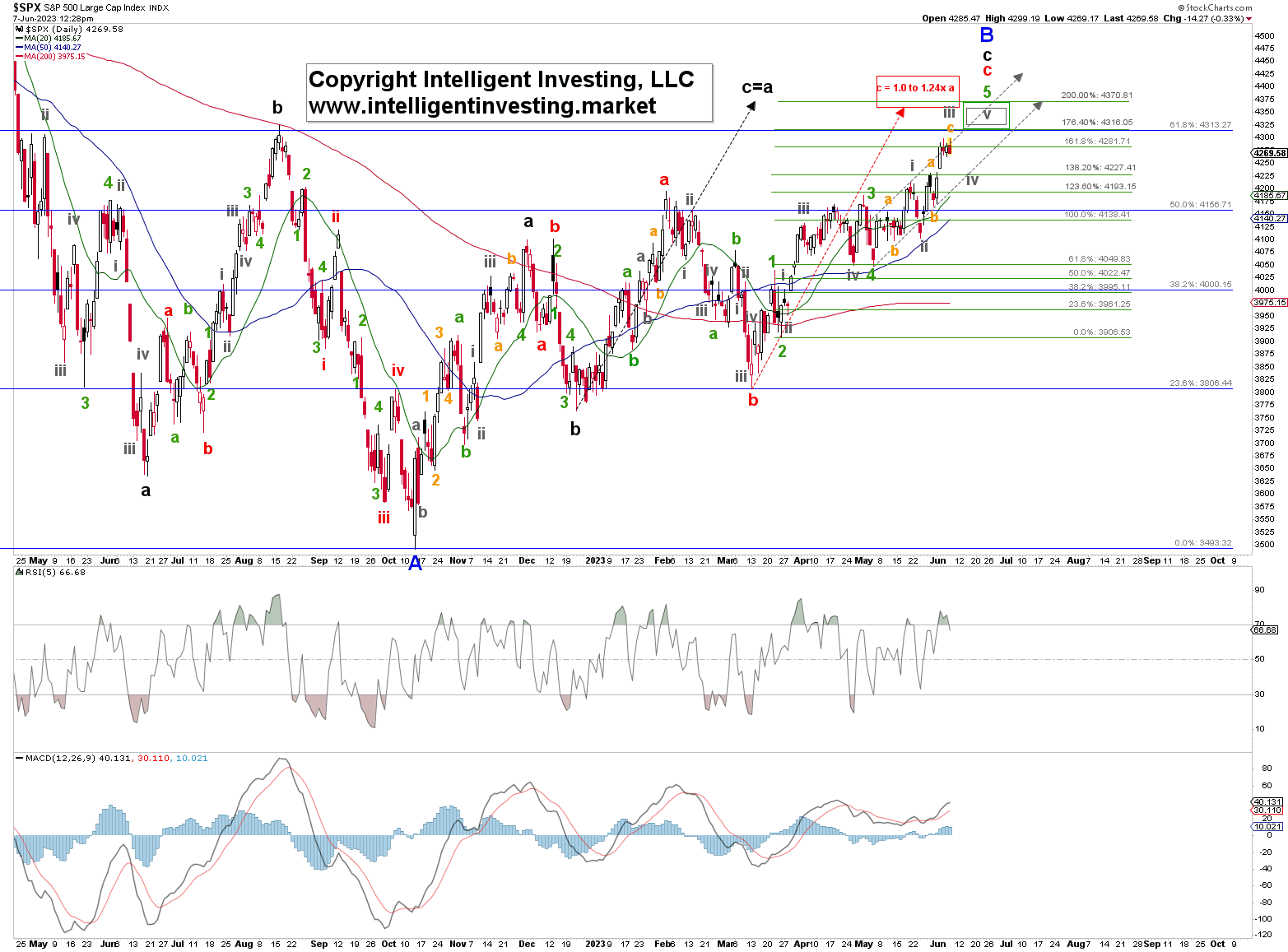

Thus, our primary expectation was correct and should still be on track. See Figure 1 below.

The SPX reached $4299 twice this week and has therewith reached our ideal “$4280-90” target zone for Orange W-c. Thus, the Grey W-iii can be considered complete for as long as price stays below this week’s high. Above it and $4310-4330 is the next target zone for a more extended 3rd wave. Hence a pullback for Grey W-iv back to around $4200-4230 is now our preferred path, from which a final rally to $SPX4315-4370 should materialize.

A Local top around June 6 also fits with the average seasonality pattern for the S&P 500 (based on 95 years of data). See Figure 2 below. We should see weaknesses by the end of this week, strengths later this month, and then weaknesses again. However, although this is only a road map as cycles are general and not specific, we must note the strength into early September of this year.

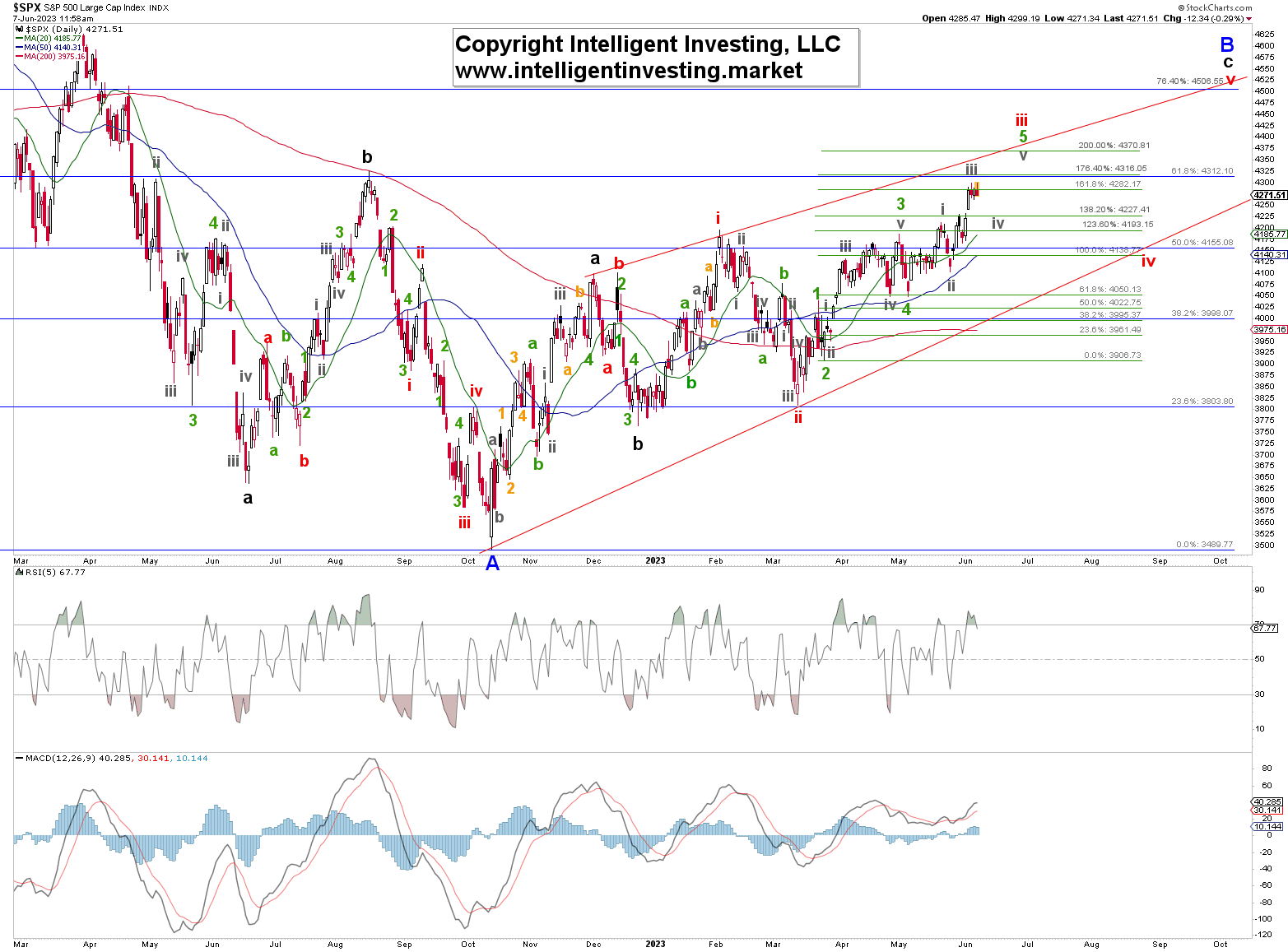

As such, an alternative EWP count must be presented where we do see the completion of a larger rally at around $4315-4370 but that top will “only” be red W-iii of an even larger (black W-c) rally. See Figure 3 below.

In this case, we should then experience the red W-iv, back to around $4150+/-50 before red W-v takes hold and rallies the index to the (blue) 76.40% retrace of the entire 2022-decline at ~$4505, instead of the 61.80% retrace at ~$4313. Besides, this path also matches the 10-year lag between crude oil and Dow Jones, which we have shared with you before. It has strength into the summer of this year, which should be a significant top.

Back to our current “closer to home” scenario. If the anticipated grey W-iv pullback stays above $4165 we can allow for the grey W-v to materialize. Below it and the Blue W-B, alternatively, the red W-iii, have most likely topped. Thus, like last week, our parameters are set for the short- to the long-term, which helps us prevent havoc on our portfolio and allows us to trade the index objectively.