This article was written exclusively for Investing.com.

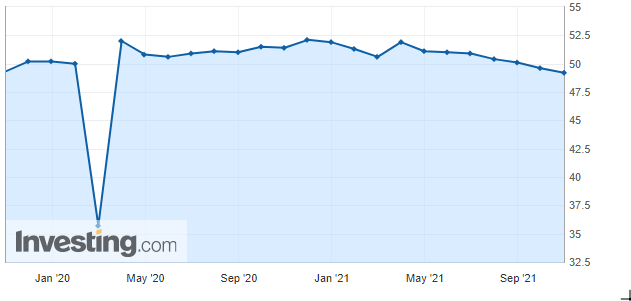

Sometimes when investors are so focused on one event, they miss the big one staring them right in the face. The manufacturing sector in China has been contracting for two months, based on the China Manufacturing PMI. This slowdown seems to have gone unnoticed by US equity markets.

The weakness is not only noticeable in the PMI. Iron ore futures have plunged by nearly 50% since the middle of July, while the Baltic Dry Index has fallen by almost the same amount in only four weeks. Additionally, commodities like soybeans have fallen nearly 25%. Whatever is driving this weakness in China, the fact is that something is happening outside of the world of inflation, and, at the end of the day, it may end up carrying more weight.

Ignoring The Risks

Given the collapse in some of these key commodity prices and shipping rates, it seems growth in the second-largest economy is slowing. An article in the South China Morning Post recently noted new downward pressure facing the economy. This is very important, given that China is the world’s second-largest economy and any slowdown there is likely to have a ripple effect across the globe.

However, the US markets have largely not even taken any notice. Since the middle of October, the S&P 500 has been on a massive risk-on rally, climbing to yet another new all-time high. Instead of noticing the weakening growth trends, it has remained focused on the risk of rising inflation rates and the need for the Fed to taper its asset purchases.

Watching Inflation

While inflation has been a persistent problem worldwide, the question is if it will remain persistent. With most of the problems coming from the supply side, one would think that those prices would adjust and stabilize over time as supply becomes available.

As a result, yields on the short-end of the curve have risen sharply due to these short-term inflation pressures and yields on the long-end of the curve have moved sideways. It would seem to suggest that the longer-end of the bond market is worried about long-term growth prospects more than short-term inflationary challenges.

This slowing of the Chinese manufacturing sector may even be what the US yield curve is starting to reflect and related to slowing global growth. Even Germany saw retail sales fall by 2.5% month-over-month for September, while its manufacturing PMI came in weaker than expected and slower than last month.

When Will It Realize?

While the US markets appear not to be paying attention to any of this, one thing is clear, Asian markets are, with places like South Korea seeing its KOSPI fall by about 10% from its highs, and the market in Taiwan down about 5% and trending lower since the middle of July. Additionally, the market in Australia has trended sideways since June.

The warning signs seem to be growing, and the more prices of crucial commodities fall, the more significant and more glaring the signals become. Ultimately, it may only be a matter of time before US markets wake up to the warning of a global growth slow down. To think, just as the Fed begins to taper.