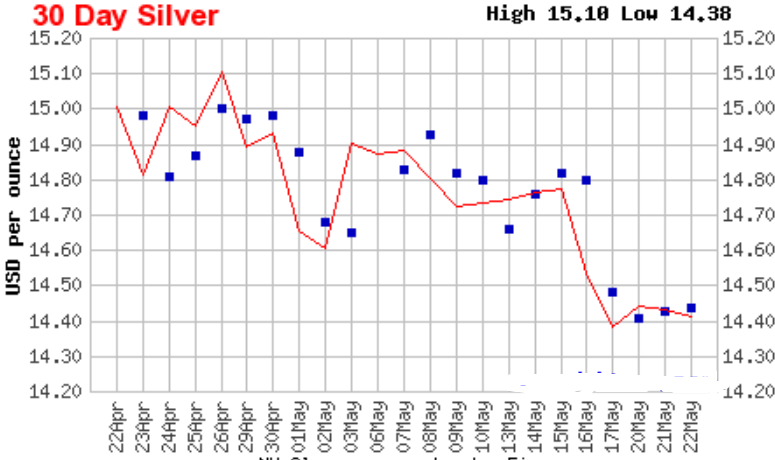

Silver has been beaten down quite a bit and is due for at least a short term bounce. It was trading in the 14.40’s and now is 14.49 and starting a leg up for now. Silver is leading gold at present.

I still consider this a trade only because when the market does finally get going south, it can take metals and miners with it for a bit. But from what I see, from charts and other indicators, we should get a decent bounce here in silver.

We have seen so much occur the last month where President Trump and President Xi Jinping from China have been battling it out on tariffs. Commodities have been hit hard but grains have been bouncing, partly because of terrible weather for planting season.

There has also been, for a time, an escalation of smack talk with Iran, and with certain individuals like Bolton in the White House, I expect that to ramp up a bit more. It does seem subdued for the moment, but any Middle East tensions should be good for precious metals.

The Fed came out and said they were worried about “low inflation,” which is another word for “deflation,” but they won’t use that term. The word deflation makes it seem like they are losing the battle of inflation, which they need to achieve their 2% goals. Deflation is the death of the Fed and they will do anything to fight it.

What does that mean? That means they will go back to QE (Quantitative Easing) to try and stimulate the economy. But they won’t do that till forced to. In this last meeting minutes released yesterday, a couple Fed members were still talking about raising rates. I don’t know what tea leaves they are reading (or smoking), but that’s out of line with reality. Housing data continues to be bad and has been for a year now. Housing is a leading indicator and one reason the markets are starting to crack.

If/when the markets do crack, and fall hard, the Fed will be forced to stop the freefall and add QE to stimulate the markets. They may go as far as implementing negative rates if they have to. The Fed will fight for its own survival. Always. And do so at the detriment of the markets and economy as it won’t work but for temporary time-frames.

I have been adamant for awhile to take from what is high (stocks) and put into what is low (gold/silver) and many have done so, buying the dips when they come. We always get dips. And I think we have one more big dip after this run up. But how much lower will it go from here is the question. The answer might be not that much. Worse case into the 11’s for silver but that depends on how bad things really get. I think the whole world will be buying what little silver and gold there is out there and that’s because the rest of the world runs on local currencies that it will take more of, over time, to buy gold and silver. As their currencies depreciate, what does a smart investor do to protect themselves? Ask those in Turkey right now that question. It takes twice as many Lira to buy gold than it did in 2017 this time. That’s just 2 years.

When we had the last financial crisis in 2008, gold and silver fell 30% from their fresh highs that were made that year. I don’t see the same decline as 2008, but there could be what I call your last buying opportunity in precious metals when we get there. I am one of the few who have spoken and written and interviewed individuals on a deflationary credit contraction coming and how most won’t be prepared for it. I’ve written and will continue to write how the Fed will be boxed into a corner and the walls can come tumbling down when markets lose faith in the Fed. But that is still a little ways off because of the Trump administration and the perception that he has the answers. Unfortunately, for many, they won’t like the outcome. The Fed is already backing away from Trump so he gets the blame for what’s next, not them. But it is the Fed who sets interest rate policy, not Trump. Those who own the insurance of gold and especially silver which should double in price before gold does (if not triple), won’t care what goes on politically, but I guarantee you most don’t have this insurance. Or enough of it to cover their other investments which most likely are U.S. dollar based. Only gold and silver are no one else’s liability and have historically been viewed as the only honest money since Biblical times.

90% silver coins are still at a good price and a great investment as they were actually real money at one point in the U.S. We also have rounds and bars at good prices for home delivery and check out how silver can be bought with your IRA.