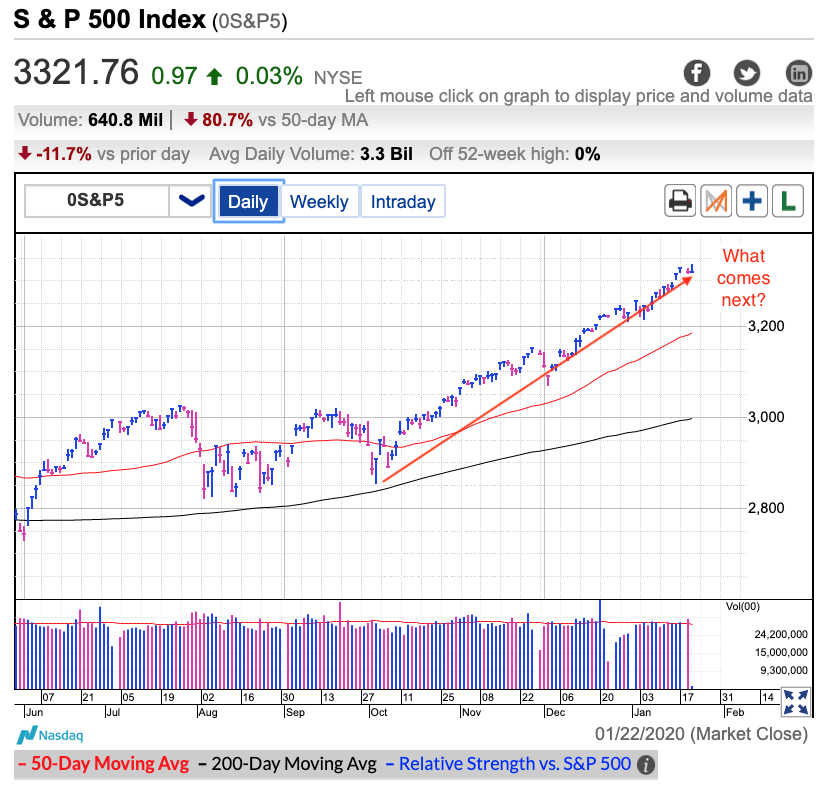

The S&P 500 bounced back from Tuesday’s small dip and so far most owners show zero interest in extending any selloff. That said, we need to remember step-backs are a very normal and healthy part of every sustainable move higher. The fact we’ve gone several months without a meaningful test of support makes me cautious.

Tuesday I saw people criticizing the market for “overreacting” to these Chinese virus headlines. While I agree this sickness is highly unlikely to impact the U.S. economy in a meaningful way, calling a 0.4% intraday slip a “reaction”, let alone an “overreaction”, is definitely a stretch. In most markets, 0.4% barely rises to the level of random noise. These “overreaction” comments definitely give us a sense of just how complacent this market has become when people become incredulous over a 0.4% dip.

The bigger question is if bulls struggle to comprehend a 0.4% slip, how are they going to react to a very normal 1% stumble? Or, a routine 5% or 10% pullback? Making money has become so easy people have forgotten what “normal” really looks like. At this point, traders are so complacent something totally benign could send shockwaves tearing through the market. While at this point talk of a 5% or 10% correction sounds extreme, these things happen all the time and nearly every year on record experienced at least one 5% pullback. When the inevitable eventually happens, I expect to hear all kinds of apocalypse predictions because compared to what we’ve seen over the last few months, it will feel like the end of the world.

All of that said, the market is still acting really well and there is no reason to alter our plans just because something could happen. We are definitely skating on thin ice, but the thing to remember about thin ice is it only dangerous if we fall through. Until that happens, expect the good times to keep rolling.

I’m definitely not calling this a top and am still long in my personal trading account, but I do know that when we hit the rocks, there is the potential for a big reaction. There is nothing to do right now other than remain alert. While it is tempting to become cynical, remember, this is still the less likely outcome. The only reason to even concern ourselves with it is if it does happen, it will be big. Remember, the greatest strength we have as little guys is our nimbleness. We don’t need to predict the future when we can simply ride this wave all the way to the edge and then hop off just before the fall.

That said, we don’t need to be fully invested at these levels. It has been a good ride, but this is definitely a better place to be taking profits than adding new money. Keep moving your stops up and consider taking some profits proactively. Once the market consolidates some of these gains, we can start looking at adding more. And if the market falls through the ice, that will present us with the best shorting opportunity in a long time.