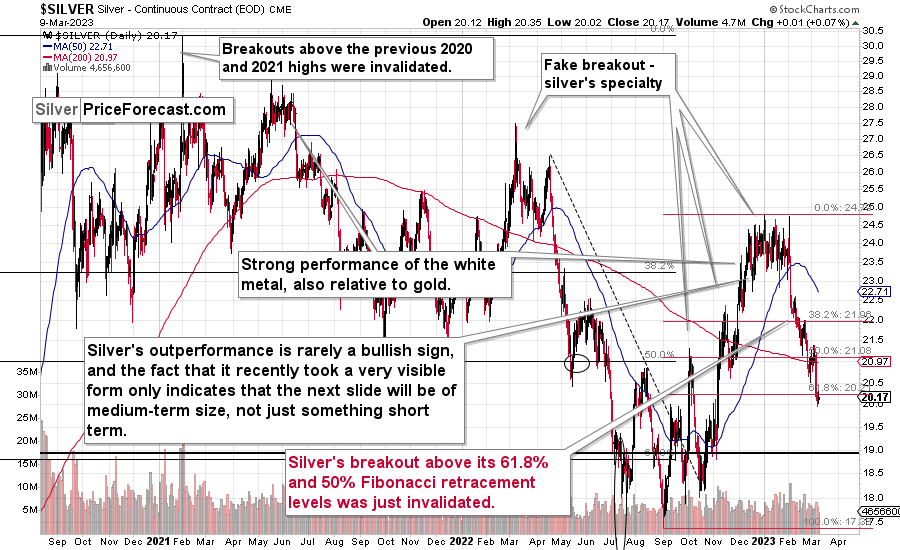

For some time, silver’s chart was very boring. It did nothing for weeks. Precisely, it kept trying to break above its 61.8% Fibonacci retracement level, and then it invalidated that breakout.

And then it happened.

Was It a Surprise?

Silver plunged below its 61.8% Fibonacci retracement, which – in the world of technical analysis – means “that’s no correction, that’s a new medium-term decline”!

That happened just a month after the white metal tried to move to new yearly highs, which is… Not surprising at all. At least to those who have been following my analyses for some time and know very well how tricky the silver market can get.

The thing is that silver is known (at least to those with expertise in this market) for its fake breakouts and fake strength relative to gold. In fact, this is so common that looking at the silver-to-gold ratio for exceptional short-term strength is one of the most useful sell signals in the precious metals sector!

With silver now trading not only below the above-mentioned retracements, but also its mid-November high, the outlook is clearly very bearish.

Let’s take a moment to recall the time when everyone and their brother were bullish on silver – in early 2021.

The silver price even tried to move above the $30 level, and it succeeded in doing so… For a brief moment.

Silver was “supposed to” take off. Shot up to the moon. Based on the physical market’s tightness, silver’s availability, a short squeeze, etc. Truth be told, it’s difficult not to write this with sarcasm (and I’m not), because I remember exactly the same reasons being used to justify silver forecasts above $100 back in the early 2000s. I’ve been there and I’ve been buying silver below $5, so I know a thing or three about what kind of analyses, discussions, and rumors were “out there” at those times.

The Similarities

Two decades later, the silver price rallied in a rather regular manner, along with gold, and then declined – also along with gold. To be precise – I’m not ruling out any of the above – short squeeze, shortages in general, etc. However, I am saying that just because something MIGHT EVENTUALLY happen, that doesn’t mean that it IS going to happen NOW or ANYTIME SOON.

For those exceptional situations, it’s great to have some physical silver (and gold, too). However on a day-to-day basis, the investment and trading parts of one’s capital should be governed while putting great weight on things that are actually likely to happen in regular situations.

One way to thrive while trading silver is not to take silver’s strength at face value. Just as I warned that even if silver was about to soar (and I really DO expect silver to soar above $100 in the following years), then it was very unlikely to do so again in 2021 as the bigger trend was not supporting this outcome.

Anyway, when silver was trying to break above $30, I warned you about the real bearishness of the situation. (By the way, this link also proves that I’ve been expecting the interest rates to rise before that materialized.)

Many months later, we see that what formed in early 2021 was a major top that started a major medium-term decline.

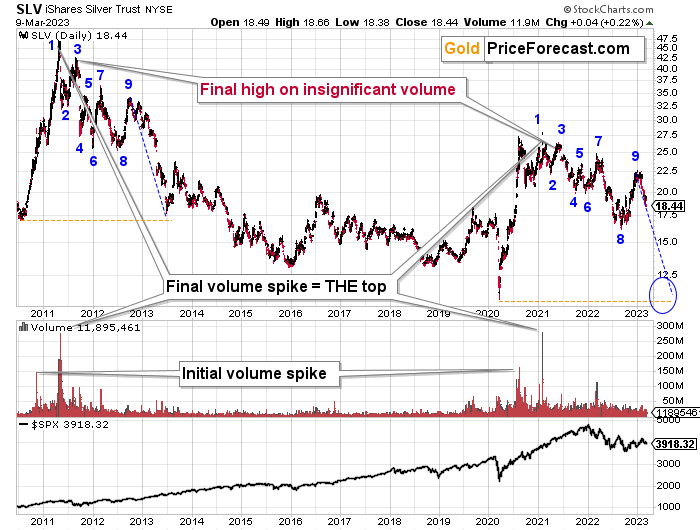

Those of you who have been following my analyses for a long time might recall this chart.

I featured it originally many months ago, and the emphasis was on the analogy in price movement and in the spikes in SLV ETF’s volume.

Indeed – the situations proved to be analogous, and the silver price declined.

What’s remarkable is how similar the declines were.

What I added today are the counters (no, it’s not an Elliott Wave count), and I added the S&P 500 at the bottom of the chart.

The counters help to see which parts of the silver price movement are analogous. They are not identical, but they are much more similar than it seems that they “should be.” Even the “8” bottom was rather broad in both cases.

Based on this similarity, silver is now starting the main part of the slide. It’s recent weakness relative to gold definitely confirms that.

Silver’s decline (and PMs decline in general) took a rather measured shape in its initial months (late 2012 – early 2013), so should we expect the same thing to happen now?

No.

The reason for this lies in the link to the stock market. Back in 2013, there was no visible decline in stocks, let alone a substantial one.

This time, we are likely to see one. And you know when we also saw some sharp declines in stocks? In 2008 and in 2020, and you can see the latter on the above chart. Silver plunged in a sharp (not measured!) manner in both cases.

Given rising interest rates and the investment public’s realization that the rates are not “about to move lower,” that is something that is likely to lead to the stock market’s sell-off. But I’ve been writing about that already.

The thing is that it has implications for the above-mentioned analogy in silver. And that is: the upcoming part of the decline in silver is likely to be sharper than what we saw in 2013. The same goes for the implications for mining stocks (and probably gold). This slide is likely already underway.

* * * * *

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' associates only. As such, it may prove wrong and be subject to change without notice. Opinions and analyses are based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are deemed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.