Cybersecurity provider SentinelOne (NYSE:S) stock has enjoyed a nice rise upon its public debut this year. Shares of this automated cybersecurity platform as holding above its IPO price but starting to offer some opportunistic pullbacks for prudent investors. The Company provides automated cybersecurity solutions for over 5,400 enterprise customers including one of the largest telecommunications and mass media companies in North America and one of the world’s largest financial institutions. The Company has a 97% gross retention rate with clients winning over 70% of POCs against competitors. Customers with over $100,000 in annual recurring revenues (ARR) grew 140% and adding the largest number of million dollar accounts in its latest quarter. The pandemic illustrated how important cybersecurity is in the new normal with elastic offices in addition to on-premises employees returning to offices. SentinelOne is a relatively new player founded in 2013, but on the cutting edge of enterprise cybersecurity.

Q2 2021 Earnings Release

On Sept. 8, 2021, SentinelOne released its second-quarter earnings report for the quarter ending in 2020. The Company saw an earnings-per-share (EPS) loss of (-$0.20), excluding non-recurring items, inline consensus analyst estimates for a loss of (-$0.20). Revenues rose 121.3% year-over-year (YoY) to $45.75 million, beating analyst estimates for $40.37 million. Annualized recurring revenue (ARR) rose 127% to $198 million. SentinelOne CEO Tomer Weingarten commented:

“We’re devoted to protecting our customers and our way of life from cyberattacks in an increasingly digital society. Cybersecurity must be autonomous - that’s what we’ve built. It must perform at a faster speed, greater scale, and higher accuracy than what exists today. Our IPO was a significant milestone and is only the beginning of the opportunity in front of us. I’m pleased with the success and growth we delivered in Q2.” Sentinel One CFO Dave Bernhardt commented, ““SentinelOne executed extremely well in Q2. Our annualized recurring revenue reached $198 million, with growth accelerating to 127% year-over-year, especially encouraging to see the broad based strength of our business, with record customer additions, large customer transactions, and net retention rates.”

Upside Revenue Guidance

The Company raised guidance for Q3 2021 for revenues to come in between $49 million to $50 million compared to $45.71 million consensus analyst estimates. The Company sees full-year 2021 revenues to come in between $188 million to $190 million.

Conference Call Takeaways

CEO Weingarten (NYSE:WRI) set the tone:

“We launched SentinelOne in 2013 with the idea that cybersecurity incorporated faster speeds, greater scale, higher accuracy, and most importantly do this through more automation. We created an autonomous cybersecurity platform to deliver our vision. Attacks and threats are only becoming more sophisticated and more common and legacy solutions and human defenses just can't keep up. Looking further the older ransomware attacks, unfortunately this isn't new, and it isn't going away and it's impossible to ignore. Our mission to protect our customers in our way of life has never been more important in a digitized world. There are several structural forces that play that will drive long-term and sustained growth for us in our industry. The growing threat landscape is just one of them. Next is the digital enterprise environment, more devices, more places, more data requires updates to critical enterprise infrastructure and that includes new attack surfaces such as containers and workloads. At the same time, we moved to a hybrid work environment. This is the new normal forcing the revolution of how we work, where we work from and fundamentally how we secure the future of work. The only way to ensure safety and security is with zero trust. Across the entire enterprise from endpoint to cloud companies want partners and platforms not siloed point solutions. Our open XDR approach is helping unify the entire enterprise view from data to device to cloud. Putting all of this together, cybersecurity has never been more critical and more challenging for the enterprise. That gives me tremendous confidence in the long-term growth potential in front of SentinelOne. Over the last eight years at SentinelOne, we've developed AI and machine learning models built patented storyline technology and created an in-house cloud data platform. We knew from the beginning that the best solution would have to harness the power of data and AI. And as a result, we're delivering real-time industry leading threat detection and response from endpoint to IoT to cloud.”

Net Retention Rate

CEO Weingarten noted:

“Our net retention rate was the highest it's ever been at 129%. Our channel partners are bringing us into an increasing number of opportunities, giving our sales teams access, scale and reach around the globe. Nick will talk a lot more about our differentiated go-to market and how that's fueling growth. I'm proud of the technology and the innovation we're bringing to customers through our Singularity XDR platform. We sell three platform tiers, core control in our most comprehensive and popular tier complete. These tiers enable us to bring our technology to a diverse set of biotech types and organizations from medium sized businesses all the way to the world's largest Fortune 500 enterprises.”

Automation is Key

“In other words, write the rules once and let it trigger automatic alerts and instant responses enterprise wide. That's more control and more automation and more prevention. The secondary of focus is around zero trust. Every edge of the network must be secured. We did this in two ways in Q2, tackling group IoT devices and expanding zero trust partnerships and enterprise can't protect what it can see, including IoT and unmanaged devices. One compromised printer can quickly become an adversary's home base for an attack. The solution for the IoT and unmanaged device challenges are ranger module. Ranger identifies and tracks all rogue IoT devices, and we've just released Auto Deploy.”, stated CEO Weingarten.

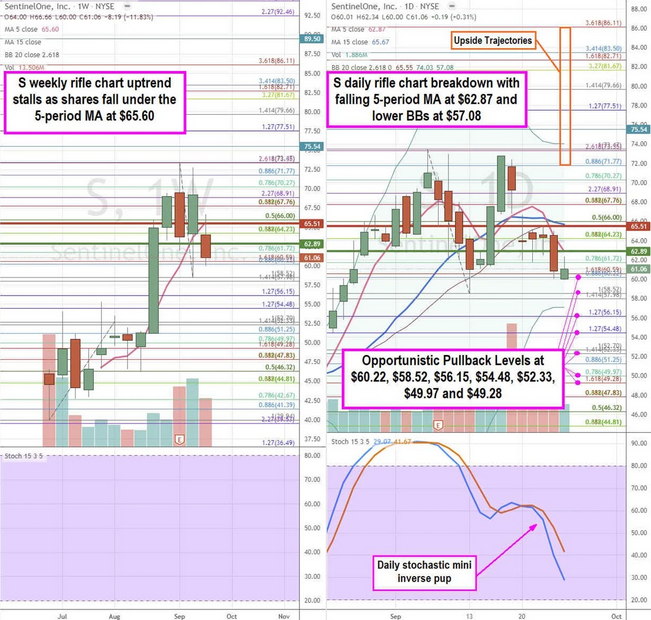

S Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames enables a precision view of the price action playing field for S stock. The weekly rifle chart is still developing since it’s a new issue, however, the weekly 5-period moving average (MA) formed at $65.60 after peaking at the $73.48 Fibonacci (fib) level. The weekly stochastic and Bollinger Bands (BBs) will need more time to materialize. The daily rifle chart formed a market structure high (MSH) sell trigger on the breakdown under $65.51. The daily downtrend has a falling 5-period MA at $62.87 which nearly overlaps the daily market structure low (MSL) buy trigger on a breakout through $62.89. The daily stochastic has a mini inverse pup pointing shares towards the daily lower BBs at $57.08. Prudent investors can watch for opportunistic pullback levels at the $60.22 fib, $58.52 fib, $56.15 fib, $54.48 fib, $52.33 fib, $49.97 fib, and the $49.28 fib. The upside trajectories range from the $71.77 fib up to the $86.11 fib level.