Healthy consumer snacks and beverage company Simply Good Foods' (NASDAQ:SMPL) stock has been performing relatively strong compared to the benchmark indices.

The healthy lifestyle foods company includes well-known brands like Atkins and Quest Nutrition, commonly found in grocery and convenience stores. Nearly half of the Company sales comes from nutrition bars, a quarter from sweet and salty snacks, and another quarter from ready-made sports shakes.

The Company was a pandemic winner. Gross margins fell (-250 bps) due to inflationary pressures from a challenging supply chain environment.

However, its Q1 2022 price increases have helped to mitigate some of the pressure as demand remains strong. The post-COVID reopening helped POS to grow nearly 20% due to foot traffic returning to convenience stores and gyms.

E-commerce has been a robust channel that continues to accelerate sales as Quest saw 14% growth. Prudent investors seeking exposure in the consumer active health snack trend can look for opportunistic pullbacks in shares of Simply Good Foods.

Q2 FY 2022 Earnings Release

On Apr. 6, 2022, Simply Good Foods released its fiscal first-quarter 2022 results for the quarter ending February 2022. The Company reported a profit of $0.36 per share beating out consensus analyst estimates for $0.27 per share by $0.09 per share.

Revenues rose 28.7% year-over-year (YoY) to $296.70 million beating consensus analyst estimates for $274.92 million. Simply Good Foods CEO Joseph Scalzo commented,

“Retail takeaway was in line with our expectations and the price increase instituted last quarter is tracking in line with our estimates and partially offsetting supply chain cost inflation. However, total net sales and earnings growth was greater than our forecast due to the timing of shipments to support earlier than anticipated third quarter retail customer programs.”

In-line Guidance

Simply Good Foods provided in-line guidance for fiscal full-year 2022 revenues to grow 13% to 15% versus 13.5% or $1.14 billion consensus analyst estimates.

Gross margins are expected to decline 250 bps YoY. Full-year 2023 adjusted EBITDA is expected to rise less than net sales growth rate and fiscal 2022 adjusted diluted EPS is expected to increase greater than the adjusted EBITDA growth rate.

The Company increased stock buyback authorization by an additional $50 million.

Conference Call Takeaways

CEO Scalzo noted that despite COVID surges, demand was strong enough to absorb the high single digit percentage price increases implemented in Q1 2022.

This helped net sales to grow 28.7%. It’s POS increased 19.2% in the U.S. The Company entered into an agreement to license Quest frozen pizza to Bellisio Foods, which currently licenses Atkins Frozen meals.

Total Quest retail takeaway in measured channels rose 40.1% nearly doubling the Active Nutrition segment growth. Amazon’s second largest customer Q2 retail takeaway grew 20% YoY.

Quest bars retail takeaway grew 22% driven by higher shopper trips in convenience stores making up 55% of total Quest sales. Quest snacks grew 88% in the quarter making up 40% of total Quest sales and robust growth is expected to continue.

Quest e-commerce grew 14% YoY. Timing of Q2 shipments will cause net sales to fall below retail takeaway growth in the second half. He concluded,

"Our customer service levels are improving, we anticipate that supply chain operating environment will remain challenging. We have good visibility into our cost structure for the balance of the fiscal year and our input costs are largely covered.

"Therefore, there is no meaningful change to our fiscal 2022 supply chain cost inflation or gross margin outlook. The price increase announced earlier this month is primarily a benefit in the fiscal 2023.

"We're executing well against our plans, and we believe we are in a position to deliver another year of solid net sales and adjusted EBITDA growth as a path to increasing shareholder value."

SMPL Opportunistic Price Levels

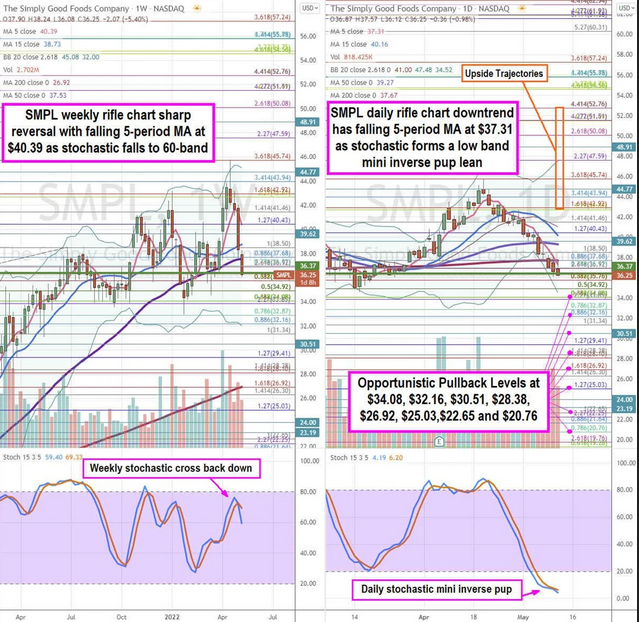

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for SMPL stock. The weekly rifle chart recently peaked off the highs near the $45.74 Fibonacci (fib) level.

Shares took a sharp sell-off to plunge down to the weekly market structure low (MSL) buy trigger $36.37. The weekly 5-period moving average (MA) is starting to slope down at $40.39 while 15-period MA stalls at $38.73 and weekly 50-period MA at $37.53.

The weekly stochastic rejected off the 80-band as it heads back down. The daily rifle chart downtrend has a falling 5-period MA at $37.31, daily 200-period MA at $37.67, daily 50-period MA at $39.27, and the daily 15-period MA slipping at $40.16.

The daily lower Bollinger® Bands (BBs) sit at $34.52. The daily stochastic formed a mini inverse pup under the 10-band.

Prudent investors can watch for opportunistic pullbacks at the $34.08 fib, $32.16 fib, $30.51, $28.38 fib, $26.92 fib, $25.03 fib, $22.65 fib, and the $20.76 fib level. Upside trajectories range from the $42.92 fib level up towards the $52.76 fib level.