- Walt Disney's shares are down 36% since the beginning of the year

- Investors fear consumers will cut entertainment spending if the economy falls into a prolonged recession

- Despite these dangers, it's hard to ignore the strength of Disney's global franchise and the cash-generation power of its legacy businesses

The world's largest entertainment company, Walt Disney (NYSE:DIS), has endured a severe beating amid this year's market downturn. Shares of the Burbank, California giant are down 36% over the past 12 months, underperforming the benchmark S&P 500 by a wide margin.

There are mounting signs that Disney has been struggling with its video-streaming service, which has become the centerpiece of CEO Bob Chapek's growth strategy since its launch almost two years ago.

During its latest earnings report, Chief Financial Officer Christine McCarthy cut the growth forecast for Disney+, saying it now expects a total range of 215-245 million subscribers by September 2024, down from the company's earlier forecast of 230-260 million subscribers.

The company also raised the prices on its streaming offerings and outlined plans for a new ad-supported tier of Disney+.

Furthermore, the report made clear that most of Disney's current subscriber growth will come from international markets where the margins are already tight, especially with the U.S. dollar hovering at 20-year highs.

Disney lost $1.1 billion in its direct-to-consumer segment last quarter, widening from a loss of $293 million a year earlier. Since Disney+ launched in late 2019, the segment has lost more than $7 billion.

Diversified Business Model

Despite these challenges, it's hard to ignore the strength of Disney's global franchise and the cash-generation power of its legacy businesses. The Burbank, California-based company has an unmatched portfolio of assets that have endured many recessions and downturns—emerging stronger every time.

The latest evidence of this strength came during the pandemic when the company's theme parks, movie theaters, and resorts faced unprecedented challenges due to global lockdowns and stay-at-home orders. Now that the pandemic is behind us, Disney's cash machine is back on track, benefiting from strong pent-up demand.

Sales at the Parks, Experiences, and Products division, including Disneyland, Walt Disney World, and four resorts in Europe and Asia, reached $7.4 billion for the quarter ending on July 31, a record amount up 70% from a year earlier. The division posted profits of $2.2 billion for the quarter, up from $356 million a year ago.

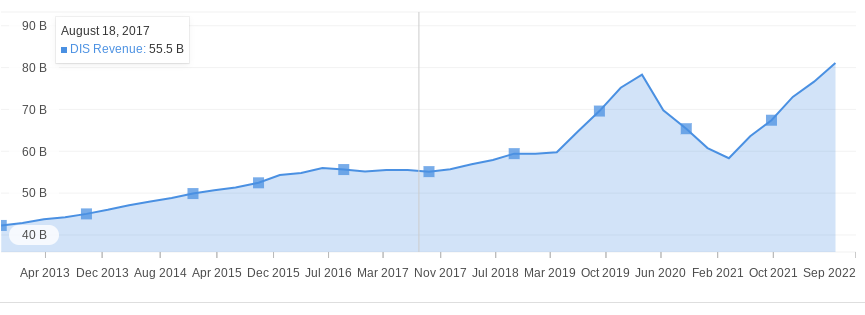

Source: InvestingPro

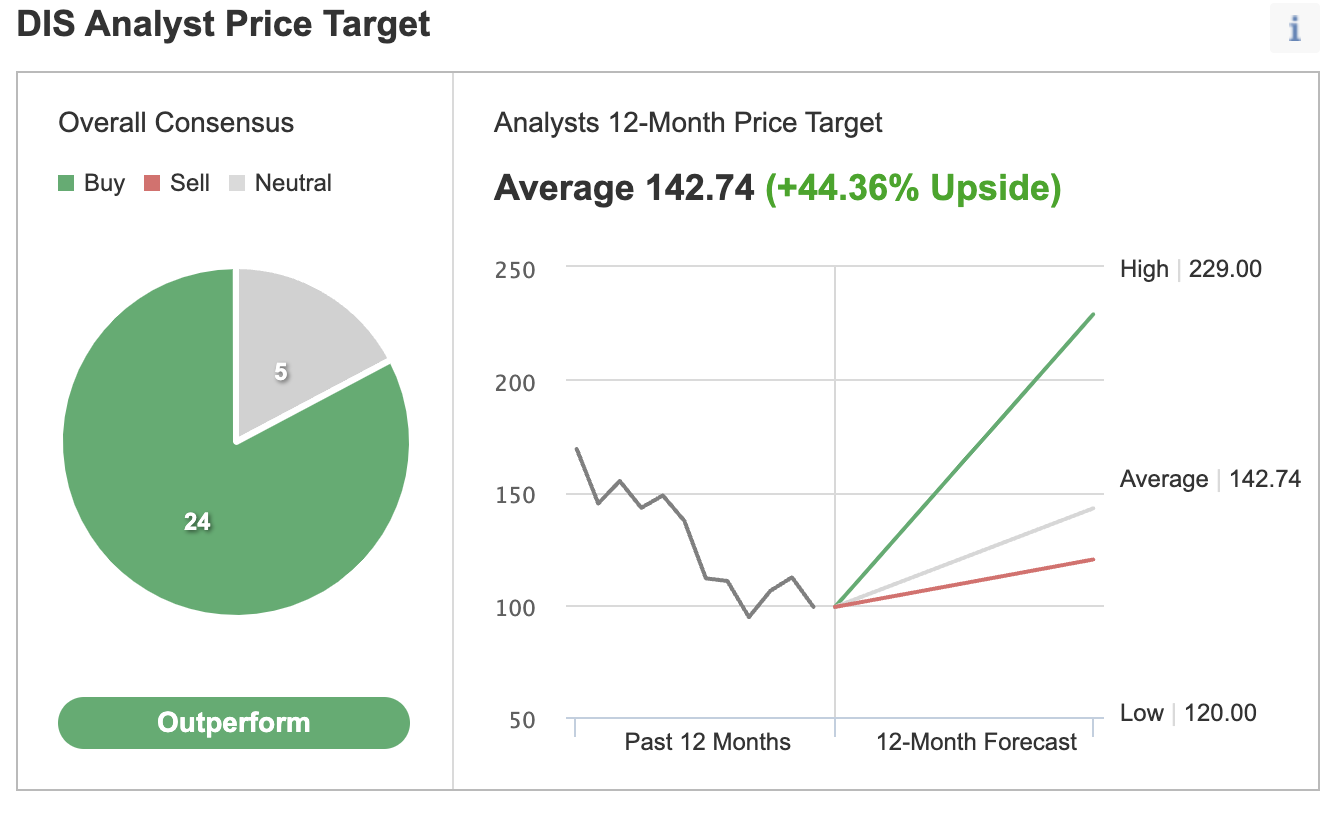

Disney's diversified business model and the strength of its franchise is perhaps the main reason that most Wall Street analysts rate the stock a buy. In an Investing.com poll, about 80% of analysts rate the Disney stock a buy.

Source: Investing.com

In a note earlier this month, Morgan Stanley's analysts said they see the entertainment giant's park segment driving the majority of free cash flow and earnings before interest, taxes, depreciation, and amortization. Also, they expect Disney's content assets are "under-earning and undervalued."

Bottom Line

Disney's stock, trading lower than before the pandemic, offers an attractive risk-reward proposition to long-term investors. Given the current uncertain economic environment, it's hard to predict how much lower it can go from here.

However, there is no doubt that Disney is a great company, and its stock will recover strongly once the market finds its bottom. For these reasons, Disney is a safe bet to buy in this bear market, in my opinion.

Disclosure: At the time of writing, the author doesn't own Disney shares. The views expressed in this article are solely the opinion of the author and should not be taken as investment advice.