It has been reported that about $10 Trillion of sovereign debt “yields” negative interest. Assume total global sovereign debt is about $60 Trillion.

Therefore, about one-sixth of all sovereign debt has negative interest rates. This brings to mind a few questions.

- Do negative interest rates sound absurd, even insane?

- Would bankers and central bankers in 2012 have believed that interest rates could be pushed so low they actually went negative?

- Does anyone see a problem with negative interest rates?

Let’s review.

- Central bankers assure us they want price inflation and want to avoid deflation. They create the desired price inflation by “printing” currencies to inflate the total currency in circulation and thereby devalue their currencies.

- Governments support this process as they can finance profligate spending at minimal or negative interest rates.

- Governments are deeply in debt, going even further in debt each second, and have no plan or intent to balance budgets, pay down debt, or even reduce deficit spending.

- Governments assure us they will repay their debts by borrowing even more currency, or by “printing” the needed currency, which most assuredly will be worth less in buying power than when their initial debts were created.

- We pretend this is fine and extend the insanity. We experience aggressive implementation of bad policy that is bankrupting the middle class, destroying pension plans, increasing wealth disparity, continually devaluing currencies, and punishing savers around the world that pushes us into a bleak abyss.

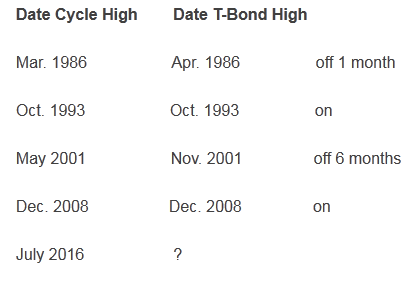

Examine the following chart of the US 30-Year Treasury bond from about 1980. I have drawn blue cyclic vertical lines every 91 months that, with one exception, point to the highs.

The black arrows indicate a steep rise in T-Bond prices starting from lows several years before the cyclic highs. The current 2014 low to 2016 high looks similar to the 1984 low to1986 high.

Given that our short-term markets are currently managed by central banks, High-Frequency-Traders, and governments, I understand that markets, technical analysis, and cycles are distorted and manipulated, but the T-Bond highs have been regular and long-term. A cyclic high in T-Bonds is due in a few months. We’ll see….

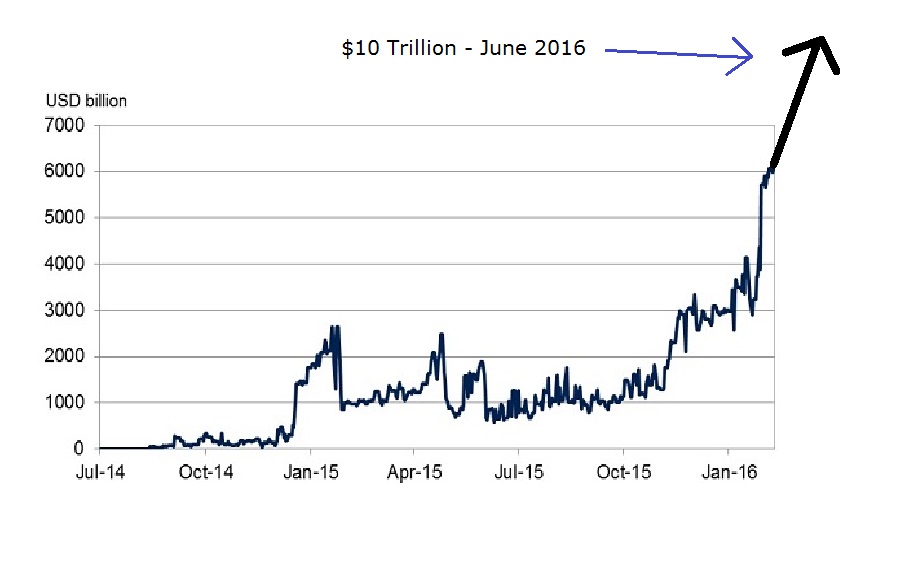

What about negative interest rates? First, they seem crazy and unpredictable. Second, there were approximately no bonds trading at negative yields in early 2014, and now there are about $10 Trillion, which Bill Gross suggests will result in a destructive supernova.

Examine the following chart:

In round numbers the total of negative yielding sovereign debt is doubling every two – six months, and appears to be accelerating.

Speculation:

Negative yielding debt has quadrupled from $2.5 Trillion to $10 Trillion in five to six months. Assume it quadruples again in five months, just in time for the US election when the total sovereign debt with negative yields would be approximately $40 Trillion. At that rate, in another couple of months all of the $60+ Trillion of global sovereign debt could have negative yield – another parabolic increase which probably will not happen.

But we know from history that:

- Parabolic increases precede crashes. Sovereign debt looks like a bubble in search of any reason to crash.

- Total negative yielding sovereign debt has quadrupled in five to six months and appears to be accelerating. A crash seems likely.

- T-Bonds have peaked about every 7.6 years (91 months). The next peak is due approximately August 1 – say between now and November 2016. A T-Bond peak could occur – followed by a nasty bond market crash that corrects some or all of the 35 year bull market in bonds.

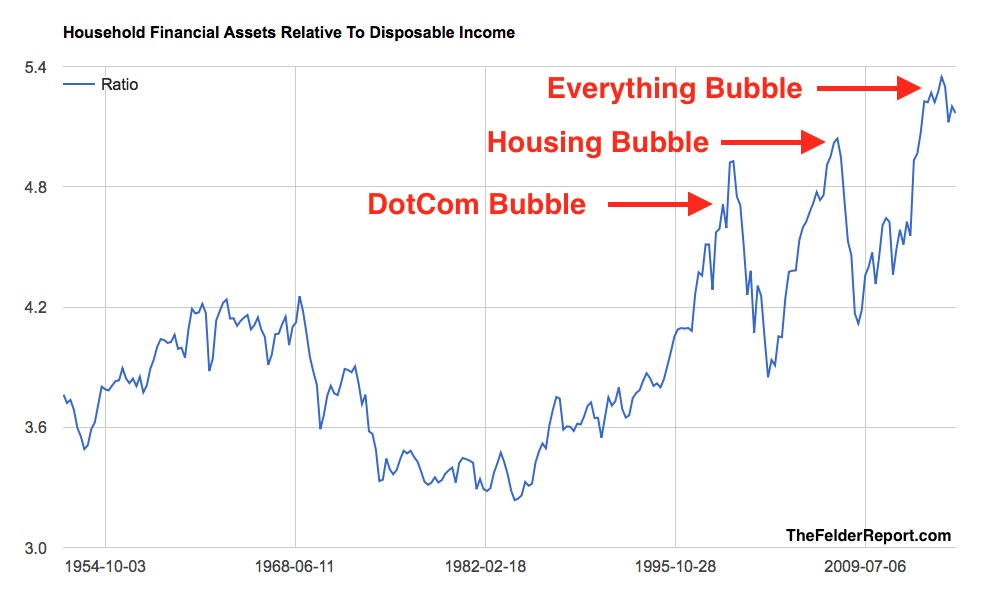

- Fragile and overextended systems and markets are vulnerable to catastrophic crashes: Internet stocks in 2000, silver in 1980, real estate in 2008, bonds in 2016, confidence in central bank credibility and competence in 2016 – 2020 (?), e-mail servers filled with top-secret data, Obamacare, Brexit, and the list goes on.

- Consider the “everything bubble.”

Conclusions:

- Negative yields on $10 Trillion in sovereign debt are a sign that bond markets are distorted and a little crazy. Look for a crash.

- The US T-bond is due for a cyclic high in a few months. Look for a crash.

- Negative yielding sovereign debt is doubling every two – three months, a parabolic increase that is likely to end in a crash.

- Bubbles always crash. Think sovereign debt, corporate debt, housing prices, student loans, central bank credibility, and more.

- If sovereign debt is “marked down” to some lower value closer to its intrinsic value and if global currencies are continually devalued, people are likely to demand real assets with no counter-party risk that are less dependent upon the integrity and credibility of central banks and sovereign governments.

Gold and silver come to mind!