From BlackRock: There are good and bad reasons to hold cash in your portfolio, but it’s important to remember cash is not risk-free. Karen explains.

Americans like cash. A lot. There is $2.7 trillion in money market funds alone, plus another $9.1 trillion in bank deposits, like checking accounts and certificate of deposits (CDs) (source: Investment Company Institute (ICI) and Federal Reserve (Fed), as of 10/16/2017).

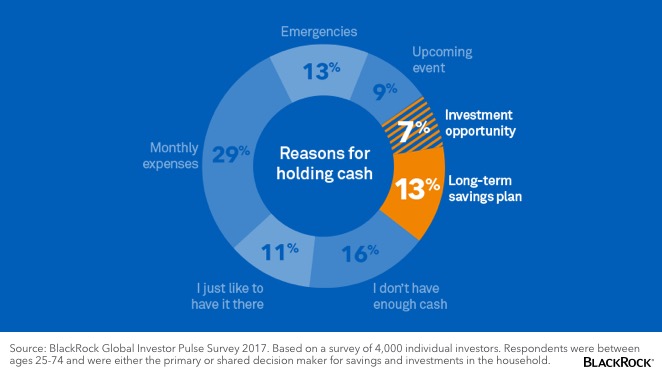

Americans have about 58% of their investable assets in cash or cash equivalents, based on our investor survey. They do so for a variety of reasons, and some of them make sense, like monthly expenses, emergencies and upcoming events. But when 11% of those surveyed say they “just like to have it there,” the comfort associated with cash seems out of place.

Why People Hold Cash

The survey shows also that about 20% of the cash is earmarked for investing purposes –either as “dry powder” to invest later or as long-term savings. However, if you have a time horizon of greater than six months, chances are that cash money may work against you.

Not Keeping Up With Inflation

The purchasing power of your cash stash can diminish as inflation eats away at it over time. Years of central bank policies of easy money have caused short-term interest rates to remain below inflation–aptly called 'financial repression' – which has penalized savers. The Fed has increased interest rates four times this market cycle and the current federal funds target rate is 1% to 1.25%, but inflation is trending around 2.2% using the consumer price index. Short-term market rates are moving closer to the inflation rate, but money market and cash yields have not kept pace. For example, the average money market fund yields just 0.88%–falling short of the 1% to 1.25% range on the federal funds rate.

Missing Out On Market Opportunities

While a money market fund or deposit account will protect the nominal value of your cash, you are missing out on a chance to grow it with interest from bonds or capital appreciation from stocks.

Here are two steps to start putting your cash to work.

Step 1: Segment Your Cash Needs

How much do you need for monthly expenses, emergencies or upcoming events? Keep that amount in cash equivalents, like a money market fund or FDIC insured bank deposit. Consider putting the remainder in the market.

Step 2: Invest In A Way That Reflects Who You Are

There’s no one-size fits all solution. The choice to invest in stocks or bonds depends on your own personal goals and objectives for the cash. The iShares Core Builder Tool can help create a portfolio based on your investment style.

On the other hand, what if you are not ready to jump in head first? Many investors are concerned about the effect of rising rates on bonds or stocks becoming overvalued after repeatedly hitting new highs. If you want to get your cash off the sidelines but aren’t ready to commit to something long term, consider a short-term bond exchange-traded fund (ETF).

Keep It Short

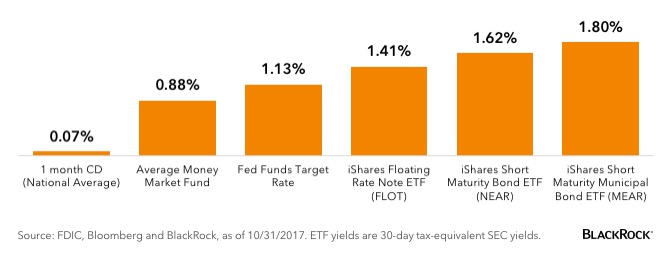

Short-term bonds tend to be less vulnerable to rising rates than longer-term bonds, while typically providing a higher yield than cash. There’s a variety of funds to choose from FLOT and NEAR hold investment grade floating and fixed rate bonds, respectively. For taxable accounts, investors can consider MEAR, whose income is generally exempt from federal income tax. These funds can be used to potentially add more income (see the accompanying chart) while helping you step out of cash and meet short- or long-term investment goals.

Bond ETFs Can Offer More Income Than Cash (current yields)

The performance quoted represents past performance and does not guarantee future results. Investment return and principal value of an investment will fluctuate so that an investor’s shares, when sold or redeemed, may be worth more or less than the original cost. Current performance may be lower or higher than the performance quoted. Performance data current to the most recent month end and standardized performance may be obtained by clicking here.

Karen Schenone, CFA, is a Fixed Income Product Strategist within BlackRock’s Global Fixed Income Group and the newest contributor to The Blog.