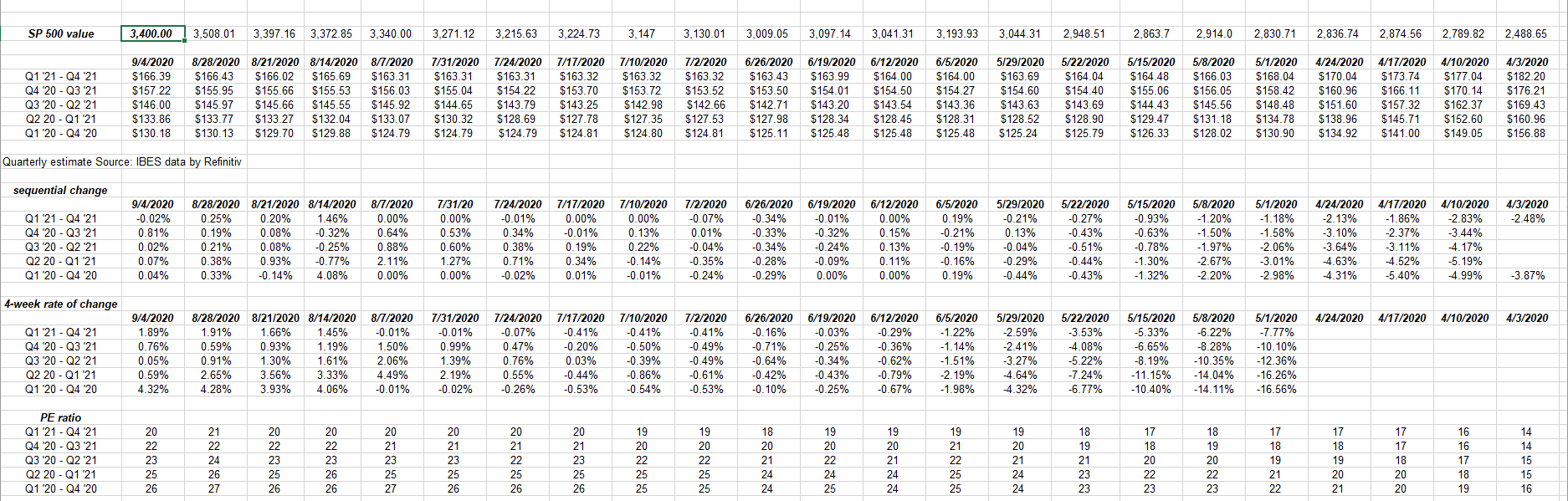

Here is what the S&P 500 earnings data looks like, compliments of IBES data by Refinitiv.

Only one name of note will report next week and that is Oracle (NYSE:ORCL), one of the 1990’s tech giants struggling with the cloud transition. Lululemon Athletica (NASDAQ:LULU) is also scheduled to report after the bell on Tuesday, September 8, 2020.

S&P 500 Forward Earnings Curve:

As readers will note, since July 2 there has been a steady improvement in the sequential and 4-week rate of change for the S&P 500 forward earnings curve.

The above table was started with in March / April of 2020 with COVID-19 so it might become less useful as we move through Q4 ’20. Eventually, this blog will return to the previous format.

3,400 is being used as the S&P 500 value since this is being written mid-day on Friday, September 4th.

S&P 500 Metrics:

- The forward 4-qtr estimate rose to $146.00 this week, vs last week’s $145.97. Since July 2nd there has been only one week of the last 10 that S&P 500 earnings didn’t improve sequentially, which is just the opposite of the earnings pattern in more “normal” times. In other words, the forward 4-qtr estimate usually starts the quarter at its highest value and by the end of the quarter is near it’s lowest value of the 12 weeks.

- The PE ratio is 23x, thanks to the 2.8% decline in the benchmark this week.

- The average “expected” EPS growth for 2020 and 2021 is still averaging 4%, for the 21st consecutive week.

- The S&P 500 earnings yield rose to 4.29% after last week’s 4.16% print, the lowest since June 19th’s 4.14% print.

Summary / Conclusion:

This broad look at the S&P 500 earnings data probably won’t reveal much insightful information until we start to get Q3 ’20 earnings around October 19th, 2020. The S&P 500 earnings yield is probably more indicative of understated or too pessimistic forward earnings estimates than higher prices, although the tech sector is distorting everything in the benchmark. The S&P 500 earnings curve shows us that 26x the 2020 SP 500 EPS estimate is pretty salty.

The downtime over the Labor Day weekend will be spent looking at some more specific topics.

Remember, S&P 500 earnings estimates change daily.