Investors have high hopes for the annual “Santa Claus” rally. But, could there be a correction before “Santa visits Broad and Wall?”

At the moment, investors are “making their list, and checking it twice.” Sure, prices remain near all-time highs, but the Fed is remaining accommodative (at least for now.) Earnings remain very “nice,” and the market largely views “pandemic” related risks largely priced in.

Yes, inflation is “naughty,” but the market seems convinced it will be transient. Furthermore, companies seem to be able to pass costs along to consumers, at least for now. Hopes are high that profit margins will continue to be strong, and eventually, earnings will catch up to valuations.

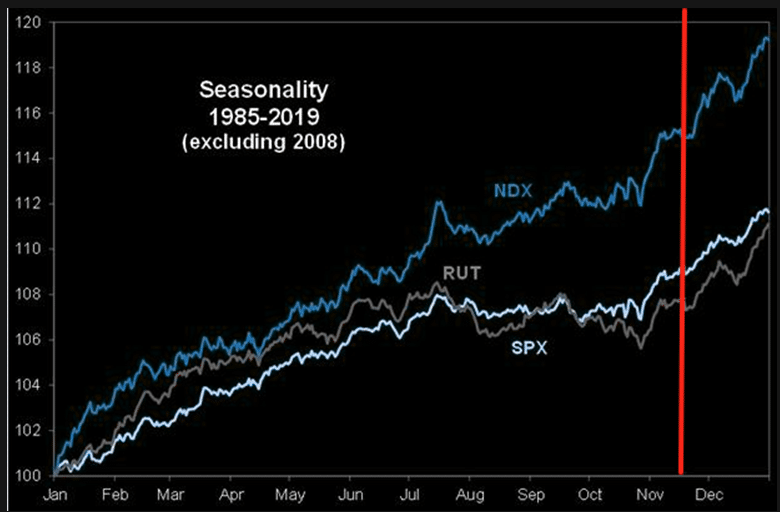

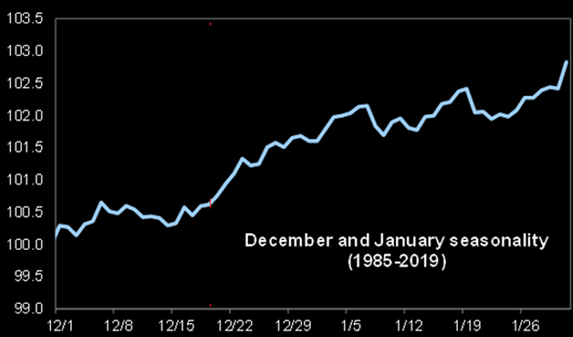

Investors’ “wish lists” are hung by the chimney with care, hopeful the “Santa Claus rally” will soon be there. While they remain “snug in their beds, the historical data dances in the heads.” The chart below from @themarketear shows the annual “seasonality” from 1985 through 2019.

It certainly seems there is little to worry about.

However, notice that dip at the beginning of December.

Mutual Fund Distributions Come First

Before “Santa Claus” comes to visit “Broad and Wall,” mutual funds distribute their capital gains, dividends, and interest income for the year. These distributions start in late November, but a large number of distributions occur in the first two weeks of December.

Every year, I get large numbers of emails from individuals confused by the sharp decline in their funds. To wit:

“Lance, I don’t understand what happened to my fund. Yesterday, the fund was trading at $10.54 per share, and today it is at $9.78. There is no news to account for decline.“

There is nothing wrong with the mutual fund. They made their annual distribution. In this case, it was capital gains and dividend income.

When the distribution occurs, the fund price is immediately impacted. However, in a day or so, you will receive either additional fund shares or a cash deposit. Such depends on how you have elected to take your distributions. Yes, on the date of distribution you will see your portfolio value decline by the amount of the distribution. But when that distribution is received and credited, your value will return to normal.

There is no need to panic.

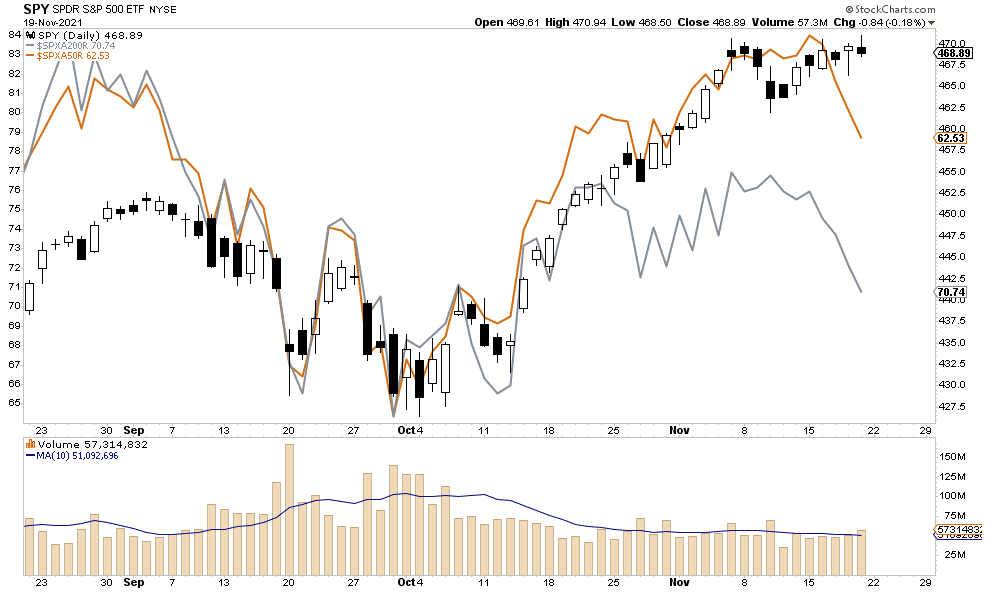

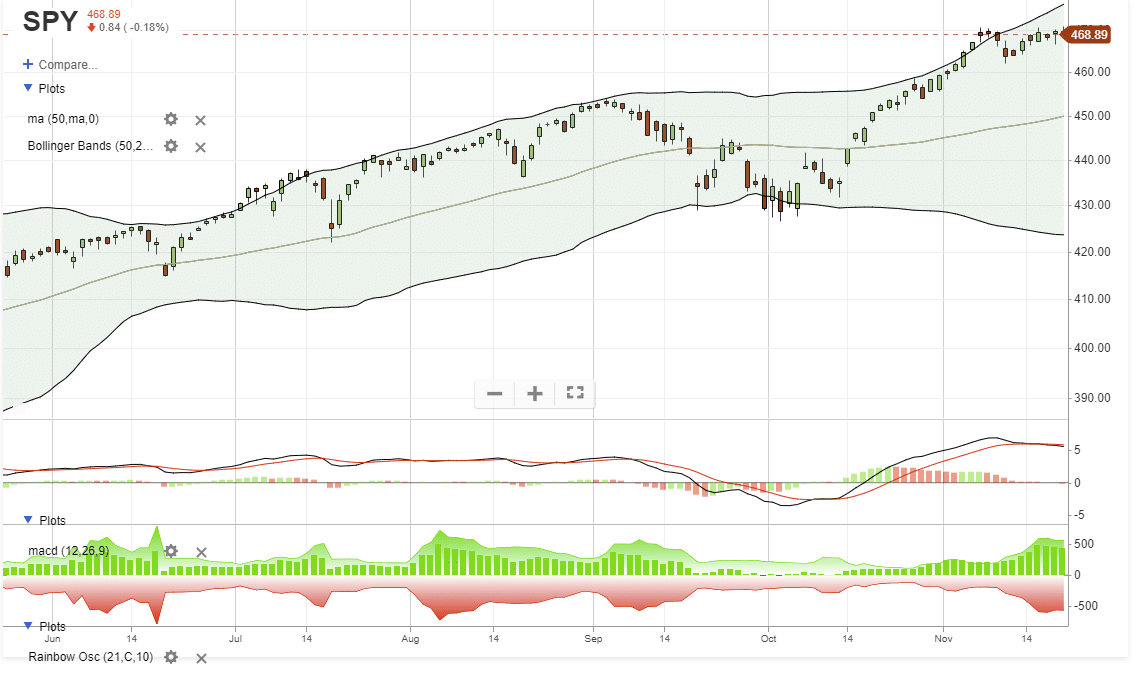

However, there is potentially a negative impact on the market. Such is particularly the case when volumes are weak, liquidity is low, and breadth is poor. As shown, during the entire advance from the September lows, the volume declined. Importantly, over the last week, breadth deteriorated.

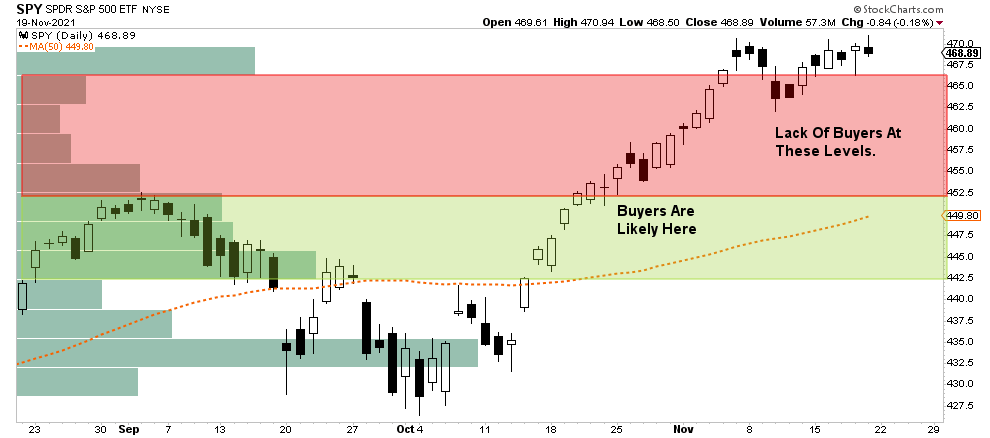

The problem is that “for every seller, there must be a buyer.” The chart below shows where volume exists at various price levels.

When mutual funds start making distributions, buyers appear to be “living” closer to the 50-dma (orange dashed line.)

As the Wall Street axiom goes: “Sellers live higher. Buyers live lower.”

Let The Market Tell You

There are more than just a few caveats to this analysis, both bullish and bearish.

- From the bullish perspective, sentiment remains optimistic, momentum is strong, and speculation is rampant. Such can certainly keep stocks elevated in the near term.

- From a bearish view, valuations, inflation, and the Fed remain challenges. However, while these broader factors tend to play out over longer periods, they provide the “fuel” for an exogenous catalyst. Such could be a spike in interest rates, a more hawkish Fed, or an expected battle over the “debt ceiling.”

However, picking one side over the other leaves you exposed to the unexpected. Therefore, the best approach is to let the market “tell you.”

Such is our approach. As noted in this past weekend’s newsletter:

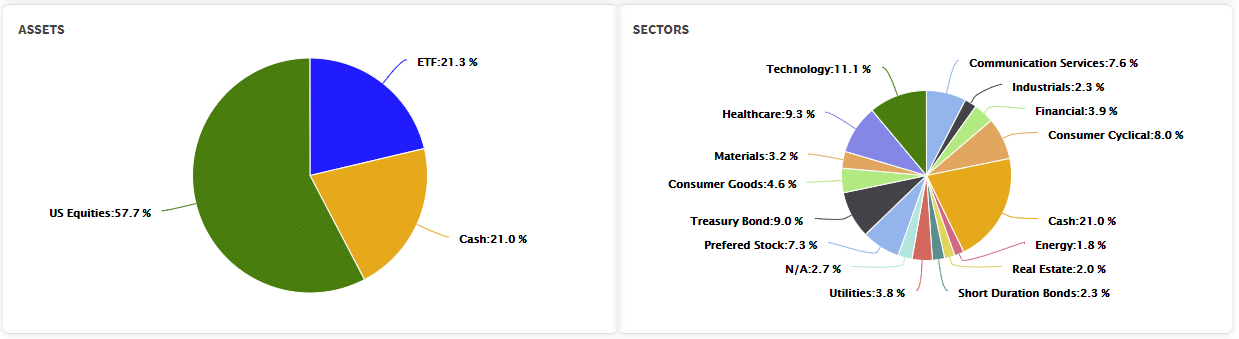

“Given the more exceeding levels of FOMO in the market currently, we remain weighted towards equity risk. Therefore, from a portfolio management standpoint, we must continue to press for portfolio returns for clients. However, don’t mistake that as a disregard for the underlying risk.

"Over the last two weeks, we took profits in overbought and extended equities (F, NVDA, AMD). We also shortened our bond duration by trimming our longer-duration holdings. Such actions rebalanced portfolio risk short-term. In addition, we run a 60/40 allocation model for our clients; such left us slightly underweight equities and bonds and overweight cash.

The RIAPro Technical Chart, suggests caution. The market is well extended above its 50-dma, is overbought, and the MACD “sell signal” suggests the risk is elevated.

If the market breaks above the current consolidation, a move higher is likely, suggesting an increase in equity exposure. However, from current levels, any advance would remain limited.

The best opportunity would come from a correction in early December providing a better entry point for the “Santa Claus Rally.”

There Are No Guarantees

Does any of this mean the market will correct with absolute certainty? Of course, not. The one thing the market does well is doing exactly the opposite of what you would expect.

However, there is a strong likelihood with the market trading weak already, any additional selling pressure from mutual fund distributions could pressure prices short-term. It is a risk at least worth considering if you are looking for a better entry point.

The good news is that if “Santa does visit Broad and Wall,” the January effect has a greater degree of potential success. Of course, there is no guarantee of that either, but historical odds are strong that momentum will carry through

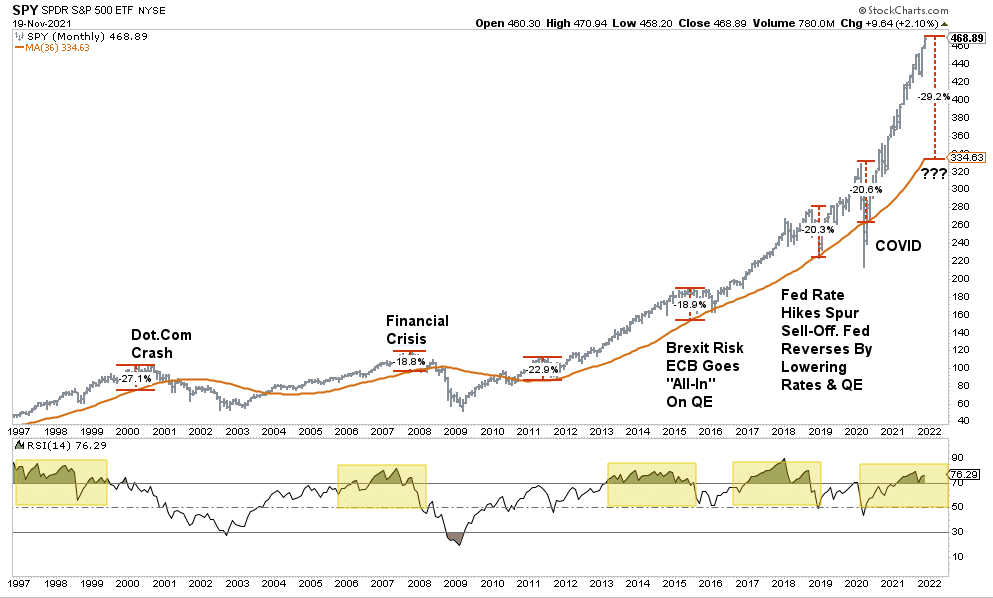

However, beyond that in 2022, I don’t have a clue. Currently, Wall Street analysts are optimistic with Goldman Sachs predicting the S&P to hit 5100 next year. Anything is possible, but when looking at the market on a longer-term basis, with earnings and economic growth likely peaking, I am a bit more sanguine on outcomes.

A Stocking Stuffer

Since we have our “stockings hung by the chimney with care,” we can stuff them with a few essential investment guidelines to navigate as we head into year-end.

- Investing is not a competition. There are no prizes for winning, but there are severe penalties for losing.

- Emotions have no place in investing. You are generally better off doing the opposite of what you “feel” you should be doing.

- The ONLY investments that you can “buy and hold” are those that provide an income stream with a return of principal function.

- Market valuations (except at extremes) are very poor market timing devices.

- Fundamentals and Economics drive long-term investment decisions—“Greed and Fear” drive short-term trading. Knowing what type of investor you are determines the basis of your strategy.

- “Market timing” is impossible. Managing exposure to risk is both logical and possible.

- Investment is about discipline and patience. Lacking either one can be destructive to your investment goals.

- There is no value in daily media commentary. Turn off the television and save yourself the mental capital.

- Investing is no different than gambling. Both are “guesses” about future outcomes based on probabilities. The winner is the one who knows when to “fold” and when to go “all in.”

- No investment strategy works all the time. The trick is knowing the difference between a bad investment strategy and one that is temporarily out of favor.

While we are certainly anxiously anticipating the arrival of the “Santa Claus Rally,” we also must remember the lesson taught to us in 2018.

Nothing is guaranteed.