Silver has been hammered lower over the past month as speculation mounts that the Fed will make a move on monetary policy in December. That has left silver knocking on the door of a six year low, so will it break through?

The selling in silver has been relentless. Since 29th October, silver has fallen on every single day bar none. That is 15 consecutive trading days in the red without any respite. The selling has come as the market sentiment swings bullish for the dollar on bets the Fed will raise interest rates at their December 15th Meeting. There have been a startling number of FOMC members speaking over the last few weeks, including Janet Yellen herself, and the rhetoric has been clear, the December meeting is a ‘live’ one and interest rates could begin to rise.

The market has put the chance of an interest rate rise at over 70%, with some surveys suggesting up to 90% of businesses tipping a rate rise. Yesterday’s US inflation figures will only serve to raise the chances of a rate hike. Core CPI remained steady at 0.2% m/m and is now sitting at 1.9% y/y. The steadiness of Core inflation will please the Fed, as will the annual figure being close to their 2% target.

Earlier this month we saw employment figures hit their strongest level in five years which has certainly given the Fed confidence. The unemployment rate fell to 5.0%, down from 5.1% the previous month. The Nonfarm employment change change figures were a big surprise as they lifted to 271k vs the market expectation of 183k. This saw the slide in silver accelerate to where we are now.

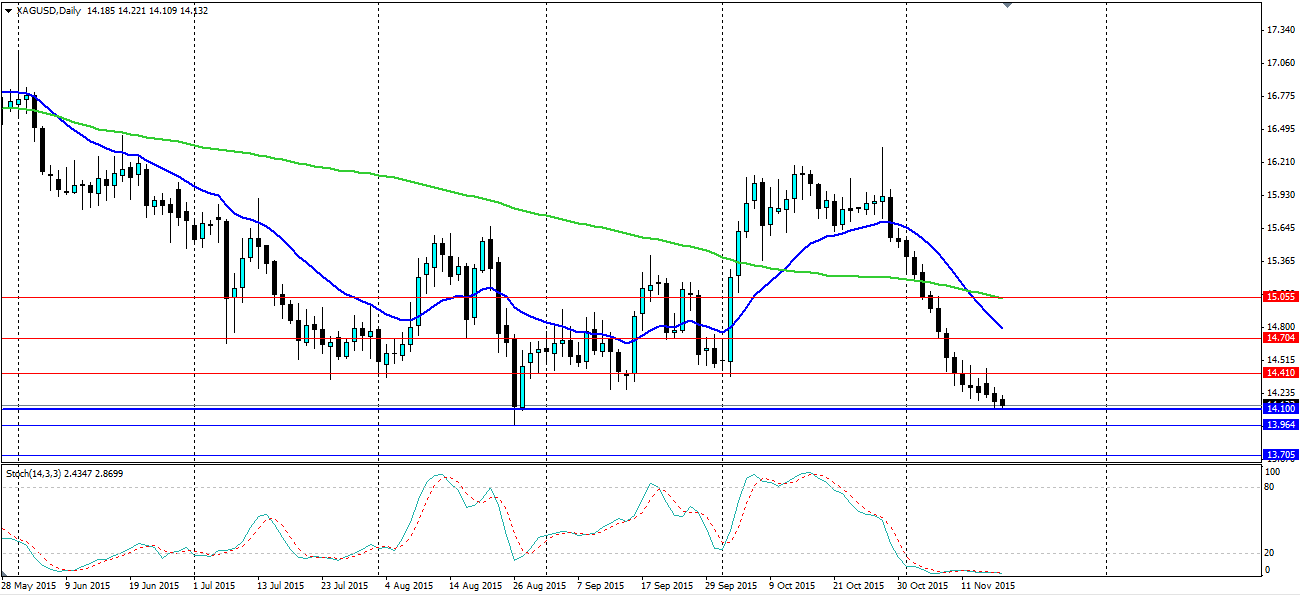

The moving averages certainly point to the bearish trend continuing, however the Stochastic Oscillator is about as oversold as it will get, at a value of just 2.4347. This alone could see some bulls try to defend the current support. The support that has been found in recent days at $14.100 an ounce, has been important for silver, and could prove the line in the sand if some bidders can be found. This level has not been tested since August, so could well see a reversal before a more concerted push to break the lows.

The six year low at $13.964 is also an important level because below that we have to go back six years to find support levels to watch. $13.705 looks to be the next level of support, although there is no guarantee the market will respect this, given the last time it was tested. Alternatively, for a bounce off the support, look for resistance at $14.410, $14.704 and $15.055.