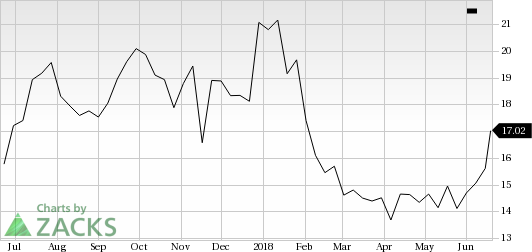

SandRidge Energy, Inc. (NYSE:SD) was a big mover last session, as the company saw its shares rise nearly 8% on the day. The move came on solid volume too with far more shares changing hands than in a normal session. This continues the recent uptrend for the company as the stock is now up 13.9% in the past one-month time frame.

The company has seen one positive estimate revision in the past few weeks, while its Zacks Consensus Estimate for the current quarter has also moved higher over the past few weeks, suggesting that more solid trading could be ahead for SandRidge Energy. So make sure to keep an eye on this stock going forward to see if this recent jump can turn into more strength down the road.

SandRidge Energy currently has a Zacks Rank #3 (Hold) while its Earnings ESP is 0.00%.

A better-ranked stock in the Oil and Gas - Integrated - United States industry is Occidental Petroleum Corporation (NYSE:OXY) , which currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Is SD going up? Or down? Predict to see what others think: Up or Down

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

SandRidge Energy, Inc. (SD): Free Stock Analysis Report

Occidental Petroleum Corporation (OXY): Free Stock Analysis Report

Original post

Zacks Investment Research