It's the most wonderful time of year again. The markets may have you feeling otherwise, but this should restore some of your holiday cheer.

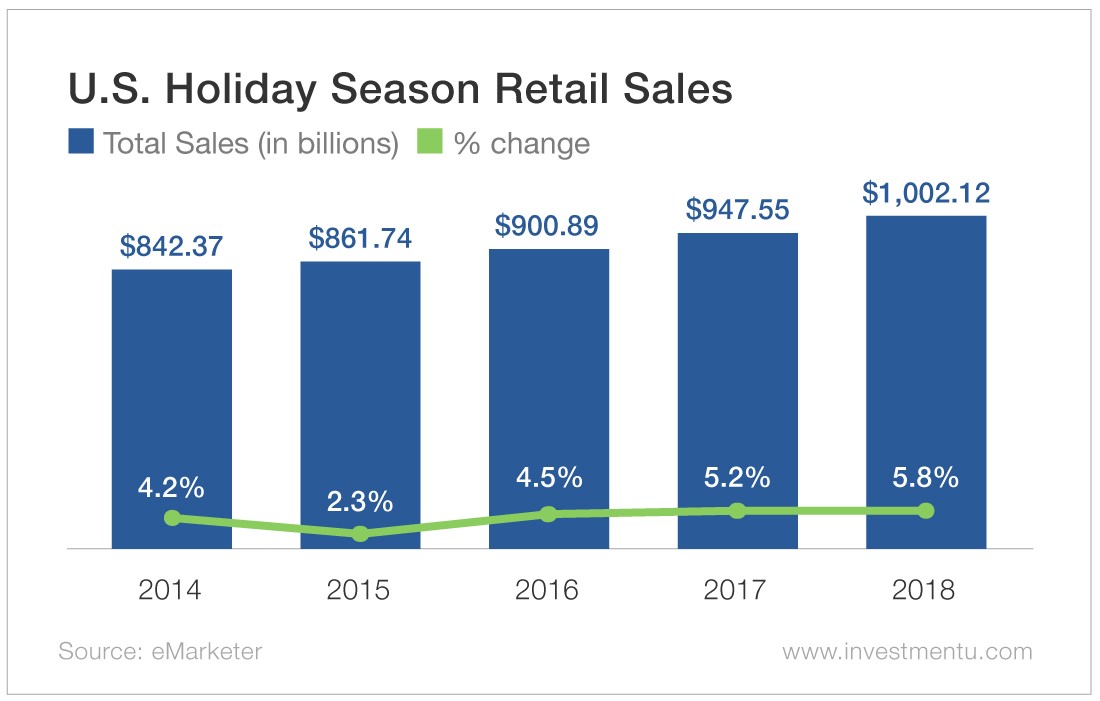

The upward trend of holiday retail sales since 2014 continues this year. Experts are expecting this to be the first $1 trillion Christmas. The best part is you can get a slice of that trillion dollars and have a little fun with your investments at the same time.

Last week, I showed you there are some strange ETFs out there. Today, I'm really going to prove it.

I found two more examples that demonstrate there really and truly is an ETF - or its close cousin, the exchange-traded note (ETN) - for everything. In fact, there's one for you this Christmas whether you're Buddy the elf or Ebenezer Scrooge.

For those Buddy the elf types (myself included), you'll probably be baking up a storm this holiday season. In addition to adding a few pounds to your waistline, holiday cookies can also add a few dollars to your bank account. The iPath Series B Bloomberg Sugar Subindex Total Return (NYSE:SGG) invests in sugar futures.

Sugar is one of those commodities that isn't going anywhere, at least not as long as a certain big man in a red suit needs cookies. As you're spreading holiday cheer with your baking skills this holiday season, this ETF may make you feel a little less guilty about that third trip to the cookie tin.

And what about those Scrooges among us? If you're feeling a little "Bah! Humbug!" about the holidays, there's an ETF for you too.

While retail sales continue to rise, there can be no doubt brick-and-mortar shopping has changed forever thanks to e-commerce.

That's what the people behind the PProShares Decline of the Retail Store (NYSE:EMTY) are counting on. This is a unique inverse fund. It's designed to go up as brick-and-mortar stores close down: For every 1% decrease in that index, this ETF will go up by 1%.

The bankruptcy of Toys R Us earlier this year is evidence that traditional retail outlets will have to adapt or die. Even retail giants like Target (NYSE:TGT) are feeling the pressure.

Both the iPath Series B Bloomberg Sugar Subindex Total Return ETN and the ProShares Decline of the Retail Store ETF illustrate there are funds for every occasion - and every type of person.