The precious metals market has slowed markedly after a tumultuous February-March and the second half of May. However, Silver continues to show signs of medium-term upside readiness.

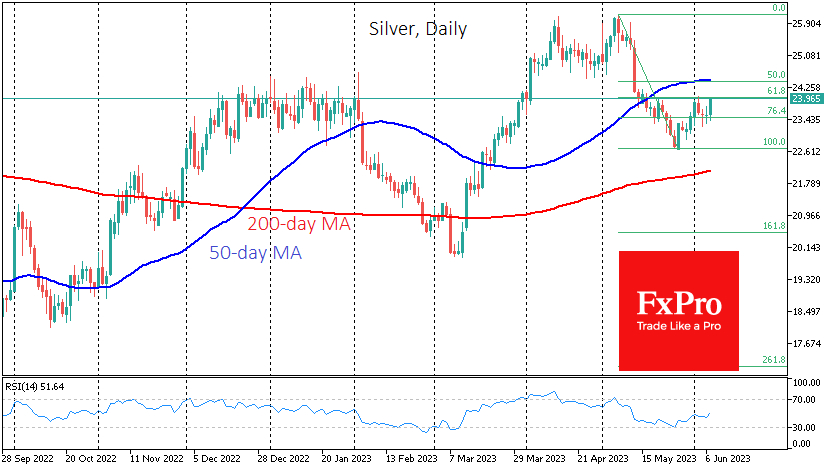

The May sell-off in Silver, which brought the price down over 13% from its peak to bottom at $22.67, was capped by a 3% reversal on May 26.

Later, May closed with a strong upward move touching $24.0 an ounce. And this week, Silver is closing the trading sessions above $23.50 despite the intraday dips. Incidentally, the latter tends to become less and less deep.

Separately, on the daily timeframes, the RSI index has turned to the upside after touching oversold territory, which is a sign of at least a pause in the downtrend. In addition, the RSI reached higher local lows at the end of May than at the lower point in March, indicating less seller strength.

Although Silver Bulls defend the lower boundary quite effectively, they have yet to prove their ability to push the price higher.

The nearest resistance is in the $24.0 area, where the price reversed to the downside at the start of June. That level also coincides with the 61.8% retracement of last month's downside move.

A rise above that level qualifies the correction and paves the way to $24.5, a significant resistance area in December-January and the 50-day moving average.

A higher rise would set up a quick return to the $26 area, near the peaks of the last two years. But in this case, the bulls will have already proved their superiority, and reaching $30 will be no more than a matter of time.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver Forms More Bullish Reversal Signals

Published 06/07/2023, 10:22 AM

Updated 03/21/2024, 07:45 AM

Silver Forms More Bullish Reversal Signals

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Use silver as AI components......bullish to next galaxy

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.