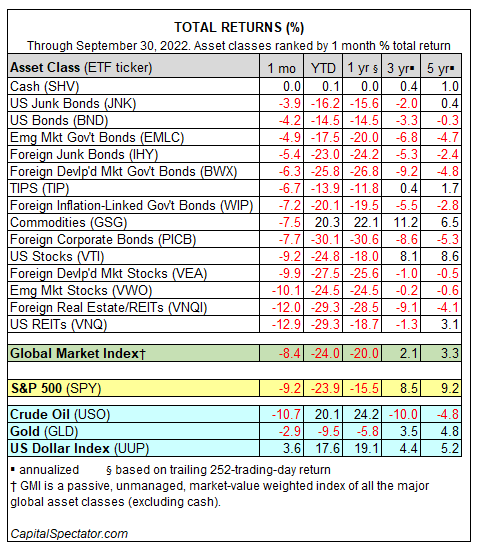

The major asset classes suffered another harsh run of monthly losses in September, based on a set of proxy ETFs. Once again, nothing was spared (except for cash). Otherwise, losses dominated, echoing results in August.

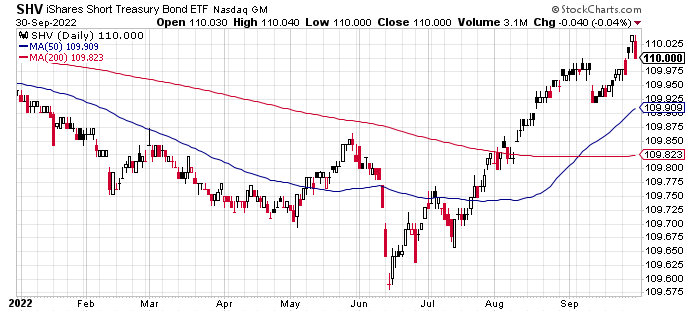

The outlier for a second straight month: short-term Treasury bills (SHV), posting an essentially flat performance in September. Holding steady reaffirms that cash is no longer trash. After two straight months of substantial outperformance in relative terms, investors are wondering if a third month of leadership for cash is brewing for October.

Meanwhile, the rest of the major asset classes suffered a steep run of losses in September, ranging from a relatively light 3.9% monthly decline for US junk bonds (JNK) to last month’s deepest loss of nearly -13% for US real estate investment trusts (VNQ).

Year to date, only cash and commodities (GSG) are posting gains. On a trailing five-year basis, there are a bit more winners, but red ink dominates for this time window too.

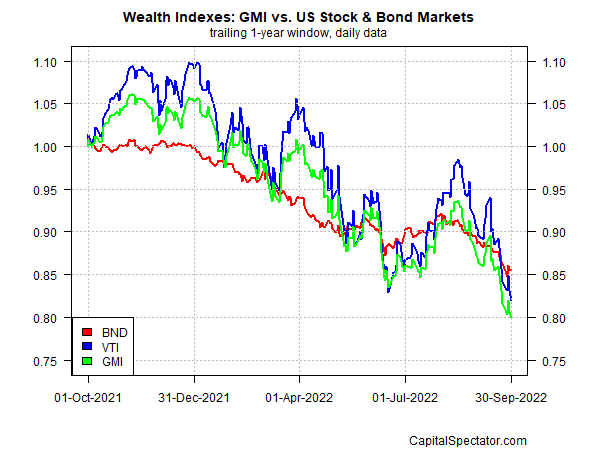

The broad sweep of red ink took a heavy toll on the Global Market Index (GMI) in September. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, tumbled 8.4% last month – the deepest monthly setback since a steep loss in March 2020, when the coronavirus crash hit markets. Year to date, GMI is down a hefty 24.0%.

Comparing GMI’s performance to US stocks (VTI) and bonds (BND) over the past year shows that multi-asset-class portfolios are taking a heavy hit. GMI trailing 20% one-year loss continues to exceed the declines for US stocks and bonds.