Market Overview: S&P 500 E-Mini Futures

The E-mini S&P 500 futures traded higher but gave back most of the gains by Friday. Bears see this simply as an E-mini breakout pullback and want another breakout attempt below the June low. Because of the strong selloff, the bulls will need a strong reversal bar or at least a micro double bottom before they would be willing to buy aggressively.

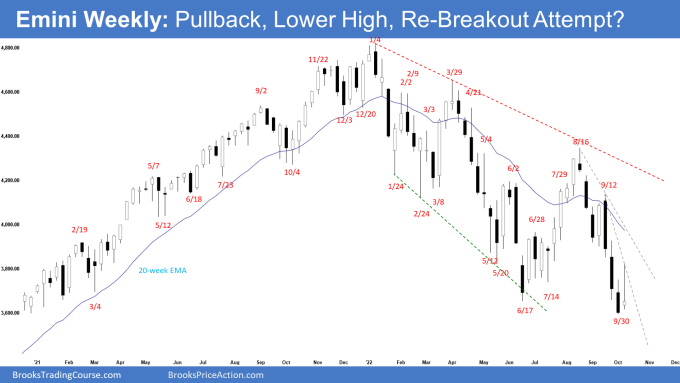

The Weekly S&P 500 E-mini chart

- This week’s E-mini candlestick was a bull doji with a long tail above, closing in the lower half of the week’s range.

- Last week, we said that odds slightly favor sideways to down and traders will be monitoring whether the bears get a follow-through bear bar following the breakout below the June low.

- The bears did not get follow-through selling below the June low. While the E-mini traded higher, it was a weak bull bar.

- They want a strong leg down like the one in April and a retest of the June low. They got what they wanted.

- The selloff from August is in a tight bear channel. That means strong bears.

- They see this week simply as a breakout pullback and want another breakout attempt below the June low.

- They then want a measured move down to around 3450 based on the height of the 12-month trading range starting from May 2021 or the big round number 3400.

- If the E-mini trades higher, the bears want a reversal lower from a lower high around the bear trend line or the 20-week exponential moving average.

- The bulls want a reversal higher from a double bottom major trend reversal with the June low.

- They will need to create consecutive bull bars closing near their highs to convince traders that a reversal may be underway and prevent a strong breakout below the June low.

- Because of the strong selloff, the bulls will need a strong reversal bar or at least a micro double bottom before they would be willing to buy aggressively.

- The problem with the bull’s case was that the recent selloff was very strong. The sideways to up leg may only lead to a lower high. This remains true.

- Since this week was a weak bull doji, with a long tail above, it is not a strong buy signal bar for next week.

- For now, the odds slightly favor sideways to down. Traders will see if the bears get another breakout attempt below June low, or if next week closes with a bull body instead.

The Daily S&P 500 E-mini chart

- The E-mini gapped up and closed as a bull bar on Monday. Tuesday gapped up again and traded sideways until Thursday below the 20-day exponential moving average. Friday gapped down creating a small island reversal.

- Previously, we said that while the selloff was strong enough for traders to expect at least slightly lower prices, traders should be prepared for some sideways to up pullback lasting days in between, which can begin at any moment.

- The bulls see the strong selloff simply as a sell vacuum testing June low within a trading range.

- They want a reversal higher from a double bottom with the June low and a wedge bull flag (Aug 23, Sept 6 and Sept 30).

- The bulls will need to create consecutive bull bars closing near their highs soon to prevent a breakout and follow-through selling below the June low.

- The problem with the bull’s case is that the selloff from August 16 was very strong. Sideways to up pullbacks may only lead to a lower high.

- Bulls hope to get a reversal higher from a micro double bottom with Sept 30 low next week.

- We said that if the E-mini trades higher, the bears want a reversal lower from a double top bear flag with Sept 21 high, or around the bear trend line or the 20-day exponential moving average. This week reversed lower from the 20-day exponential moving average.

- The bears want a retest of the Sept low, followed by a breakout and a measured move down to 3450 or slightly lower around the 3400 big round number which is also 2020 high.

- Bears want at least another leg down forming the wedge pattern with the first two legs being September 6 and September 30.

- The September low is close enough and likely to be retested again.

- Since Friday was a bear bar with a small tail below, it is a sell signal bar for Monday.

- If the bears get a strong breakout below the September low with follow-through selling early next week, the odds of them reaching the targets below increase.

- For now, the odds slightly favor sideways to down.