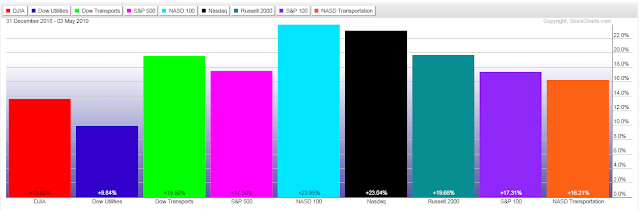

The following graph of the U.S. Major Indices shows the percentages gained from January 1 to the highs that were made, so far, in 2019 (about a week ago).

In my 2019 Market Forecast post of December, I reported that the SPX gained 9.62% for 2018 and thought that, "2019 is likely to bring the same level of volatility and uncertainty, not just in U.S. equity markets, but in other world markets and world politics, as well." That was based on the assumption that central bankers would continue to tighten their monetary policies, with no further fiscal stimulus packages on the horizon in the U.S. at the time. Since then, the Fed has loosened its monetary policies and has indicated that no rate hikes would be implemented in 2019.

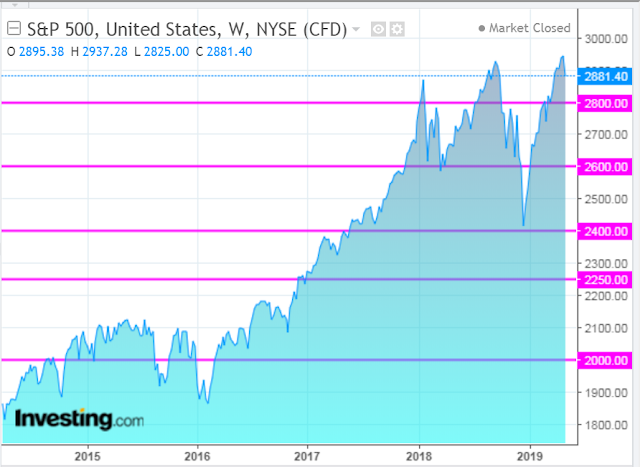

I further mentioned that the SPX may, either, retest its all-time high of 2940.91, or resume further declines, putting it at 2400, or lower, to possibly 2250 or 2000 (on the date of my post, the SPX had closed at 2546.2).

After hitting a low of 2346.58 on December 26, the SPX closed out the year at 2506.85 and has since climbed to a new high of 2954.13 on May 1, surpassing its prior high. It has pulled back a bit to close at 2881.40 on Friday.

After further examination, I'd now add 2800 and 2600 to those major support levels, which are evident on the following weekly chart (shown in simple "area" format). At a glance, 2600 stands out as a "right shoulder" target on a potential "inverted head and shoulders" formation, albeit following a large rally from the 2016 Presidential election, rather than after a decline, which would be more typical for this type of technical formation in order for it to trigger and spawn a new rally to, potentially, new highs.

Chart powered by TradingView

Inasmuch as the SPX has pretty much fulfilled my forecast in its gains for 2019, we may have just seen the top put in for the year, and we may see it pull back to, at least, 2600, or lower. At the risk of repeating myself, I'll, instead, refer to my recent posts here, here, here and here, which describe the market gauges I'm monitoring in this regard.