Last week’s Fed decision on interest rates sparked a significant, 4-day rally off the lows in the main stock market indexes. After weeks of steady losses, the bounce certainly gave a welcome reprieve to nervous investors.

However, both the NASDAQ Composite and NASDAQ 100 indices have now bounced into key overhead resistance of their 50-day moving averages. On the daily chart of the NASDAQ 100 Index below, notice this is the first touch of the 50-day MA resistance since the downtrend began in January.

In an uptrending market, a pullback to 50-day MA support is often a low-risk buy signal in anticipation of an uptrend resumption.

Conversely, in a downtrending market, a rally into overhead resistance of the 50-day MA can provide a low-risk SHORT entry point—especially on the first touch of the 50-MA within a downtrend.

However, it’s imperative to first have a rule-based system to find the proper, low-risk short entry points with positive risk-reward ratios.

Following The Trend

As trend traders, we only focus on buying stocks (going long) in uptrending markets. In a bullish market, the Morpheus Trading system focuses on buying explosive, high-flying growth or momentum stocks trading near 52-week highs. But we shift our focus to selling short when conditions turn sour and the major indices begin trading below their 50-day moving averages.

This simple trend trading methodology always puts the odds of a winning trade in our favor–regardless of market conditions.

Short Setup: Ledge Breakdown

Last month, we showed you a Simple Strategy to Profit from Short Selling a Weak Market. That article walked you through how we sold short Meta Platforms (NASDAQ:FB) for a quick +10% gain in six days using the basic Morpheus "Short the Bounce" technique.

Today, we introduce you to a different type of short setup known as the "Ledge Breakdown."

The general concept of the Ledge Breakdown is to identify and sell short stocks in a strong downtrend after a few weeks of choppy, sideways price action. Such "chop" is just basing action at the lows, which we call a ledge.

Here’s how it works…

How To Identify The Ledge Breakdown Short Setup

In order to consider short entry based on the Ledge Breakdown pattern, the stock must first meet the following five criteria:

- Stock must be in a strong downtrend, after breaking down below a major support level. This means moving averages should be stacked to the downside: 20-day MA below the 50-day MA, and 50-day MA below the 200-day MA.

- After a significant selloff, the price chops around for several weeks to form a "ledge." The high of the ledge (base) should be at, or just above, the 20-day EMA, but below the declining 10-week MA (on weekly chart).

- After a few weeks of chop, the 8-day and 20-day exponential moving averages converge together, which makes the break of support more significant. Note the 10-day EMA can be used in place of the 8-day EMA.

- Wait for the formation of a tight-ranged inside day, at or near the 20-day EMA, as a low-risk entry point. This day becomes the trigger for a short entry.

- The actual short entry point is when the price breaks below the low of the tight-ranged day. A firm stop is placed neatly above the same day’s high (or two-day high if it isn’t much higher).

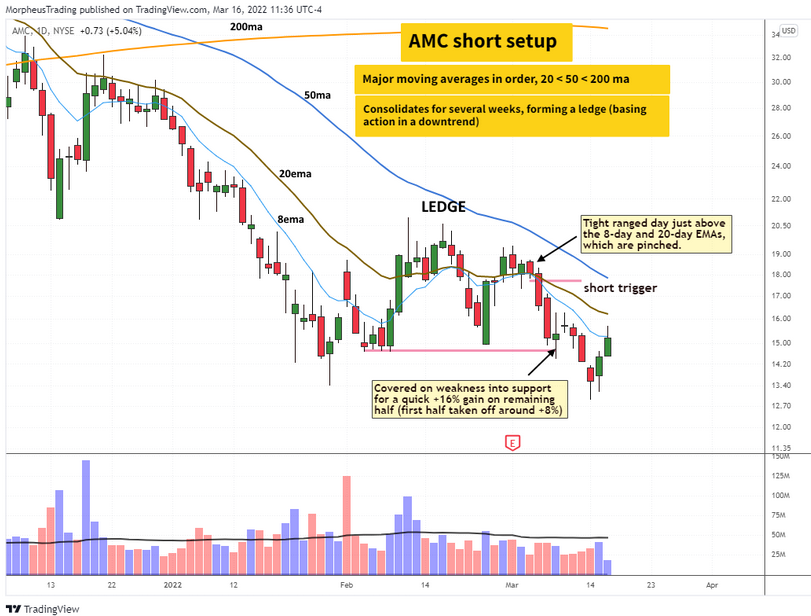

We recently scored a +16% gain by following our trade alert for Ledge Breakdown short entry into AMC Entertainment (NYSE:AMC). AMC's daily chart below reviews the original setup and winning result:

Ledge Breakdown Checklist For AMC

Let’s review how the AMC setup met each of our five criteria for short entry with the Ledge Breakdown setup (reference the prior list above the chart):

- AMC cracked support at $30, then dropped 40% more over a few months before basing at $15.

- AMC paused for several weeks after finding support at $15, with the ledge high above the 20-day EMA, but below the declining 10-week MA.

- The 8-day and 20-day EMAs converged to pinch together after several weeks of chop.

- AMC formed a tight-ranged inside day on Mar. 3, right at convergence of its 8 and 20-day EMAs. This was our short signal.

- AMC triggered for short entry on Mar. 4, immediately after the price broke down below the prior day’s low.

Trade Management

With all types of short setups, we aim to quickly lock in profits on partial position size, then hold the remaining shares in anticipation of further gains on the short side.

After selling short AMC beneath the March 3 low, we covered half of the position for a quick +8% gain just two days later. We then alerted subscribers of our stock trading report that we were covering the remaining shares for a +16% gain on Mar. 8 (as the price undercut support t $15).

We are typically quicker and more aggressive with taking profits in short positions versus long.