Shares of ServiceNow Inc. (NYSE:NOW) rallied to a new 52-week high of $119.47, eventually closing a tad lower at $119.38 on Oct 5.

The share price momentum can primarily be attributed to the growing adoption of the company’s platform and tools by 2000 (G2K) companies, as defined by Forbes. The company is also gaining from its rapid penetration into the non-ITSM markets such as customer service, human resource and security.

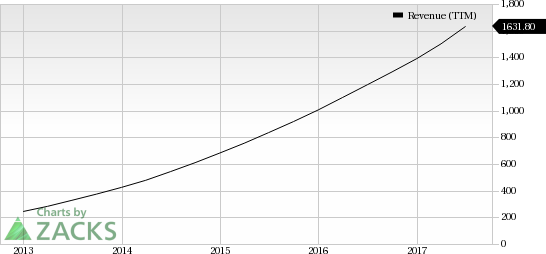

The company also posted impressive financials for the second-quarter 2017 where revenues of almost $478.5 million surged 40.2% year over year. The top-line figure also surpassed the guided range of $469–$474 million.

ServiceNow stock has gained 60.6% year to date, substantially outperforming the 28.3% rally of the industry it belongs to.

Key Drivers and Competition

ServiceNow has been a dominant name in the IT service market (ITSM). The company is steadily winning market share amid the ongoing trend of replacing legacy on-premise systems with cloud-based processes, especially among G2K companies. The growing penetration at G2K customer base has been driving ServiceNow’s top line, which has been exemplary, increasing at a CAGR of more than 70% over 2009–2016 time frame.

Notably, with none of the customers exceeding 10% of revenues in the last couple of years, the customer base remains unaffected by the problem of customer concentration. Diversified clientele is another positive for the company.

Moreover, the company’s expanding product portfolio (including emerging products) and strong renewal rate (almost 98%), are the other key growth drivers. Additionally, the popularity of its Customer Service Management product, launch of a new HR product and the availability of the Jakarta platform to all is anticipated to boost the company's performance further.

Notably, in August 2017, ServiceNow was declared a Leader in the 2017 Magic Quadrant for IT Service Support Management Tools by Gartner for the fourth consecutive year. However, in spite of an improving top line, mounting losses and stiff competition in the non-ITSM markets from established players like Oracle (NYSE:ORCL) and salesforce.com (NYSE:CRM) remain concerns for the company.

Zacks Rank & Key Pick

Service Now currently has a Zacks Rank #3 (Hold).

A better-ranked stock in the broader technology sector is Micron Technology, Inc. (NASDAQ:MU) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Micron Technology is 10%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure.

See these buy recommendations now >>

ServiceNow, Inc. (NOW): Free Stock Analysis Report

Salesforce.com Inc (CRM): Free Stock Analysis Report

Oracle Corporation (ORCL): Free Stock Analysis Report

Micron Technology, Inc. (MU): Free Stock Analysis Report

Original post

Zacks Investment Research