Is a bear market on the way?

My research suggests the downward sloping trend line (light orange line in the daily/weekly SPDR® S&P 500 (NYSE:SPY) charts below) may continue to act as solid resistance – possibly prompting a further breakdown in the markets.

As we've seen recently, news and other unexpected events prompt very large price volatility events in the major U.S. indexes. For example, the CBOE Volatility Index recently rose above 30 again, which shows volatility levels are currently 3x higher than normal levels.

Increased Volatility And The Start Of An Excess Phase Peak Should Be A Clear Warning

This increased volatility in the markets, coupled with the increased fear of the Fed and the global unknowns (Ukraine, China, debt levels), may be just enough pressure to crush any upside price trends over the next few months. Technically, my research suggests the $445 to $450 level is critical resistance. The SPY must climb above these levels to have any chance of moving higher.

Unless the U.S. markets find some new support and attempt to rally back towards recent highs, an “Excess Phase Peak” pattern will likely continue to unfold throughout 2022. This unique price pattern appears to have already reached a Phase 2 or Phase 3 setup. Please take a look at this weekly General Electric (NYSE:GE) example of an Excess Phase Peak pattern and how it transitions through Phase 1 through Phase 4 before entering an extended bearish price trend.

SPY May Already Be In A Phase 4 Excess Peak Phase

This daily SPY chart highlights my analysis, showing the major downward sloping trend line, the middle resistance zone, and the lower support zone. Combined, these are acting as a “wedge” for price over the past few weeks – tightening into an apex near $435~440.

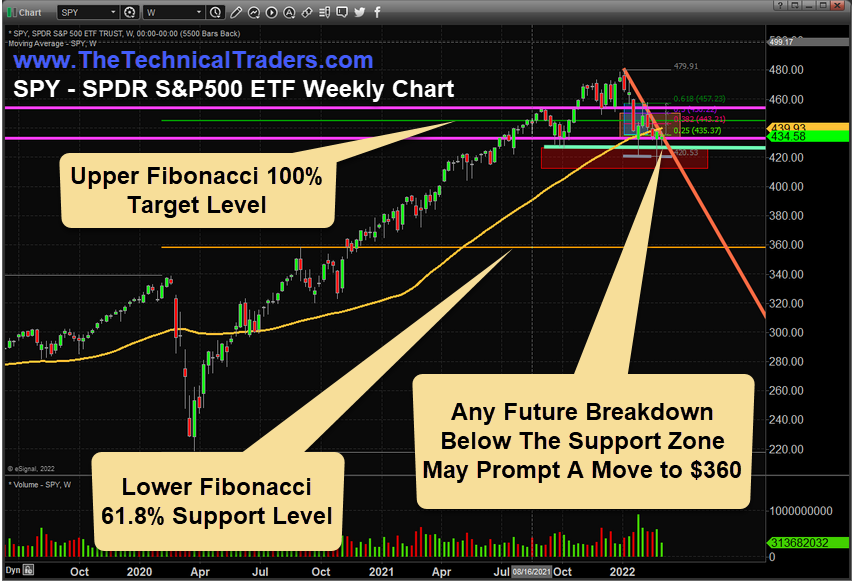

If the major U.S. indexes attempt to break this downward price trend, then the price must attempt to move solidly above this downward sloping price channel and try to rally back into the resistance zone (near $445~$450). Unless that happens, the price will likely transition into a deeper downward price move, attempting to break below recent lows, near $410, and possibly quickly moving down to the $360 level.

SPY Weekly Chart Shows Consolidation Near $435 – Possibly Starting A Phase 4 Excess Peak

Traders should stay keenly aware of the risks associated with the broad U.S. and global market decline as the Ukraine war, and other unknowns continue to elevate fear and concerns related to the global economy. In my opinion, with the current excess global debt levels, extended speculative market bubbles, and the continued commodity price rally, we may be starting to transition away from an extended growth phase and into a deeper depreciation cycle phase.

My research suggests we entered a new depreciation cycle phase in late 2019 and are already more than 25 months into a potential 9.5-year global depreciation cycle. What comes next should not surprise to anyone.

Traders should stay keenly focused on market risks and weaknesses. I expected the conflict in Ukraine to have been priced into the U.S. markets over the past 7+ days. However, I believe the markets were unprepared for this scale or invasion and will attempt to settle fair stock price valuation levels as the conflict continues. This is not the same U.S./global market bullish trend we've become used to trading over the past 5+ years.