Since the S&P 500,Dow Jones Industrial Average, NASDAQ are down more than 20% from their highs (one commonly accepted definition of a bear market), stocks are considered to be in a bear market.

I don’t subscribe to the ‘any 20% decline equals a bear market’ notion. Calling a bear market after a 20% decline usually isn’t much help because historically, and ironically, most bear markets end after a ~20% S&P 500 decline (see chart below).

The chart below compares the average bear market with the 2020 meltdown. I originally published this chart in March 2020 and argued that stocks are approaching a good buying opportunity.

The 2022 downturn is much different from the 2020 meltdown. Still, as promised in my last article, I wanted to explain why the odds of an upcoming buying opportunity are much higher than many expect.

2022 Mid-election year decline ‘on schedule’

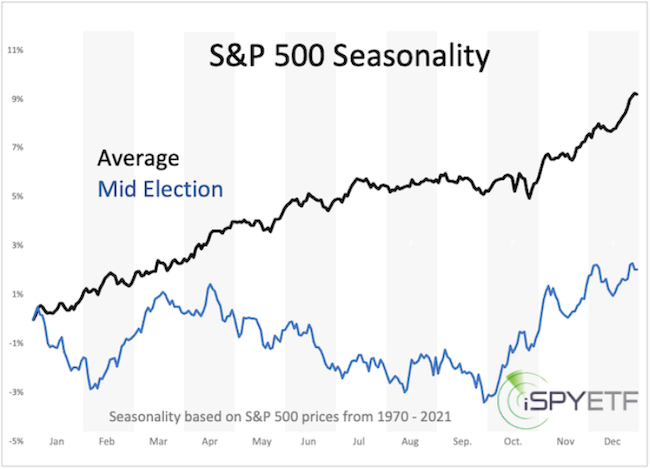

Stocks’ 2022 performance seems shocking, but it’s not that unusual based on the election year cycle. 2022 is the mid-election year, the weakest of the 4-year presidential election cycle. Historically (going back to 1950), the S&P 500 declines on average about 20% into the mid-term election year low.

The following year (the pre-election year, 2023) is the strongest year of the election-year cycle as incumbent presidents prime the pump to increase the odds of reelection. Historically, the S&P 500 gains about 50% from the mid-election year low to the pre-election year high.

Cycles project a fair amount of political and economic turmoil starting in Q1 of 2022. Based on seasonality and cycles, 2022 will be a tough year to navigate, where high stock prices early in the year should be used to raise cash for a better buying opportunity later in the year.

Some may say, ‘that’s easy to say in hindsight,’ but I wrote the above in my 2022 S&P 500 Forecast. The S&P 500 mid-election year seasonality chart accompanying the above commentary highlights the tendency of a Q4 low.

Target level

Discerning the potential timing of a buying opportunity is just one part of the equation. Identifying a price target is another. One potential zone for a low is the S&P 500 support zone, around 3,400. Corresponding support for the SPDR S&P 500 ETF (NYSE:SPY) is around 340, and Invesco QQQ Trust (NASDAQ:QQQ) is around 238.

In summary, if the S&P 500 drops to about 3,400, I’ll have my eyes peeled for a potential buying opportunity. If various sentiment and breadth readings display the kind of ’throw in the towel’ readings usually seen near meaningful lows, it will further enhance the buy signal.